In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

The risk of recession has fallen more sharply recently and, according to the Macro Fever Curve, is still at 71%, after having been at 100% for almost an entire year...

According to the Heart Beat, the risk of a recession has also fallen from over 80% recently to 67%...

The Philly Fed orders are a good indicator for the ISM Mfgt Index, which reflects the economy very well. The trend here is also showing a more promising picture again... Why should the Fed cut interest rates in this environment?

Therefor no surprise: the strength of the US Treasury yield over 10 years is having a positive impact: Rising market yields again would support a more positive economic picture. But the market is actually expecting around four to six rate cuts‼! This should be exciting for the stock market...

Briefly to another region: the credit stimulus in China should have a positive impact on commodities and industrial metals towards the end of 2024...

The most important index of recent months in 2023: The level of the reverse repo facility: after a New Year's rash, the liquidity of this program continues to fall, most recently to USD 603 bn. The question remains in 2024: Where will the liquidity for the Biden debt explosion come from when this water trough dries up?

In the overall calculation, this has not yet had an impact on FED’s net liquidity; on the contrary, it has recently increased and more or less confirmed the correlation with the S&P500.

However, once the water trough is empty, the Fed's QT is likely to be increasingly called into question... In fact, all other central banks in the Top5 are already allowing liquidity to rise again...

On the stock market: More than 80 % of all S&P500 stocks were recently back above the 50-day average. In the past, this meant overbought and marked an important (interim) top...

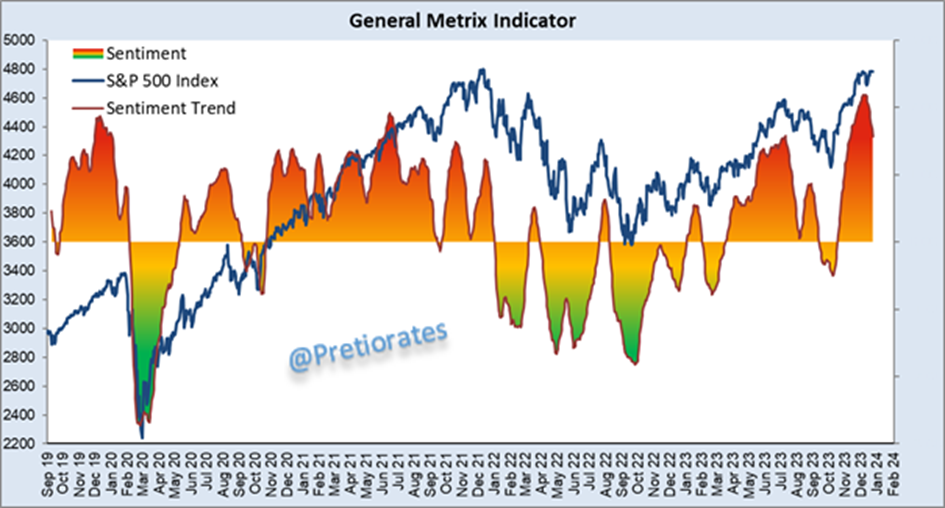

The General Sentiment Indicator is already falling again...

After setting a multi-year record of optimism, the General Metrix Indicator is already falling again...

The Fear Indicator still does not indicate any fear (or caution)...

We recognize: The fall bull market was created in particular by the inflow into S&P500 ETF... It showed a record inflow within a 24 day period. Smells like a buying panic...

Compared to PE performance, the S&P500 may have been a little too optimistic...

Cyclicals perform positively during bull markets. This was again the case in the second half of 2023 - but no longer recently...

Long positions in the US dollar futures by the non-commercials have recently been massively reduced. Possibly positive for the greenback...

Unbelievable: The gold price reaches new all-time highs... but the number of outstanding Gold ETFs continues to fall... Bull markets only end in euphoria...

The same picture with silver ETFs: ETF investors do not recognize any upside potential for gold's little brother, despite exploding demand from the solar industry...

According to the big cycle, questions will only arise again in late summer 2024...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

Until next week, successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.