In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

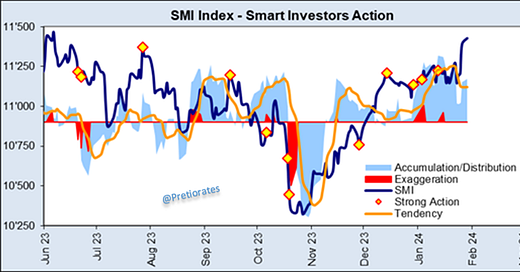

The SMI index continues to benefit from broad-based accumulation (blue area positive), and in some cases the bulls are even exaggerating (red areas)...

Since almost mid-December, the SMI has undergone a consolidation which smart investors have used to reduce their positions. However, new purchases now seem to be picking up again...

The picture is similar for DAX investors. Smart investors have not been buying since the beginning of December. Only recently have they started buying again...

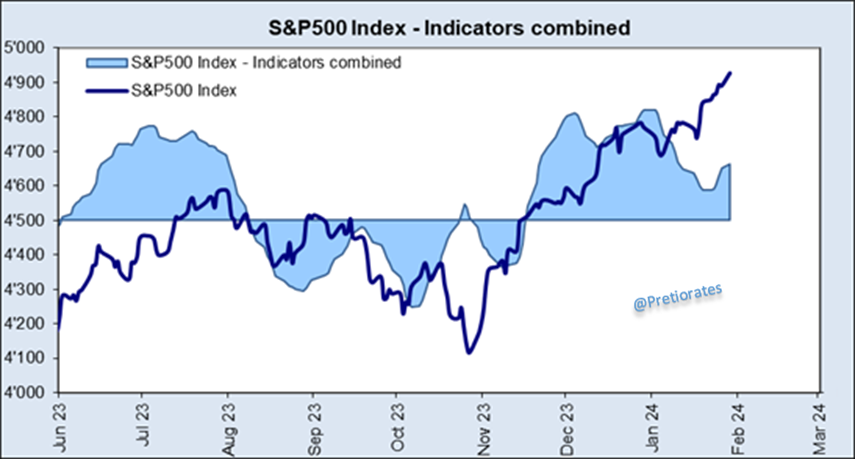

The action is still in the US equity market. The accumulation (since the beginning of November) continues. At the moment, the market is somewhat exaggerated again (red area in positive territory), which makes setbacks more likely - but they don't have to be...

The combined indicators are still in positive territory...

The trend strength of the S&P500 also shows up: The strength tank is still full...

The same picture with the Nasdaq Index: It continues to accumulate (blue area positive), but is repeatedly exaggerated (red areas in positive territory) - which can also be described as euphoria... However, there are currently no "exaggeration" points...

The strength tanks of the Nasdaq index are also still full...

The market cap of the Nasdaq continues to rise and is now over USD 20 trillion, but it has not been the Magnificent Seven that have driven the market up recently (percentage market cap of the M7 has hardly risen at all, black line)...

After a long time, investors now seem to be favoring defensive stocks again...

In fact, the copper/gold ratio (boom/doom ratio) shows that the cyclicals are probably being traded too high...

The sentiment of the economic data is also weakening again. Are fears of recession returning?

The accumulation of sentiment indicators (General Sentiment Indicator) is about to fall into the negative zone... A sudden turn to pessimism would probably surprise the market...

The S&P500 Fear Index recently showed a euphoric state for a short time, which has not been seen or felt since the end of 2019...

The Skew/VIX ratio remains at a very high level. It indicates that long puts are being bought, but the low volatility (and thus the high ratio) lets us know that this is not out of fear or uncertainty...

The FED balance sheet continues to look stock market bullish: Net liquidity (green area) continues to rise...

But the "water trough", the Reverse Repo Facility (RRP), is decreasing at the same rapid pace. In the meantime, the market is becoming increasingly aware of the issue. A growing number of participants are assuming that the end of the RRP will - or must - herald the end of tapering or QT. The Fed should not surprise the market with this and should announce it beforehand - or address it. As the RRP will be empty in the spring at the current pace, Jay Powell is under time pressure. Will he address the end of QT as early as this week?

On the bond side, not much is really happening yet... the spread between the Treasury over 2 and 10 years has recently narrowed again to 26 bips...

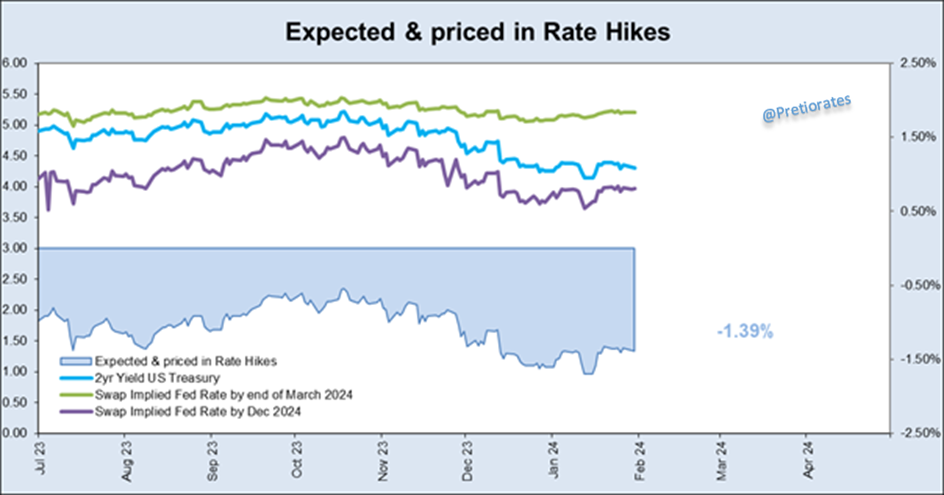

The spread between the Treasury over 2 years and the FED Fund Rate, on the other hand, is at 120 bips, which means that the market is currently assuming five rate cuts (¼ each)...

The swap market takes a similar view: it is pricing in a potential cut of 139 bips by the end of 2024...

The (not so) big surprise: the forex market also seems to have come to terms with this: The strength signals for the US dollar remain bullish...

Phd Economy, traditionally represented by the copper price, does not share the (economic?) expectations of the S&P500... Either the stock market is too high, or the copper price is too low...

The harmony between the gold price and the US market yield, on the other hand, is given... (market yield fell, weaker economic expectations like the copper price?)...

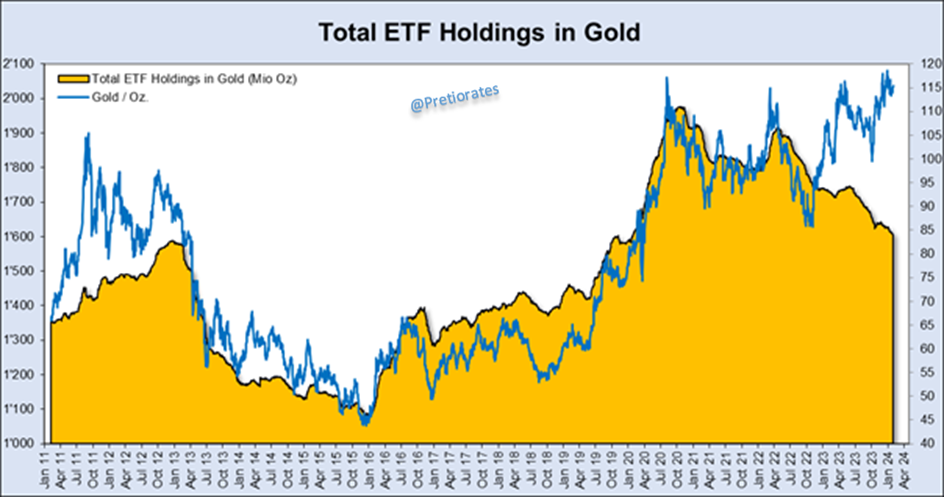

By the way: The Chinese continue to accumulate massive amounts of physical gold and are prepared to pay up to 3% more...

In the West, on the other hand, interest continues to fall - despite the gold price being just below its all-time high. The number of outstanding ETFs with physical gold backing continues to fall... (actually a bullish indicator...)...

The same picture with silver ETFs... sorry, no interest... (although the solar industry is coming up with new record production and guidance every day...)...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

Until next week, successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.