In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

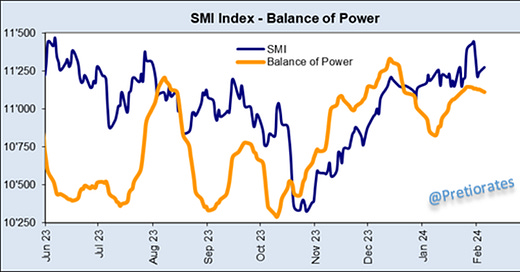

The SMI balance of power between the bulls and bears (balance of power) seems to be shifting back towards the bears... In addition, the divergence of the indicator is disturbing: the bulls have reached a new high, but had less (remaining) power...

The combined indicators, on the other hand, remain bullish... (but this is a slow indicator)...

The trend strength of the SMI also remains in the green...

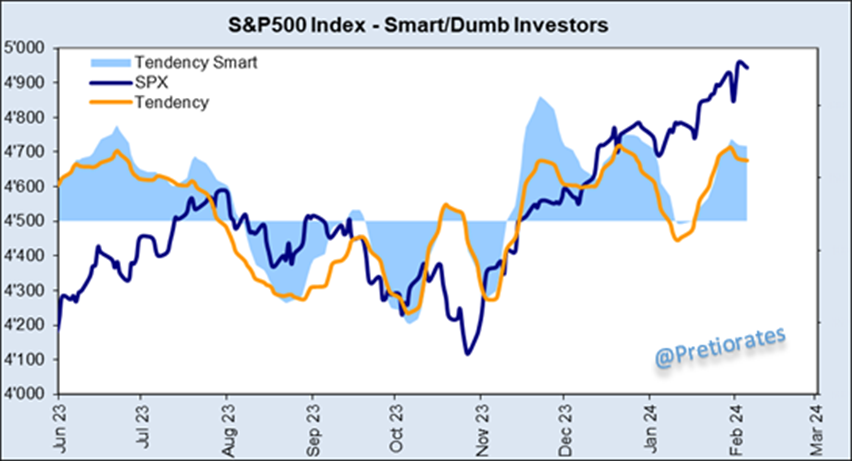

The bulls have also made further progress on the S&P500, but the index between the smart and less smart investors has reached a high level and is (currently) not rising any further...

The combined indicators remain positive...

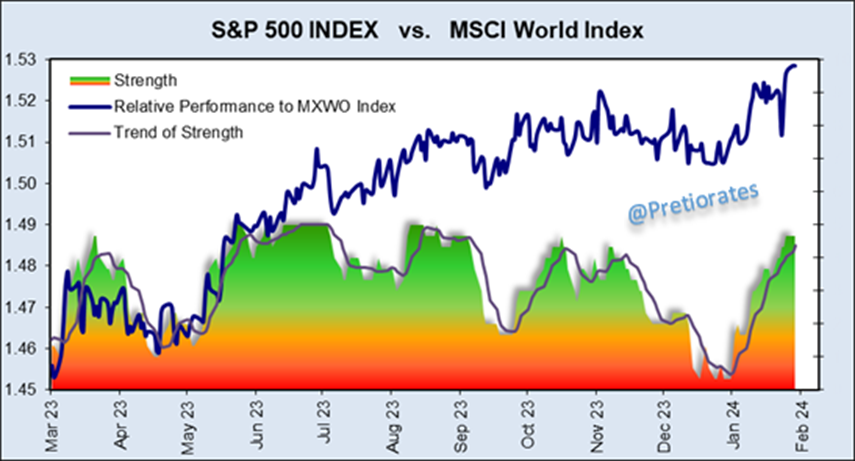

Compared to the MSCI World, the S&P500 is still the prefered stock market...

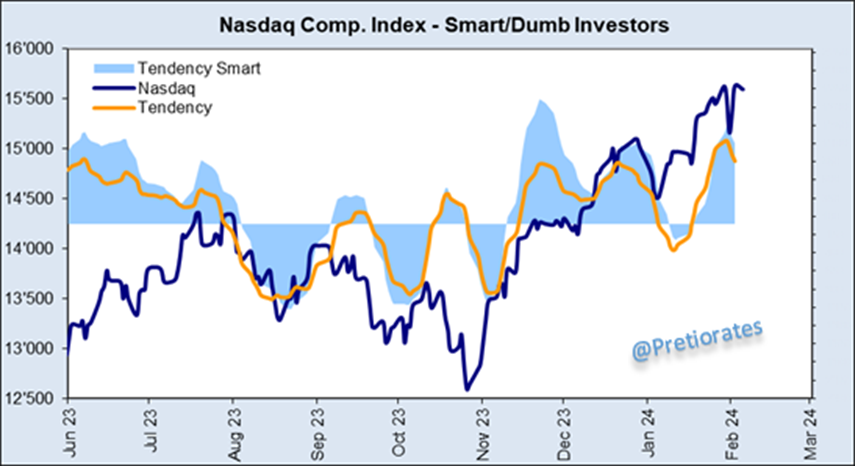

Nasdaq: The first signs of weakness after a positive run can be seen in the ratio of smart to less smart investors...

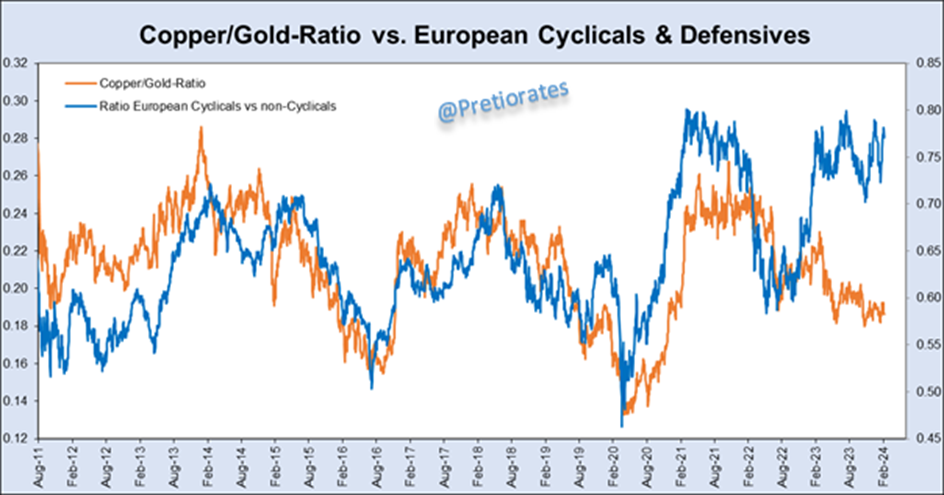

Despite the (very good) economic data: The copper/gold ratio (boom/bust ratio) remains at a relatively pessimistic level and does not share the optimism of cyclical stocks...

The ISM was published a few days ago. The latest development is better, but far from the optimism of cyclical stocks...

The Cyclical Stocks Warning Index gives similar signals: Cyclicals' strength is weakening sharply...

The logical consequence of the two charts above: the correlation between the ISM and the copper/gold ratio is more likely to be correct...

Phd Copper has generally been regarded as the economic specialist par excellence for decades, even if this has become less important over the last few decades with the emergence of services. Nevertheless, Dr. Kupfer does not really agree with the run of the S&P500 index...

The ISM Mfgt. has just been published, but we are already looking forward to the next release. The Philly Fed Order Intake is giving very good indications. The last one lets us know that things will become more pessimistic again next month...

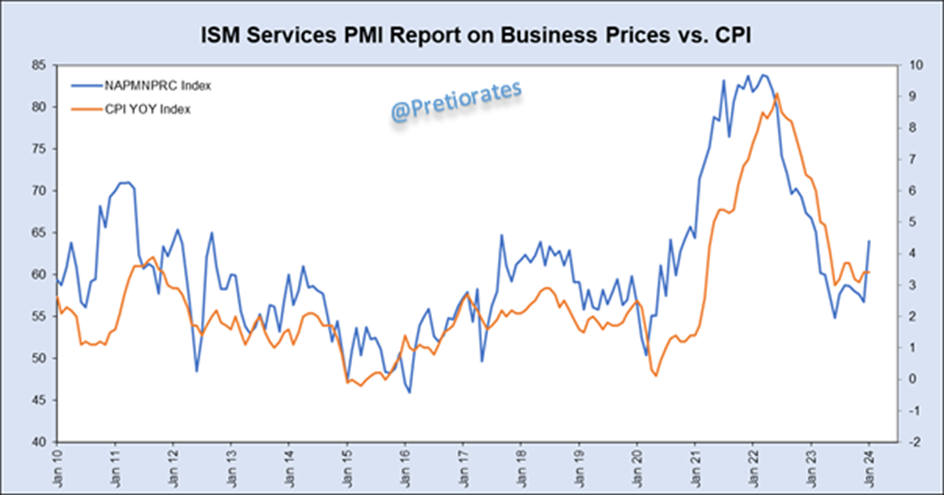

The ISM Services also gives very good indications of inflation trends. And lo and behold, according to this indicator, we should expect inflation to rise again in the coming months...

The Real US Economy Indicator (summary of several economic data) has risen recently, but the silver/gold ratio (boom/security indicator) does not really agree...

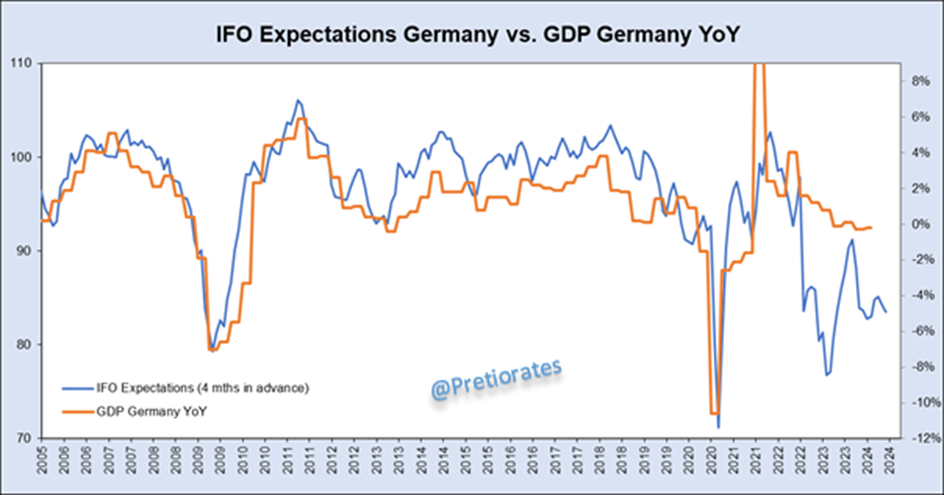

The IFO Expectation suggests a rather lower GDP in Germany....

And another look at the commodity world: the oil market remains in a slightly tight supply situation... which should continue to provide some support for the oil price for the time being...

In the gas market, on the other hand, there is an even more massive oversupply. Biden wants to save the climate, but perhaps he also has one eye on his own gas market and thus has (another) reason for the export ban?

Exciting? An empty chart, because the lithium price has not shown any trend strength since last spring. But now it is turning positive... Is the lithium market on the verge of a major recovery?

Compared to the Bloomberg Commodity Index, the strength has been evident for some time...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

Until next week, successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.