In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

Smart investors continue to accumulate the SMI Index, even recently when the market tended to weaken. Interesting... Because defensive stocks are in demand? Today's market at least confirms this. It is the only one of the top 10 European markets that is (currently) trading in positive territory...

Accumulation is also indicated in the combined indicator, but with a negative divergence (no longer the same strength)...

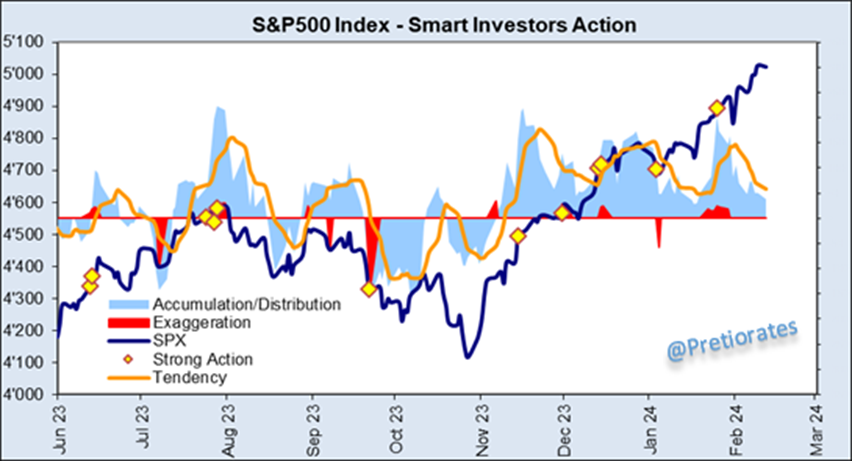

Accumulation is also continuing in the US market (S&P500), but the smart investors have scaled back their activities somewhat - despite new highs...

The S&P500 also continues to be the measure of all things compared to the MSCI World Index... strong outperformance...

Of course, the Magnificent Sevent are again making a big contribution. They have set a new record in terms of market capitalization, but not (yet?) in terms of percentage weight within the Nasdaq 100...

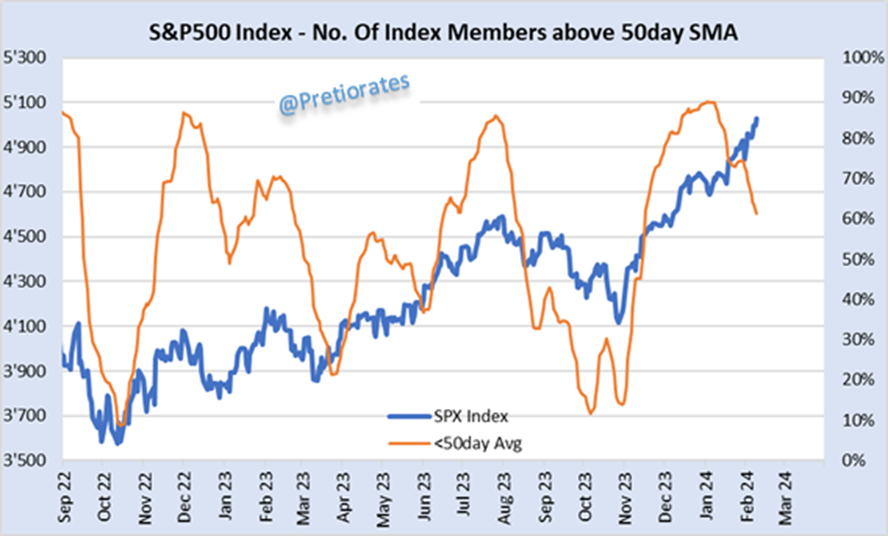

The number of stocks within the S&P500 trading above the 50-day moving average is decreasing. In the past, this was often a signal that the bears had been let off the chains...

One word: S&P500 Index is overbought...

Do we need a fundamental argument for a potential correction on Wall Street? Recession risk has fallen from 67% to 60% in the last few days. So why should interest rates fall? According to Economy 1.0, shouldn't they rise sooner? Thoughts that are currently priced in diametrically differently by equities...

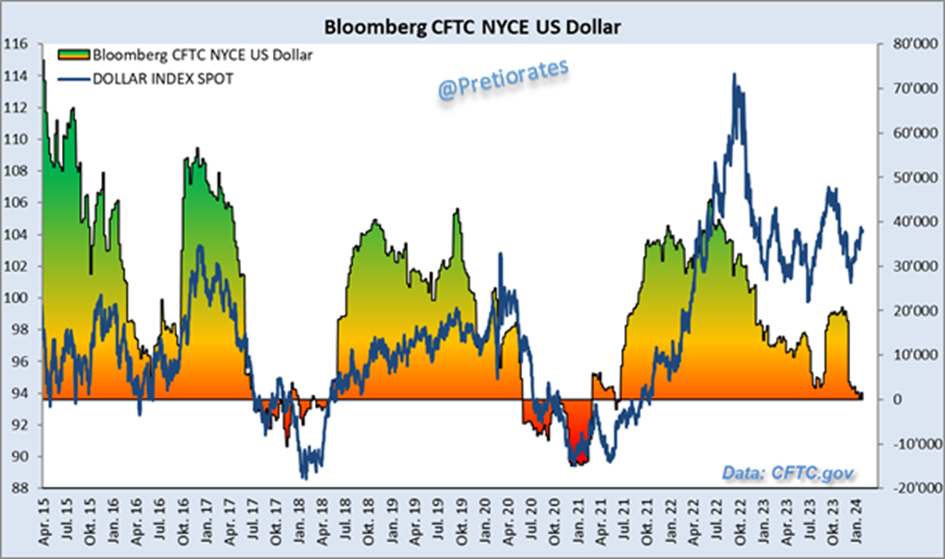

A funny thing is happening in the forex world: long positions in US dollar futures have completely disappeared on the part of non-commercials (professional investors). No opinion? No faith in the US currency??? At least a rather rare case...

One might think that long positions have been built up in the world's second largest currency, the euro. But on the contrary: the non-commercials have also massively reduced these positions in recent weeks...

Even the strong short positions in the Canadian dollar have recently been almost completely covered...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

Until next week, successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.