In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

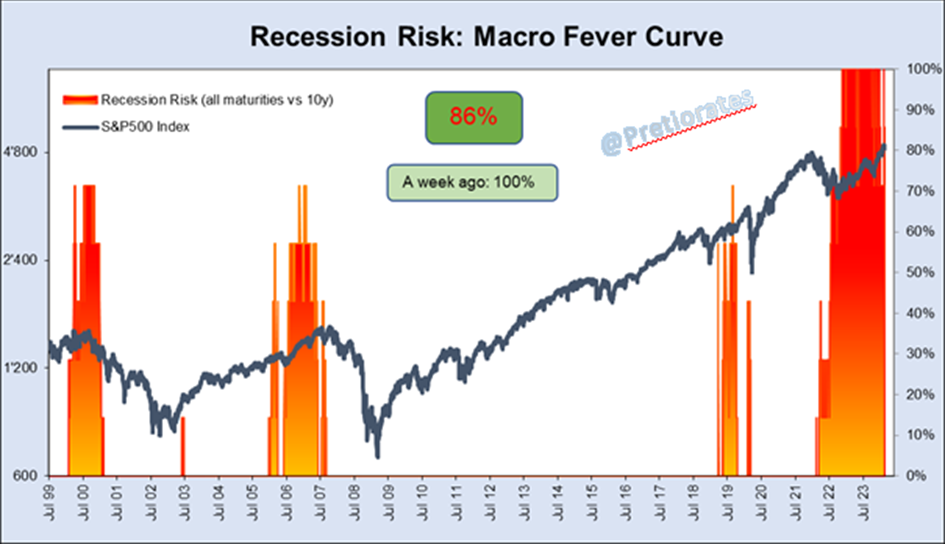

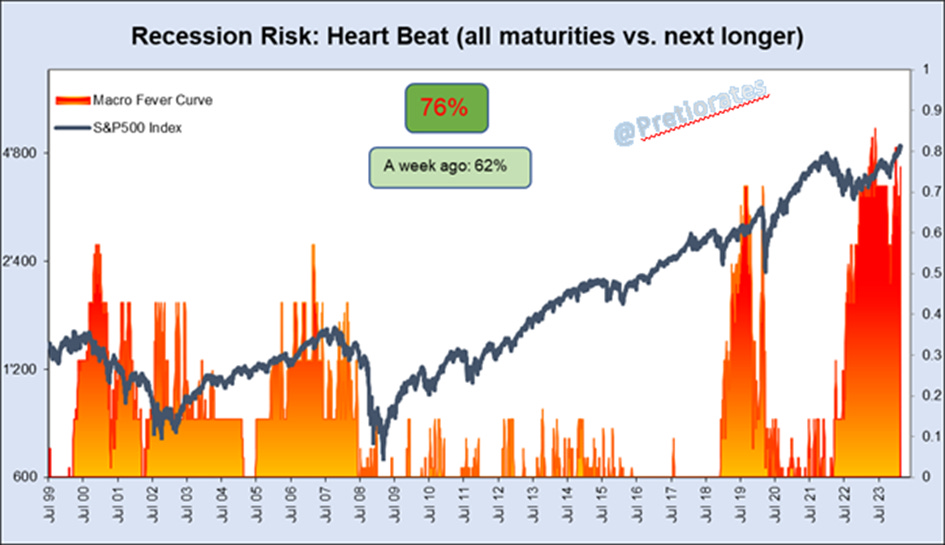

Interesting: The indicators regarding the risk of recession are beginning to contradict each other, something never has happened before...

While the macro fever curve clearly indicates a lower risk (falling from 100% to 86% within a week)...

...the recession risk according to the economic heartbeat rose from 62 % to 76 %...

This is probably not too significant at the moment. However, it clearly shows that the market is searching for a new consensus. Was the previous interest rate cut fantasy too strong after all? With a strong economy, it makes little sense to lower interest rates...

The spread between the current FED fund rate and the market yield of the US Treasury over two years has narrowed a little, i.e. the fantasy of lower interest rates has diminished somewhat...

A confirmation from the futures market: The spread in the bond futures market has also narrowed recently, i.e. the futures market expects less potential for interest rate cuts...

However, not much has changed in the yield curve in recent weeks...

An interesting side note: China has recently increased its investments in US Treasuries again somewhat... A surprise from the political stage...

The ISM Services PMI report gives a good indication for the upcoming CPI development. The CPI was published last week in line with expectations. The PPI, on the other hand, was clearly above expectations. It is clear that higher producer prices will probably sooner or later turn into higher consumer prices...

Meanwhile, another leading indicator is not very optimistic for the German economy: the IFO Expectation suggests that German GDP is likely to continue trending southwards...

The copper price, also known as the Phd Economy, has shown no clear trend in recent months. In comparison, the S&P500 index is clearly too optimistic.

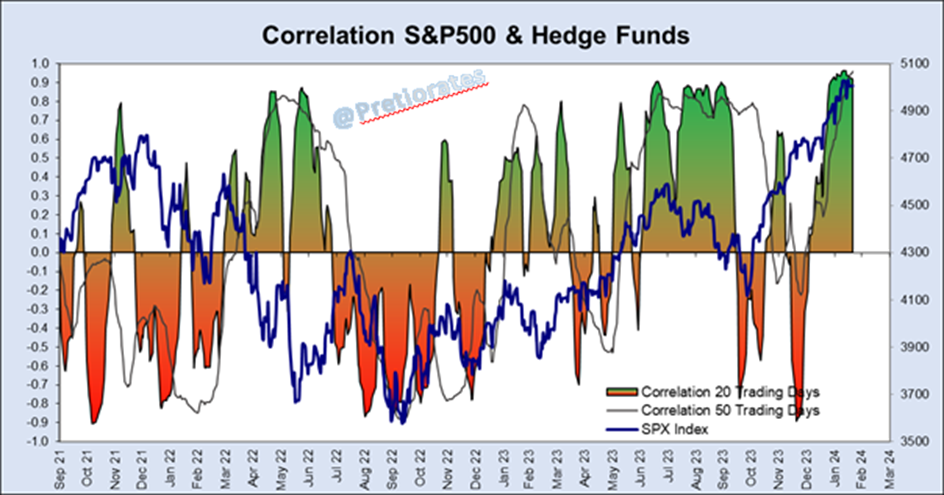

The hedge fund positions are mostly trend followers... Currently they are massively overweight in equity exposure... Contrarians will love it – it can be understood as an actual bearish message...

High prices are paid for long out-of-the-money put options, i.e. they are sought after (high SKEW index). However, the ratio compared to the VIX index is also very high - i.e. they are bought for hedging purposes, but not because a correction is expected...

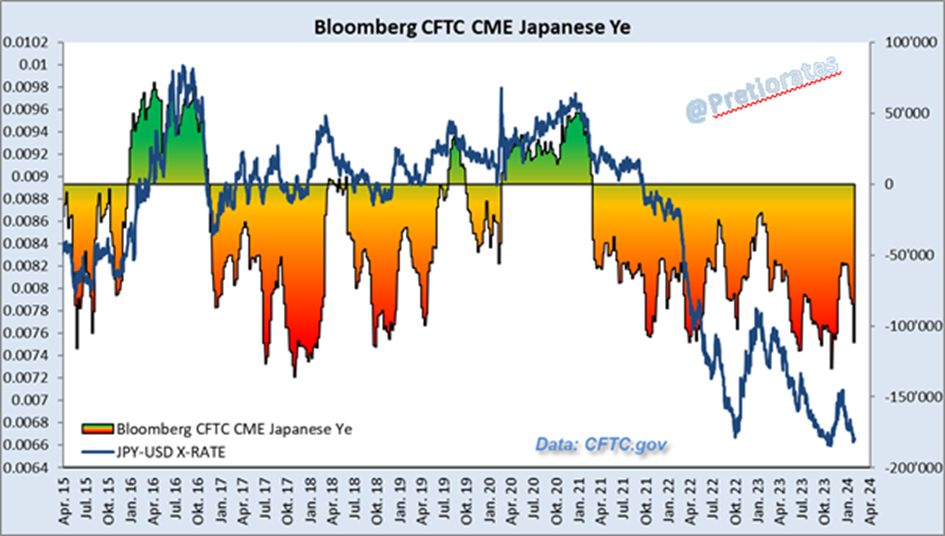

Another look at the currencies: The yen - which was considered a save-haven currency just a few years ago - has fallen massively over the last three years. Short positions in the futures market (COT) have recently been built up again, even at much lower levels...

On the other hand, the financial market seems to have grown fond of the British pound... There has been a clear build-up of long positions in the futures market (COT) on the part of non-commercials (financial institutions)...

Also exciting: the short positions in palladium futures were also built up again in record numbers. This is actually surprising: if EV sales are faltering so strongly, the palladium fantasy should be rising again thanks to hydrogen vehicles and fossil-fueled cars...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

Until next week, successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.