In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

The AI stocks are taking a break

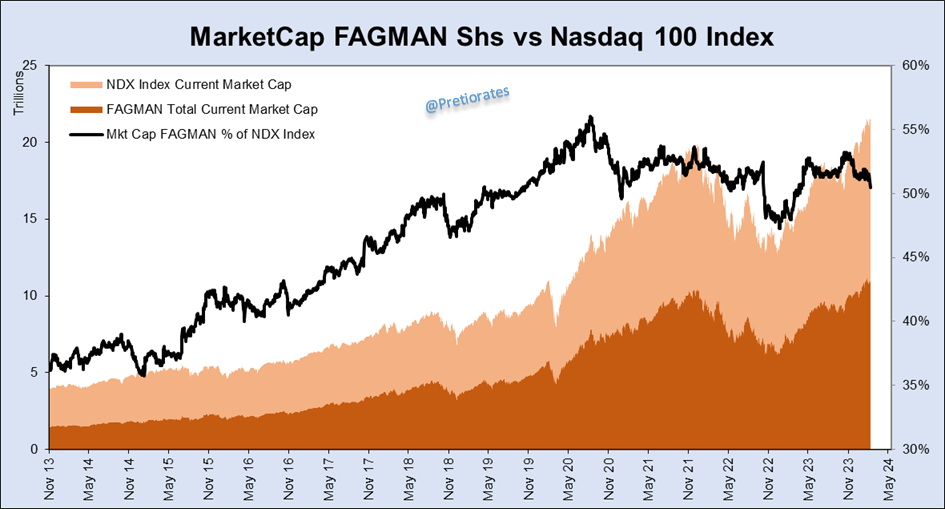

You remember the (old) FAGMAN stocks? They are even correcting a bit...

The macro fever curve has risen again to 100% recession risk...

New recession fear shouldn’t be a surprise: The Leading Economy Indicator has now fallen the same number of months as it did back in 2008...

However, smart investors are still accumulating in the Swiss market...

Instead, the combined indicator shows only a slightly positive trend...

The DAX index is rising without accumulation... probably because this is simply the current trend...

The S&P500 is currently accumulating again, but with an exaggeration (which is usually acknowledged with a countermovement)...

The combined indicator of the S&P500 Index continues to show a green light...

Infact the S&P500 index continues to show strength...

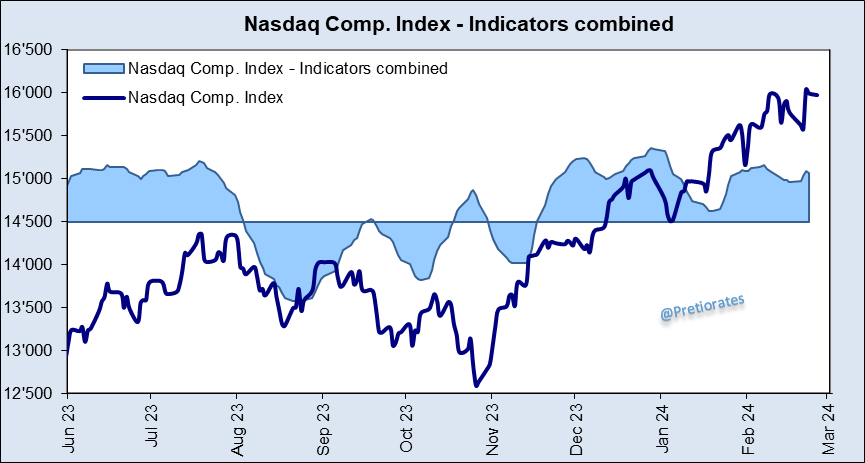

A slightly different picture with the Nasdaq: smart investors are no longer really accumulating....

However, the combined indicator is still showing a green signal...

Conclusion: No desire for change. The markets seem to be moving along the edge. Still up, but it’s going down on both sides...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

Until next week, successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.