Pretiorates' Thoughts 28 - Precious metals and base metals out of control

Published on May 17th, 2024

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

Ten days ago we mentioned in Pretiorates' Thoughts 26: Chapter 2 should start with Precious Metals. Even if there are further consolidations and emotional sell-offs in the near future, as long as a premium is paid on physical Gold and Silver in Shanghai, the bull market is likely to continue. And who knows, investors in the western world are coming under increasing pressure - because they are not involved... Perhaps they will be responsible for the top...

Gold is currently still trading at a premium of 1.5 % in Shanghai, which underlines the demand from Chinese investors...

Despite the massive rally, a premium of over 10% is still being paid for Silver... The solar industry sends its regards. What is interesting is not how many GW of solar energy is planned, but how many solar panels are manufactured in China. And China is flooding the world with solar panels...

Another star of the week is Copper. There is no question that the big buyer here is also China. Are investors also paying a premium in China? But of course: Copper is almost always traded at a higher price than in London (LME). It is currently over 10 % higher here too...

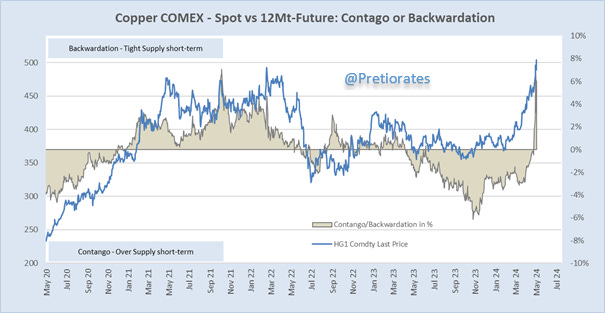

But the red metal is becoming scarce. The prices of the various maturities of futures show whether there is a shortage of supply in the spot market or not. If a higher price is paid with a longer term, there is sufficient Copper in the exchange warehouse (contango). However, if stocks become scarce, a higher price is paid for futures with a shorter term - this is known as 'backwardation'. On the London Metals Exchange (LME), the situation has just changed from cotango to backwardation. The Copper stock is slowly running out...

In Chicago on the COMEX exchange, on the other hand, there is already a kind of panic. The situation has changed sharply to backwardation in the last few days and shows that there is a big shortage of physical Copper...

This is also reflected in the difference in market prices on the spot market... The difference between the LME and COMEX has exploded to a level that has probably never been seen before...

The tense situation is now also evident in the Nickel market. The Nickel market was flooded by Indonesia last year and prices halved. But now this market has also fallen into backwardation... If buyers cannot get the Nickel they need immediately, they should be prepared to pay higher prices...

A little reminder: Copper is also known as PhD or Doctor Copper. The price rises when the economy is strong - and falls early when a recession threatens. This makes it a good economic prophet. The same also applies to inflation: with a lead time of around 3 months, the copper price indicates the course of inflation. The correlation is impressive and has been evident for many years... Is inflation following Copper again?

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.