Pretiorates' Thoughts 33 - A surprising development in the gold market

Published on June 6th, 2024

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

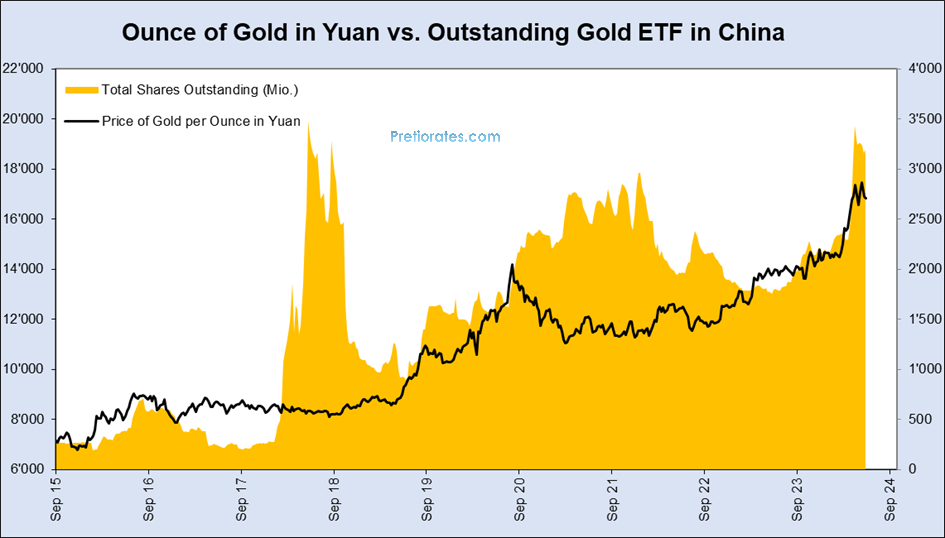

The gold market seems to have calmed down somewhat after the run. In China, too, the number of outstanding ETFs with gold backing has stopped increasing. Unsurprisingly, market prices have also consolidated...

It is highly likely that the gold and silver markets have consolidated because retail investors in the West continue to be among the sellers. The number of outstanding ETFs with gold coverage has continued to fall in recent weeks... The sellers of gold ETFs are mainly retail investors, but also professional asset managers, who are bringing their asset allocation back to a lower value (balancing) as a result of the price rise...

The same picture can be seen with silver ETFs... after a very brief upsurge, the number of investors, especially Western investors, who want to be invested in silver is already falling again...

The mining indices (GDM Index) have seen an improvement in sentiment since the beginning of the year (Tendency, orange line) and the market has also been optimistic again since the end of February (Sentiment, blue area). Since then, sentiment has actually never reverted to pessimism. And this is actually bullish...

Indeed: the brief correction of the last few days has already seen a return to “strong action” (which is often followed by trend changes) and, above all, we are currently seeing massive, rarely heavy “strong action” (red area). This indicates nothing other than that the selling pressure seen recently was exaggerated - and thus an end to the current (down) trend should follow...

What is also very special is that the accumulation in silver by 'smart investors' has been massive over the last few days despite the slight correction...

And something else very exciting: Not surprisingly, the 'smart investors' in the Chinese gold market have actually distributed some of their investment recently…

In the Western gold market, on the other hand, it is a real surprise that the 'smart investors' in the West have used the recently lower gold price to accumulate massive amounts. There is even an 'exaggeration' (red area), which indicates exaggerations. The 'smart investors' tend to be bullion banks and professional investors. Retail investors usually invest in ETFs. Is it possible that the smart investors in the West have recently used the lower gold price to clean up their portfolios? Think about potential short-positions…

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.