Pretiorates' Thoughts 34 - Base metals could soon take off from the base again

Published on June 13th, 2024

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

The inflation figures have been published. If we want to get an idea of where inflation is heading before the release, we analyze the commodities...

By the way, commodities are extremely cheap compared to the S&P500 index...

The ISM figures were also published this week. The copper/gold ratio used to have a very high correlation with the economic number. Copper tended to perform better in positive economic cycles, gold during the rest of the time. In the meantime, however, times are changing due to the high demand for copper (electrification) and gold (financial system and geopolitical developments)...

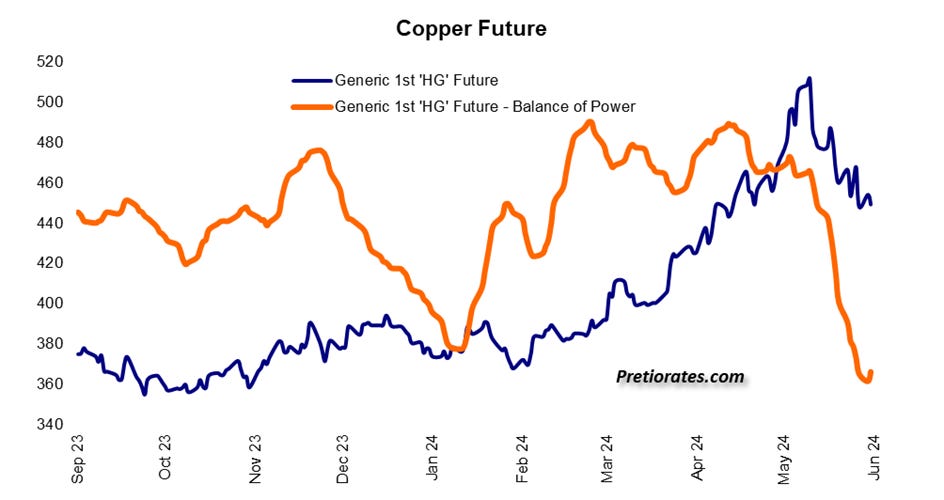

The massive backwardation in copper futures shows how scarce the availability of copper currently is...

The trend strength of the copper price has, however, declined somewhat in recent days...

However, the short-term indicators are already massively oversold... Ready to speculate???

The same indicator shows a similar situation for nickel: massively oversold...

And also zinc: The earlier movements cannot be compared with the last ones...

In the medium term, however, the trend strength continues to weaken...

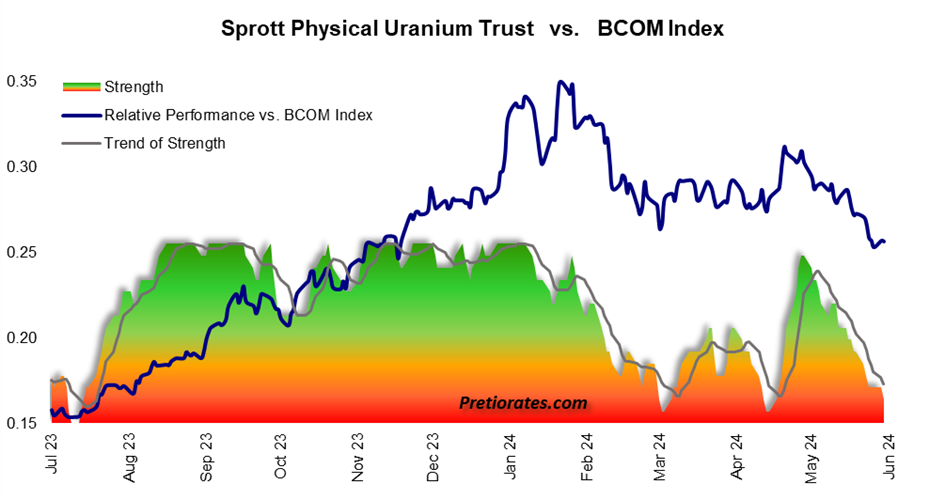

This has been the case with uranium for some time now. The Physical Uranium Trust from Sprott was a winner in 2023. Since the beginning of the year, however, only for a very short time...

The balance of power, the strength between the bears and bulls, lets us know that the bulls could soon take control again...

And again on the Sprott Uranium Trust: it is currently trading at a discount of almost 15%... Who wants a dollar for 85 cents?

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.