Pretiorates' Thoughts 37 - The US Equity Market, the last man standing?

Published on July 4th, 2024

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

The US stock market continues to rise, while almost all other markets worldwide have long since entered a consolidation phase. The question is more topical than ever: how long can the US market maintain its solo run?

Optimism has been waning for a few days now, but the index continues to be carried upwards by a few stocks...

The trend strength of the S&P500 is still there...

The ratio of the S&P500 compared to the World Index shows how strong the outperformance of the US equity market has been in recent weeks...

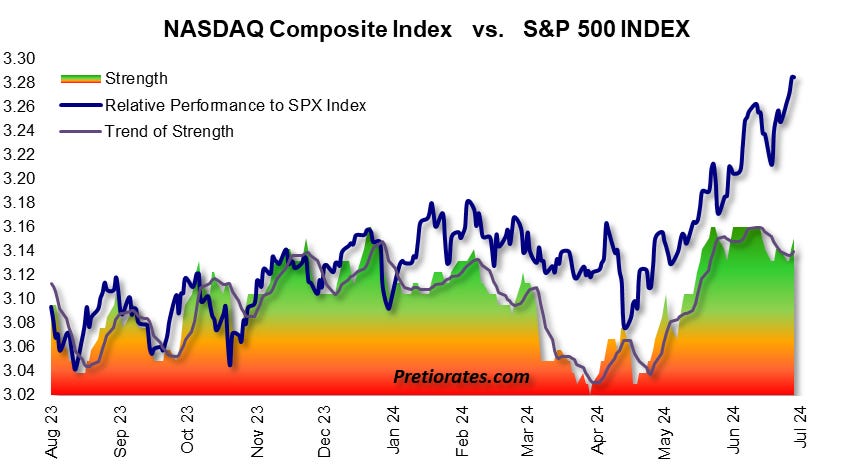

Optimism has also waned recently on the Nasdaq. This is a basic prerequisite for a correction. The other is for the indicator to fall into the pessimistic zone - we are still a long way from that...

The Nasdaq has massively outperformed the S&P500 index...

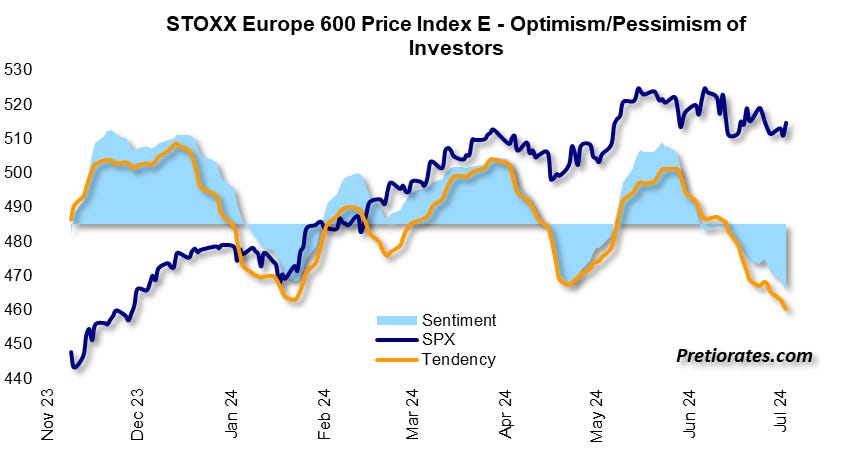

As already mentioned, pessimism has long since gained the upper hand in Europe. The Stoxx 50 Index with the largest European companies has already reached such a pessimistic level that a (technical) recovery should be possible...

The same applies to the broad Stoxx 600 Index: the stock markets are deep in pessimistic territory...

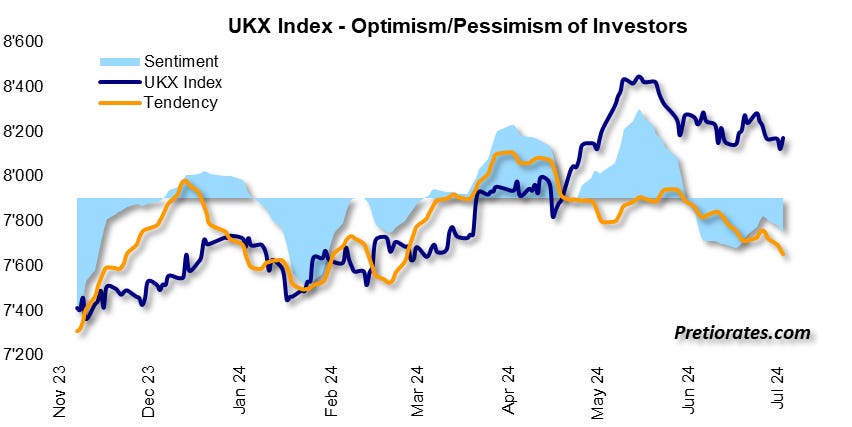

Not surprisingly, the UK stock market has been consolidating for some time due to the elections - with the potential for a continuation...

...because smart investors are still not accumulating. No uptrend without sustained buyers...

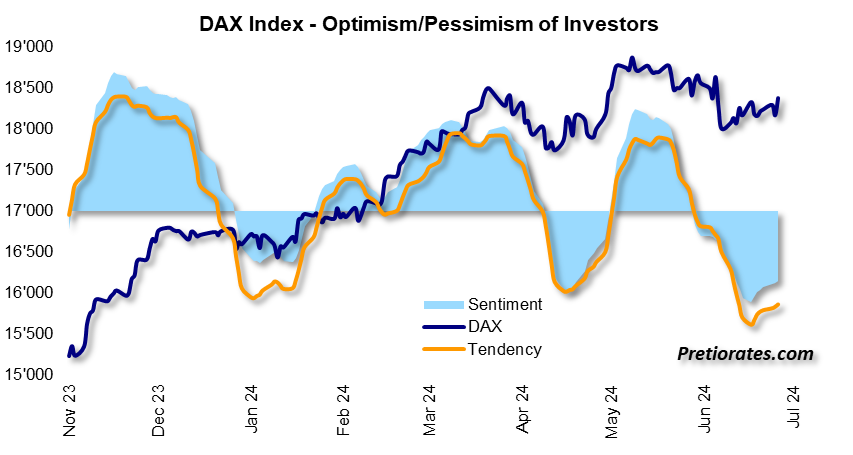

Sentiment on the German DAX index is improving again somewhat. Still too little for sustained advances...

In Switzerland, sentiment has only just fallen into pessimistic territory. The consolidation could turn into a correction...

And as in the UK, the effects of politics are also evident in France: sentiment is deeply pessimistic...

But at least: when sentiment is this negative, smart investors usually show up. In fact, the indicator shows that accumulation is already taking place again in the background...

Accumulation is also evident in Tokyo...

And in contrast to the stock markets already discussed, optimists predominate in Tokyo...

In China, too, sentiment will soon return to the predominantly optimistic zone...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.