Pretiorates' Thoughts 38 - How magnificent are the seven individual magnificent?

Published on July 8th, 2024

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

The seven Magnificent stocks are responsible for the trend of the US indices. So you can analyze these seven stocks and get an idea of where the US market will be heading in the near future. Not how healthy it is, just where it could go.

We have developed the Magnificent 7 Index for this purpose. We have not based it on share prices, but on market capitalization, which we believe is more meaningful.

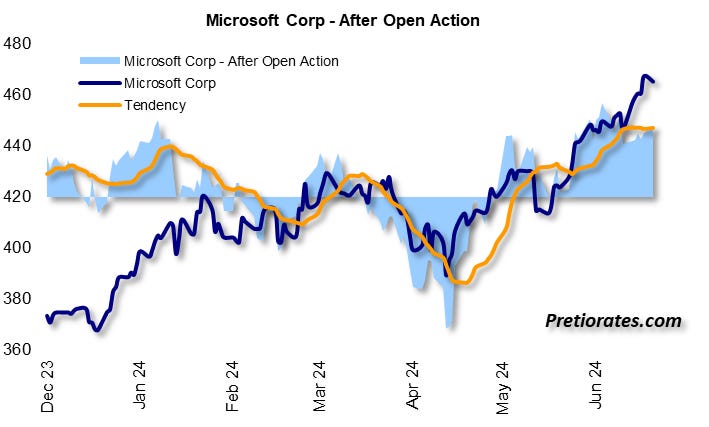

We use two of our most valuable indicators: The 'After Open Action' expresses how the market develops after the opening. The opening phase is often overdone and is often random. Professional investors, on the other hand, usually only enter the market after the opening. The light blue area shows the activity: Accumulation or distribution. The orange line shows the trend: Bullish in the positive area, bearish in the negative area, with a falling or rising trend.

The second indicator shows the strength of the trend. If five different criteria are met, it shows a trend strength of a maximum of five points and is therefore deep green. It is a lagging indicator. It shows the current direction, but not the future. As long as the trend exceeds five points, you should remain invested. Speculatively, you can also use the trend strength as a guide.

According to the 'After Open Action', this index has been and remains bullish since the beginning of the year, apart from a brief interruption in April.

The trend strength is also currently at its highest level…

The comparison with the S&P500 Index is exciting: the strength against the broad index has recently increased massively again….

Alphabet had a weak period in the spring. Since then, investors have been accumulating, and it is striking that they are doing so in stages...

The trend strength has actually been at the highest level since April...

Amazon was not really convincing during the spring. Since then, however, the stock has made steady progress and has apparently found friends with investors again...

From November 2023 until the consolidation during April and May, Amazon was one of the favorites - and seems to be again...

Apple did not behave like a Magnificent 7 for a long time. Professional investors did not show a clear line in their activities either...

But the trend strength has been back in full force since May - after a brief flameout in November/December 2023...

Meta has been enjoying increased popularity among investors again since mid-April...

...and is apparently returning to the glory days between October 2023 and March 2024 based on the strength of the trend...

Microsoft's share price movements were not really magnificent until May 2024. But since then, the AoA indicator has been pointing to bullish times...

The trend strength, which has returned to full strength, speaks a clear language...

Between February and April, professional investors were not really accumulating in Nvidia. This has changed again since the beginning of spring...

Even if the full trend strength is no longer present, it is at least still slightly bullish...

And the last of the Seven Magnificent, Tesla, has recently been able to achieve full momentum. Professional investors have never really seemed interested in Tesla this year. However, this has changed in the last two weeks. A massive accumulation...

The trend strength already increased in May/June - and has now reached full strength.

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.