Pretiorates' Thoughts 40 - The US dollar should not yet be written off

Published on July 28th, 2024

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

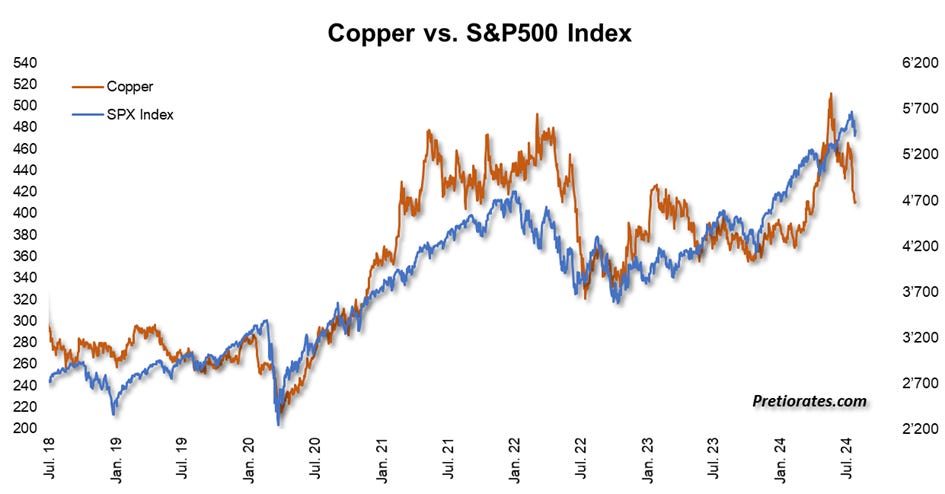

Copper is also known as PhD Economy, as its price has a high correlation with economic development. In spring, a temporary supply problem caused a price spike, which has already been corrected. The economic development in the USA does not suggest that the brown metal could see a higher market price in the near future...

The futures market also confirms that a falling market price is to be expected...

Since the economic trend is also one of the most important inputs for the stock market, it is not surprising that the skies over the US stock market are now also clouding over...

The US dollar is (still) one of the most important safe-haven currencies. When economic times get tough, the US currency usually sees increased demand and rises. Ergo, the same applies to the counter-correlation with many industrial metals. In fact, our strength indicator confirms that the US dollar could appreciate again in the near future...

A stronger US dollar means lower costs for goods imported into the USA, which should mean that inflation continues to fall – which the cycle also confirms at least until the end of the year...

A rising US dollar also puts pressure on precious metal prices – especially gold. And as mentioned in a previous issue, no support can be expected from the gold cycle in the near future. If the geopolitical situation does not heat up further worldwide – which we hope it won't – the gold price is likely to continue the consolidation that has begun recently...

Silver bugs have recently been suffering more and more, as the ratio between gold and silver has once again increased massively. Silver is increasingly seen as an industrial metal, which is why the gold/silver ratio is also increasingly correlated with the economy and the US dollar. Compared to the US dollar, this ratio has therefore been rather too low in recent weeks and months – and has now returned to normal...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.