Pretiorates' Thoughts 43 - After the turmoil, there is still no green light

Published on August 14th, 2024

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

It is not uncommon for severe corrections to attack the low again in the short term. If the stock market confirms this tradition again, it is currently only a technical recovery.

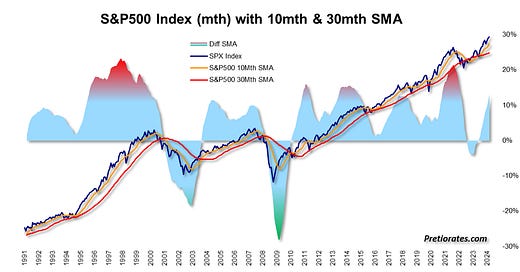

A look at the long-term indicators reveals the following: a high difference between the moving average lines over 10 and 30 months in the S&P500 Index has often indicated massive exaggeration phases in the past. When the spread reaches 10%, it has always been dangerous for the bulls in the past...

The NYSE, on the other hand, has not yet generated enough new lows for individual stocks for the following indicator to generate a long-term buy signal...

The (technical?) recovery to date has also not been particularly convincing. Long-term significant recoveries after sell-offs should come with convincing volume...

The Zweig Breadth Thrust indicator measures market momentum and often provides reliable buy signals when there is exaggeration. However, the selling momentum of recent weeks has not yet led to this...

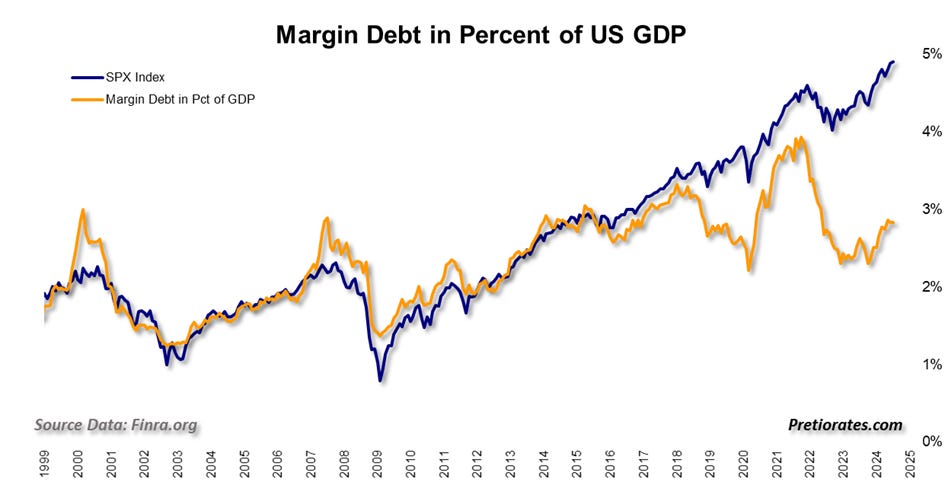

The activities of private investors also continue to attract attention: they are particularly active during periods of increased speculation, usually near important highs. The margin debt data from Finra.org helps us to measure the activities of private investors. The changes in credits for investment show a high correlation with the annual percentage change in the S&P500 Index...

The percentage change from the previous year tells us that private investor activity was increased, but not to the extent that was observed during long-term top marks...

Strong changes within 15 months also provide fairly reliable buy and sell signals...

The figures from Finra.org should also be adjusted for the increase in economic output. It is clear from this that the credit for investments by private investors was much more pronounced three or four years ago...

By analyzing the data from another provider, the AAII Asset Allocation Survey, we obtain the not insignificant input that investors are still rather heavily invested in equities compared to the consumer sentiment of the University of Michigan...

The development of real wages also provides valuable input on the development of Wall Street. With a time lag of six months, there is a very high correlation with the percentage change in the S&P500 Index. Most recently, the development of wages has not been very convincing. Therefore, no major leaps on Wall Street should be expected in the next six months...

The strength of the shares of cyclical companies also tells us a lot about the strength of the economy. Since July 1, 2024, this indicator has been telling us that we should only be invested in cyclical stocks up to a maximum of 50%...

That’s it for today!

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.