Pretiorates' Thoughts 45 - The bulls in the stock market shouldn't feel like winners yet

Published on August 26th, 2024

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

In the long term, the stock markets are dominated by fundamental developments. In the short term, however, sentiment has a greater influence. And in the last four weeks, these sentiments have reached extreme levels on both sides...

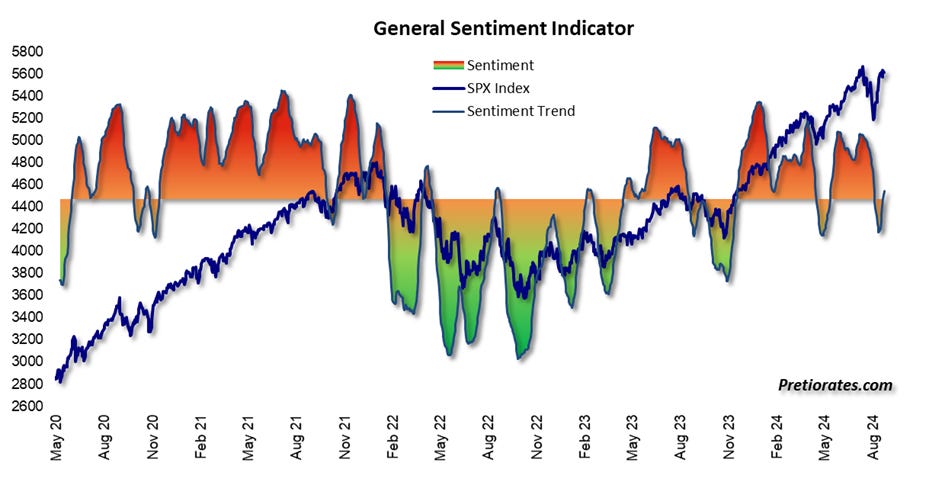

The General Sentiment Indicator with the Short Term Inputs reached typical lows at the beginning of the month, but is already on its way back to euphoria...

The spread between the Volatility Index Spot and the 200-day average even generated a buy signal...

The spread between the spot volatility index and the six-month futures contract also fell to a level last seen in November 2020...

The spread between the S&P500 index compared to 20 days earlier also reached such a low level, which usually leads to (stronger) recoveries...

The S&P500 Fear Indicator has even reached the maximum possible low, but is already back in more euphoric territory...

The long-term oriented General Sentiment Indicator, on the other hand, has only briefly remained in negative territory...

And if you compare the current price/earnings ratio of the S&P500 with the average over six years, the market still remained at too expensive a level even during the panic days at the beginning of the month...

The 21-day average of the call/put ratio has not even reached negative territory...

With the extreme movements of recent weeks, the market pendulum has naturally swung more strongly. In the meantime, however, that of the S&P 500 Index has reached an extreme value on the positive side - which usually results in weaker markets...

The Smart Investors Action of the S&P500 Index has also reached an extreme value that has never been seen in recent months. Exaggeration (red areas) also indicate exaggerations...

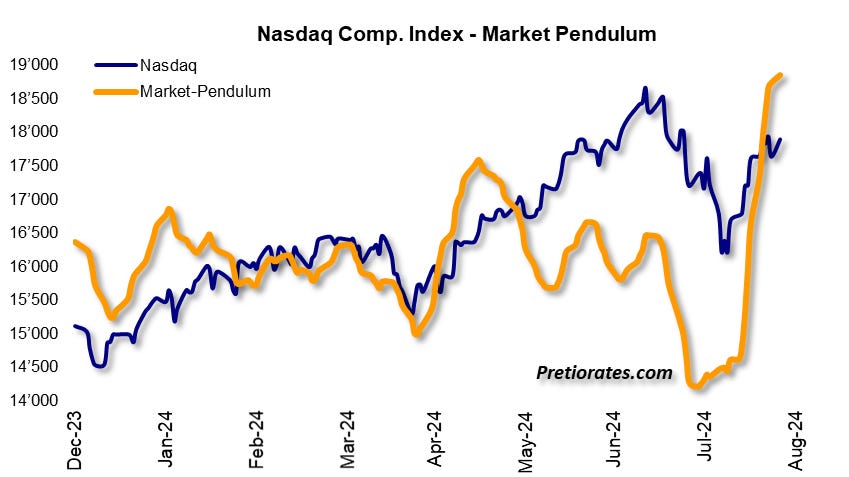

The same picture with the Nasdaq Index: the Market Pendulum has reached a positive extreme, which usually indicates negative developments...

Here, too, the Smart Investors Action shows extreme values...

The short-term sentiment indicators are already showing extreme values again, while the long-term indicators continue to leave a rather bearish impression. As mentioned in earlier Thoughts, a second wave of selling is therefore likely to occur over the next few days and weeks...

That’s it for today!

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.