Pretiorates' Thoughts 48 - The beautiful dreams of lower interest rates

Published on September 13th, 2024

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

This week, the market was informed about the latest development in US inflation. And although the somewhat higher core rate did not really meet the market's wishes, it continues to dream of massive interest rate cuts by the Fed. While the Fed rate is still at 5.5%, the US Treasury with a term of over two years already indicates a market yield of just above 3.5%. One wonders whether the market is not too optimistic about interest rates...

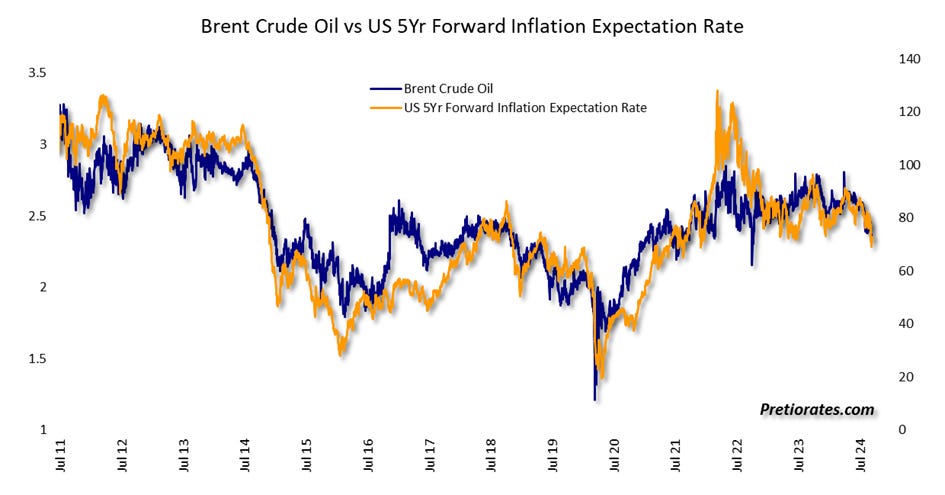

The oil price (Brent crude) has a very high correlation with inflation expectations. In fact, the falling oil price indicates that inflation will continue to fall. So far so good...

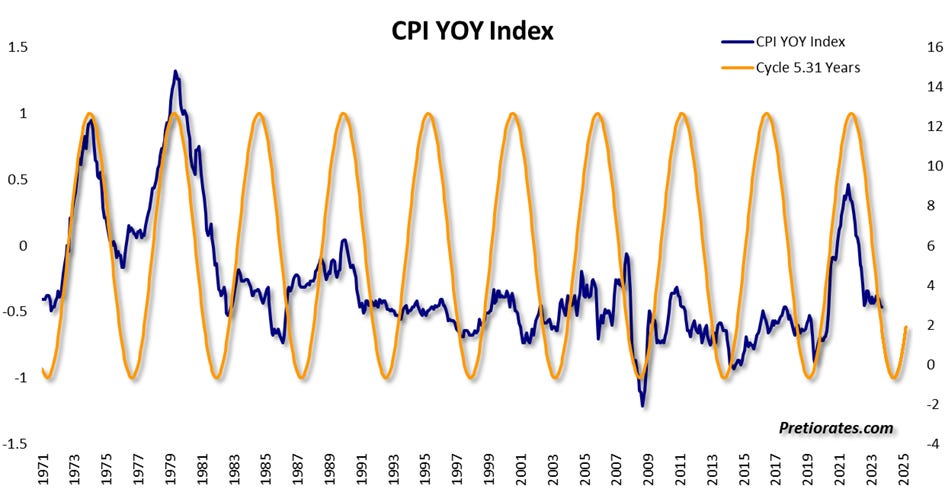

We can also observe a correlation between the inflation trend (CPI) and the commodity indices...

The economic trend also shows a certain weakness, see the development of the ISM Manufacturing Index. This is confirmed by the massive drop in the Copper/Gold ratio.. This ratio increases when the economy is doing well, thanks to a rising Copper price. But due to the increasing uncertainty, the price of Gold is currently rising and reducing the ratio.

However, lower interest rates also mean a weaker US dollar with a relatively high degree of certainty. The potential for interest rate cuts, or rather the fantasy of interest rate cuts, has recently led to a weak greenback.

This chart provides two pieces of information: The Gold/Silver ratio is highly correlated with the currency and should continue to fall.

Secondly: The US dollar basket, an important indicator of the trend of the US currency, is now about to fall below the 100 mark. This is a renewed sell signal in terms of sentiment. But it is also a sell signal for the technical analysts, because it means that the low from August 2023 has been undercut...

However, a lower US dollar makes imports more expensive for the USA. Simply put, if the US dollar falls by 5 %, imported products also become 5 % more expensive. And the USA imports a lot. We recall the inflation cycle shown in one of the last issues of Pretiorates' Thoughts. The low point should be reached at the end of 2024 before inflation could start to rise again...

The question may therefore be asked: Will it really be possible for the FED to cut interest rates as much as the market is currently pricing in? After all, it can hardly be assumed that rising inflation would be ignored and not combated with high interest rates...

That’s it for today!

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.