Pretiorates' Thoughts 51 – Will the Chinese party be followed by a hangover?

Published on October 4th, 2024

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Dear readers!

The Chinese stock markets are closed from October 1st until October 8th for the ‘Golden Week’. However, the timing of the financial and economic measures taken by the People's Bank of China (PBoC) was simply perfect. After many months of growing pessimism in the stock and real estate markets, many short positions have built up. And these were forced to close them before the long holiday week. No investor wants to be unable to trade during the current geopolitical developments for eight days.

While those in China remain closed, the rest of the financial markets continue to celebrate the economic stimulus pills. However, these should be met with a healthy dose of skepticism: the measures particularly mean support for existing real estate owners, who have recently come under pressure. China's cities still have a vacancy rate of 50-60 million apartments. Some sources even speak of up to 100 million and larger regions have a vacancy rate of up to 20 %. With a demand of around 12 million apartments per year (average over the past few years), there is thus enough supply for a few years. However, with the development of the Chinese economy since the Covid pandemic, demand has decreased.

The measures are definitely relieving the pressure on existing property owners, whether they are private owners or business dealers, and are therefore very positive. However, it is questionable whether they are also positive for construction companies. With this vacancy rate, further real estate is hardly likely to be built. And only if more is built is there a greater need for Copper, iron ore and other metals.

Copper was able to advance massively. With a little delay, iron ore as well. Is that justified? And do we need more imports when China's Copper and iron ore warehouses are already overflowing?

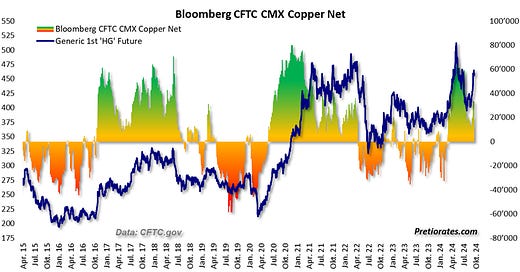

The futures market shows that the 'non-commercials', i.e. the financial institutions, have again significantly expanded their long positions. These have high expectations and if they are not met, the future positions are quickly sold again...

The various maturities also show that the Copper market is still in a 'contango' situation. The longer-dated futures contracts are more expensive than the spot market, which implies a current surplus...

The combined indicators for the Copper market have reached a high level again. This suggests that the bulls' strength could soon wane...

The Yanshan Copper premium, which is a premium for physical delivery, was still in negative territory in the summer and has only just stabilized in the positive zone again. This premium often serves as a benchmark for the availability of Copper. In principle, it provides a positive indication for the Copper price when it is quoted above USD 100 per tonne...

It would therefore not be surprising if the current euphoria in the Copper market – and the other financial markets in China – were to subside somewhat.

However, as the long-awaited, sustainable Copper price rally has not yet started, one indicator is giving slightly positive signals for the time being: commodities often mark their low in the long term when the ratio between the commodity index and the Gold price also marks a low. Gold and commodities generally move in opposite directions in terms of the economy. And commodities adjusted with Gold result in an inflation-free valuation movement. When the ratio reaches a significant low, the time for commodities may have definitely come. But this signal cannot be given yet...

Another highlight of the last few days was the publication of the ISM Manufacturing and Service figures (Institute for Supply Management). The ISM for Manufacturing figure fell further to 47.2 points. Below 50 points indicates a weakening economy, above 50 points indicate a strengthening economy. It is therefore not surprising that the Copper/Gold ratio shows a high correlation. Copper rises in price during a boom, Gold during an economic bust. Conclusion: the ratio is rather too high and thus indicates that the Copper price in relation to Gold is rather too high...

There is also a high correlation between the ISM and the Oil/Gold ratio – the price of Oil also rises during economic upswings. The current message: the price of Gold in relation to Oil should continue to rise (as the ratio should continue to fall)...

On the other hand, the development of the ISM Services index is positive: it remains above 50 points and has continued to rise. The only problem is that this economic indicator is highly correlated with inflation…

Could it be that higher inflation will follow???

That’s it for today!

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.