In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Dear readers!

Hurray, China is buying Gold again! The announcement by the People's Bank of China (PBoC) is likely to have delighted the Goldbugs. We are also Goldbugs. But we are also investors who want to make successful investments first and foremost. Therefore, this week we will take a brief look behind the scenes to see whether the Gold and Silverr prices are indeed on the verge of a new upswing...

As always, we differentiate between the Gold trade in China and the western hemisphere. The Chinese market is much more dominated by physical trading, whereas the western hemisphere is dominated by 'paper Gold' (certificates and futures).

Indeed, smart investors in Shanghai have recently been accumulating again slightly, but the momentum seems to be already being lost again...

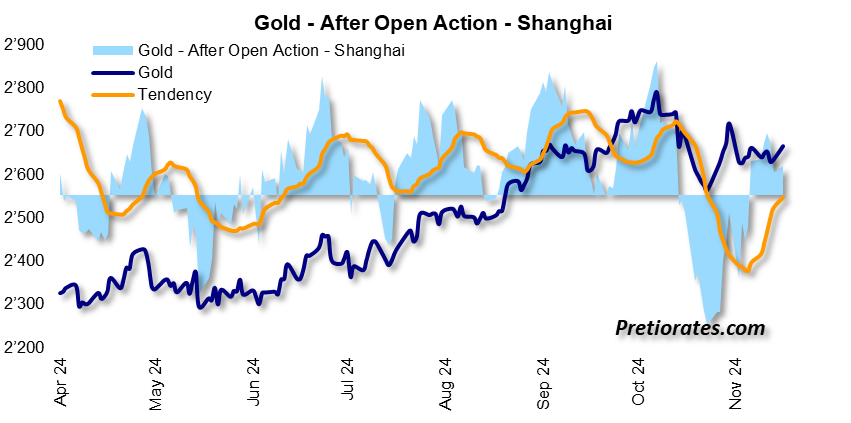

The after-open action, when the big investors are active, also shows a slightly positive picture...

However, there is little optimism, although the Gold price has recently shown a surprisingly strong performance. On the contrary: the market is only just recovering from a deeply pessimistic attitude...

The renewed strength against the US Dollar is positive. Without this, a sustained rally is not to be expected...

In the western hemisphere, on the other hand, investors remain on the seller side, and the love for Gold continues to leave something to be desired...

The Gold market in London or Chicago also continues to show a slightly pessimistic attitude...

In the Gold ETF trade in China, it can be seen that Chinese investors have even been selling positions again recently... – but of course the number of outstanding ETF shares is still at a historically very high level...

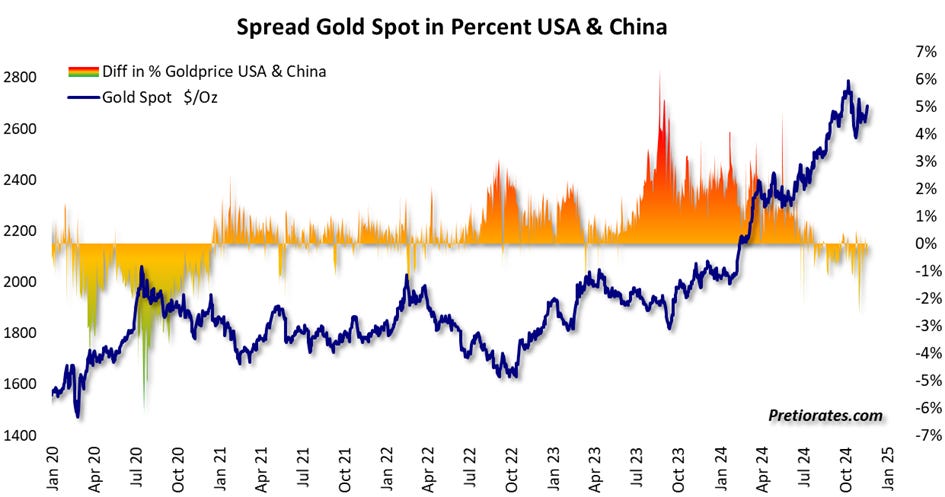

But what is really important in the short term is whether investors in China are willing to pay a premium for physical Gold again. Unfortunately, this is not the case...

By contrast, a premium of around 6% is still being paid for Silver. It is fairly certain that demand will continue to come from the (Solar) industry...

But the 'Smart Investors Action' also shows that investors worldwide are still not accumulating. In addition, two 'Strong Action' signals were triggered recently, which often indicate an impending countermovement. Not really a bullish picture...

The 'Market Pendulum', which offers support especially for short-term traders, has reached a level that rather indicates another consolidation...

Conclusion: The upswing of the last few days is more likely to have been caused by geopolitical developments. These may escalate or calm down again. We know that political movements are usually rather short-lived. The news of the Chinese purchases, on the other hand, is unlikely to have contributed much to the upswing. And with 'only' six tons, they were not really convincing either. In the medium and long term, precious metals remain very promising. In the short term, it is possible to wait and see.

What is rather interesting is the fact that the otherwise secretive PBoC communicated the purchases so openly. Is this to be interpreted as a signal to its own citizens?

That’s it for today!

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.