In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Dear readers!

US President Trump makes facts. Not everyone took the threat of tariffs seriously, but since he introduced them against his neighboring countries and China, the soup is being cooked hotter in Europe as well. Even the precious metals market in London, where most Gold has been stored since the introduction of the ‘Financial Services Act’, now fears the possibility that deliveries of Gold and Silver may be subject to a tax. The problem is that even the major US custodian banks such as JP Morgan have stored much of their Gold in London. The Bank of England (BoE) and the LBMA hold a great deal of Gold (8535 tons as of the end of January 2025), but a large proportion is deposited for ETFs, certificates and other ‘paper Gold’.

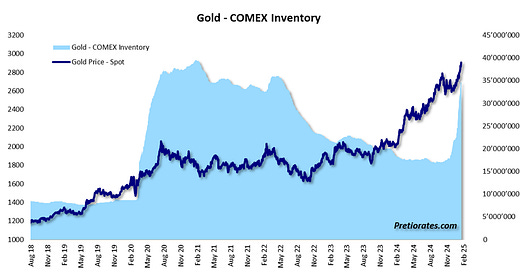

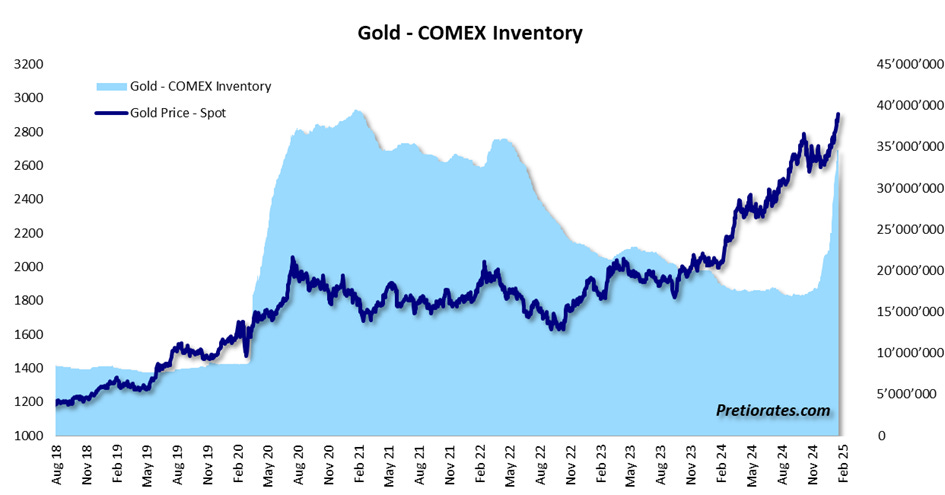

Physical Gold is now being transported to the US at the highest possible speed. This led to an incredibly sharp increase in COMEX inventories...

Silver inventories, on the other hand, are already at a relatively high level, so the increase was less pronounced...

It should be noted that wholesale trading in the Gold market in London primarily involves bars over 400 ounces (12.5 kg), while in the US it is primarily 100-ounce bars (COMEX). Of course it is possible that the available Gold and Silver in Europe is running short. But it is more likely that the available bars over 400 and 100 ounces are running short. The refineries can no longer keep up with demand.

Therefore, the lease rate for borrowing physical Gold rose from practically zero to temporarily over 3%...

The lease rate for Silver even rose to over 6% at times. Needless to say, this is an all-time high...

The shortage can also be seen in futures trading: the spread between spot trading and one-month futures trading shows an increased fever curve...

In the Silver market, the spread – or stress situation – has existed for some time...

Goldbugs now seem to expect that the long-awaited moment has arrived, when the discrepancy between ‘paper Gold’ (futures, ETFs, etc.) and the physical market will come to an end. 90% of daily Gold trading is in paper form and can never be covered by physical material. Furthermore, large bullion banks are said to be constantly building up short positions and keeping the market price artificially low.

Well, it should be noted that these rumors have never been proven over the last 30 years. If you have been convinced of this for 30 years, it can be very frustrating and expensive. There have been fines for individual cases of manipulation – as in other assets in the global financial markets. However, it is true that individual large sell orders that lead to sharp price drops in a short period of time during trading days with thin volume do not make sense. Except...

However, a more successful – and less frustrating – analysis is likely to be of who is now behaving how in the market. And we recognize: Investors in Shanghai, after all the largest buyer in the global Gold market – have been accumulating again for a few weeks...

Sentiment has also improved steadily since November 2024, but has now become somewhat euphoric, which should encourage caution...

ETF purchases by Chinese investors are also holding up at a very high level...

But, here comes the big ‘but’: Chinese professional traders are still not willing to pay a premium for physical Gold. On the contrary, there has been a discount again and again in recent days and weeks. In other words, Chinese investors are accumulating without rushing...

In the Silver market, they are still willing to pay a premium of 5-7 % for physical Silver compared to London or New York. But no longer the 10-15 % they were willing to pay for in 2023 and 2024... The reason for this is likely to be found in demand from the solar industry...

And what about Western investors? Smart investors have been accumulating again since December 2024. We pointed this out in Pretiorates' Thoughts 65 a month ago.

With the sharp rise in the Gold price since then, sentiment has also improved significantly...

But retail investors, who mainly invest in Gold ETFs, are still not on board. The number of outstanding Gold ETFs is still around 25% below the late 2020 peak...

The situation is even more extreme for Silver ETFs: the number of outstanding fund certificates is around a third below the late 2020 peak...

Conclusion: The hectic pace in physical Gold and Silver trading in London and on the COMEX is actually only related to professional trading. It is more likely that it is a problem with the availability of the required bars (100oz & 400oz) and less about physical Gold in general. In other words, the hectic pace could also subside very quickly without much happening to the price. Of course, it could also be a fire smoldering in the background, but speculating on that could be very expensive. And if US President Trump keeps his promise to end the war in Ukraine in 48 hours – sorry, maybe he meant 48 days – then he would have achieved something again. However, the Gold market could take this as an opportunity for a correction.

That’s it for today!

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.