In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Dear readers!

As a loyal reader, you are familiar with our impression that the stock markets could be near a top that could last several months. In Pretiorates’ Thoughts No. 67, we speculated that the Magnificent 7 could save us from a major debacle after DeepSeek. Not all seven, but most fulfilled our hopes.

It has never been worthwhile to discuss the trigger for a major correction of more than 10 or even 20%. There are theories, but in the end it will be something else – which almost all investors will only learn about afterwards.

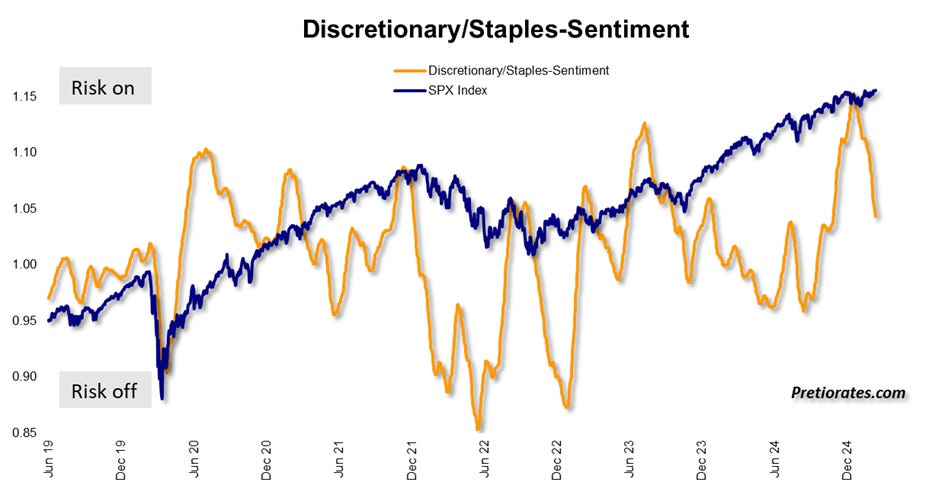

However, the indicators show that the stock markets are tired and perhaps 'looking' for a trigger. Investors have been taking cover for a few days now by favoring staples over discretionary companies. Let us remind ourselves: the staples sector includes companies that are less affected by economic cycles than those in the discretionary sector. That is why they are also called 'defensive stocks'. If the ratio of the two sectors falls, one should act more cautiously...

The widening spread between Trust Interbank Notes and Libor is also striking. We can't quite make sense of it yet, but historically, a wider spread has never been a good sign. Is something brewing in the background?

The skew index shows how expensive hedging in the derivatives area is, for example the long-term puts on the index. Currently, investors are hardly concerned about this...

Our cautious attitude is confirmed by the 21-day put/call ratio. Investors are buying calls, but hardly any put options. Exuberance is usually punished by the stock market...

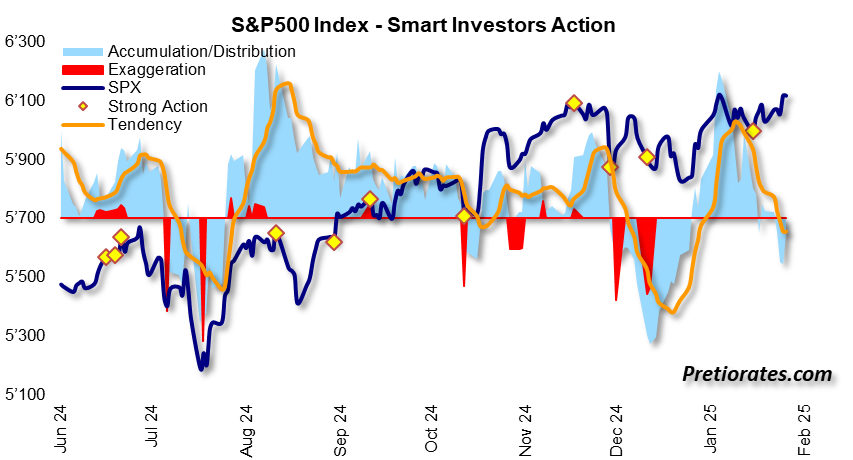

It is therefore interesting to know how the 'smart' investors are behaving in the background. By way of explanation: the blue area indicates whether they are accumulating or distributing. The orange line shows the trend. When the areas turn red (exaggeration), even the smart investors get nervous and act with significantly higher volume – which usually results in a countermovement. Similar signals are given by the yellow dots (strong action). Together, they are particularly meaningful.

We can see that 'smart' investors have been distributing for a few days now – but still without any rush...

The signals in the Nasdaq are clearer. Advances are already showing exaggeration – which means that the upward trend must be questioned...

We are also seeing similar developments in Europe: the Stoxx50 was able to gain more than 10% in record time, but the big and market-decisive investors are not really accumulating...

The same applies to German equities, which may have surprised every investor...

In London, too, the mood is party-like – without the 'smart' investors really being there...

The Swiss SMI is dominated by three defensive stocks (Nestlé, Novartis & Roche). Not surprisingly, accumulation was somewhat stronger in January, but has now also decreased...

Interestingly, optimism in the SMI has also recently reached undreamt-of heights...

In France, the CAC40 index has also risen at a record pace – but 'smart' investors have made massive use of this for distribution in recent days...

Conclusion: stock markets are still close to all-time highs. But the question of whether things can get even better is definitely on the table...

That’s it for today!

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.