In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Dear readers!

Traditionally, it is believed that the shares of senior Gold miners perform at about three times the leverage of the Gold price. However, they have not done so for several years. Therefore, the unanswered question has been hanging in the air for just as many years: why not?

The margin, the profit achieved from the Gold price minus the production costs, is crucial for the performance of senior Gold miners. In fact, there has been a sharp increase in mining costs in recent years, which basically consist of energy, infrastructure and manpower. All three cost factors have risen sharply, particularly since the pandemic.

The extent to which energy costs, for example, influence Gold miners' stocks is shown by the highly correlated ratio of the price of Gold and oil compared to the Gold Miners Index...

Manpower costs have also risen because, with social development, young geologists and engineers no longer want to work in remote regions. In addition, the mining industry has a reputation for not being sustainable, although it was much earlier than others in placing a higher value on sustainability. As a result, the talent pool has continued to shrink – and salaries have risen. Sustainability has also found its way into investors' minds: investment rules now sometimes prohibit direct investments.

A company had a big day yesterday and we would like to congratulate Agnico-Eagle Mines. As of yesterday, Agnico has surpassed Newmont's market capitalization, making it the world's most valuable Gold mining company...

In the short term in the entire market of Gold miners, a very strong accumulation has recently been evident in the Smart Investors Action since December 2024. Profit-taking during the last few days immediately led to an 'exaggeration' (red area) and a 'strong action', which usually lead to countermovements. In the current case, this would mean new advances...

The Balance of Power very well indicated the strong forces of the Gold bulls, although these currently seem somewhat depleted...

Optimism has also increased since the last month of the previous year...

Professional and private investors are investing directly in shares of senior miners. While professional investors also use Gold futures as an alternative, retail investors mainly use ETFs.

The number of certificates in circulation from an ETF is not fixed. When demand is high, it increases, and the opposite is true when demand is low. The strength of demand can thus be analyzed by the number of outstanding certificates of an ETF.

The following chart shows how strong demand has been over the last five days. We can see that it is only during the last few days, after the Gold price has already risen sharply, that demand for ETFs with physical delivery has increased.

While the above chart shows the changes, the next chart shows that the number of outstanding ETFs with physical Gold deposits is still around 25% below the 2020 peak. Investors still do not seem to be really invested in Gold...

The situation looks different when only the Gold ETFs in China are analyzed. These were only introduced in 2015 and recently there was another massive increase in the number of outstanding certificates – which confirms the high demand from Chinese investors...

The same analysis for Silver: despite the rise in the Silver price since summer 2024, inflows and outflows are evident. But nowhere near as strong as they were during the rally of summer 2020...

The number of outstanding certificates for Silver ETFs available worldwide is also around 30% below the peak of 2020... This means that significantly fewer investors are invested in Silver than just over four years ago...

Various ETFs have been launched for senior miners. It can be seen that the advances since the beginning of the year have tended to be used for profit taking. Only recently, near the top, did demand rise again...

However, the number of outstanding senior Gold miners ETFs has been continuously declining since spring 2024 – after remaining fairly constant for years. Apparently, demand for Gold mining stocks is not increasing – but decreasing...

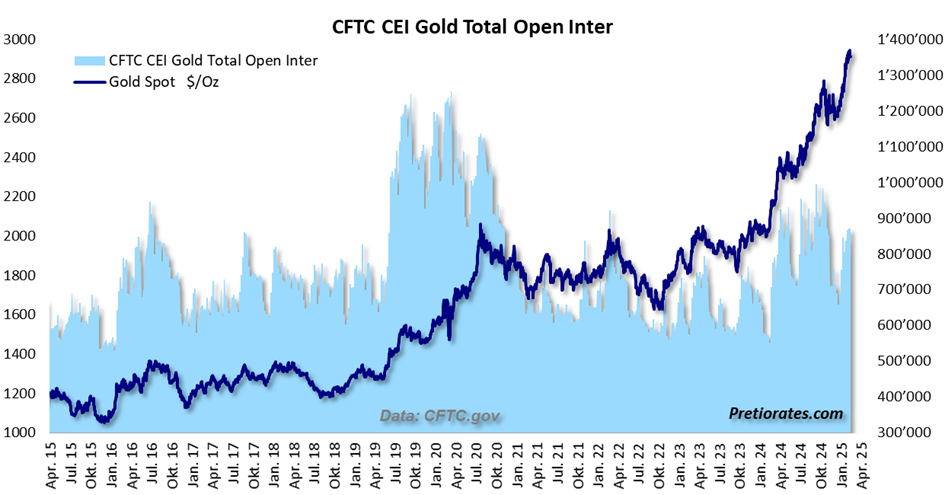

While retail investors primarily make their investments in ETFs, Gold futures are actually firmly in the hands of professional investors. In the case of ETFs, we know the number of outstanding certificates. For futures, this is the number of open contracts. And we can see that the number of open contracts in Gold futures can be described as average...

The same applies to Silver futures: the number of open contracts has recently fallen again and is well below average...

Conclusion: We can see that retail AND professional investors have not increased their precious metal investments in ETFs and Gold mining stocks recently. The demand responsible for the rising prices of Gold and Silver is thus almost exclusively reflected in the physical trade. This also means that there is a high potential that the under-invested investors can still bring a lot of demand and thus higher prices into the market. According to key figures such as cash flow in relation to the share price, the senior Gold miners are extremely undervalued. But this is food for thought for a later occasion...

That’s it for today!

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.