Pretiorates' Thoughts 76 – The Market Flirts with Dovish Dreams, while Bonds Start to Sweat

Published on April 9th, 2025

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Dear readers,

Before we get to the new thoughts, check out the AI video from our last edition!

Please watch and give it a like! Or even better: subscribe to our AI channel!

Pretiorates' Thoughts 76 – The Market Flirts with Dovish Dreams, while Bonds Start to Sweat

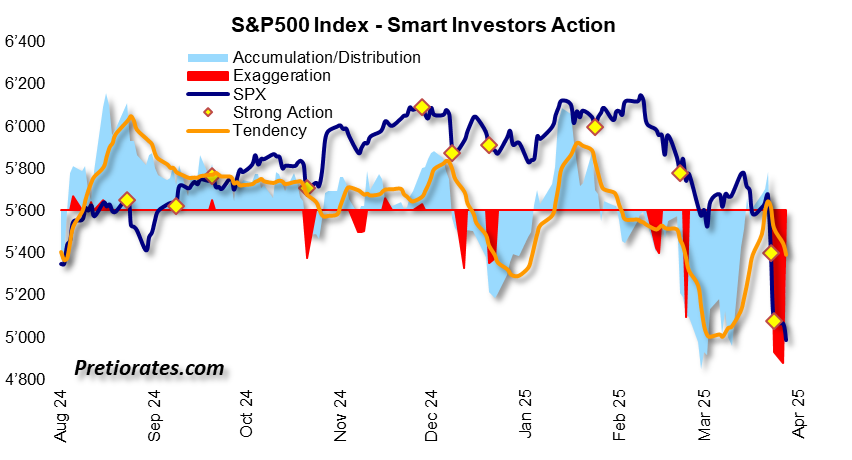

Following the sharp sell-off across global equity markets, we've reached a level that could trigger a more pronounced technical rebound. The ‘Smart Investors Action’ indicator for the S&P 500 is showing a massive exaggeration – an extreme we haven't seen in years…

Similarly, the S&P 500’s long-term Fear Indicator has hit a level that suggests most of the willing sellers may have already exited the market. This should ease selling pressure. And when selling pressure drops below the level of new buying interest, prices typically begin to rise again…

Sector rotation supports this outlook: In times of economic strength, the ‘Discretionary’ sector – which includes cyclical consumer goods like luxury items – tends to outperform the more defensive ‘Staples’ sector, which includes everyday essentials. Ahead of the major market correction, this ratio dropped sharply, sending an early warning signal. Now, however, it has reached a level that in the past has marked significant market bottoms…

The ‘General Sentiment’ indicator – a composite of various short-term inputs – has also recently fallen to levels that historically indicate the potential for a rebound in equities…

Despite these technical signals, financial markets are increasingly pricing in a global economic slowdown, triggered in part by U.S. import tariffs and geopolitical tensions. Should the economy indeed lose momentum, the Federal Reserve would likely respond with rate cuts. The Bond market has already priced in four 25-basis-point cuts – a full percentage point…

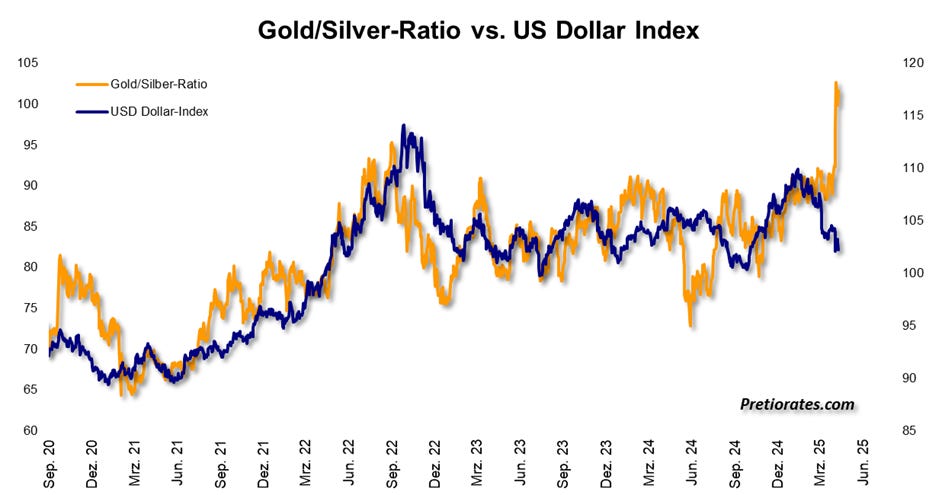

Fears of a recession, or even stagflation, have also made their mark on the U.S. Dollar and the price of Silver. The Gold/Silver ratio has surged, as Silver is being viewed more as an industrial metal than a traditional precious metal. That said, Silver may still benefit from any future rise in the price of Gold, which tends to perform well in times of uncertainty, especially during stagflation. Should this happen, the strong historical correlation between the Gold/Silver ratio and the U.S. Dollar basket may also reassert itself. Silver therefore has a very high catch-up potential…

The ratio between the Gold price and the broader commodity index has been rising for nearly two years, suggesting growing macro uncertainty. Theoretically, such an environment should also lead to widening spreads between safe and riskier Bonds. Fiscal support from the Biden administration may have delayed this, but spreads are now starting to widen – and there’s still significant catch-up potential in the Bond market…

This yield differential – commonly referred to as the U.S. Investment Grade Credit Spread – is a classic risk indicator. The larger the spread, the greater the perceived risk in financial markets. Accordingly, it is closely correlated with the S&P 500. The spread, which is plotted inversely in some charts, is now expanding – and setting the tone for equities as well…

As with everything in finance, markets move in cycles. One particularly reliable cycle – the 83-month cycle – has held up consistently for over three decades. It now points to increasing volatility in the Bond market…

The short-term ‘Balance of Power’ index also suggests that Bond yields in the U.S. are more likely to rise than fall in the near future…

Conclusion: There are growing signs that storm clouds are gathering over the U.S. Bond market. The current flirtation with rate cuts could turn out to be a trap. The Bond market is already sweating – and that rarely bodes well for equities. For now, staying on the sidelines might remain the most prudent strategy.

We wish you successful investments!

Yours sincerely,

Pretiorates

These thoughts will be available as an AI video on Youtube.com within 48 hours: https://www.youtube.com/@Pretiorates

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.

To day S&P 500 9.52% up, etc. You see under the water, congrats!