Pretiorates' Thoughts 77 – Gold gets the glory, Silver could steal the show

Published on April 16th, 2025

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Dear readers,

Before we get to the new thoughts, check out the AI video from our last edition: The Market Flirts with Dovish Dreams, while Bonds Start to Sweat!

Please watch and give it a like! Or even better: subscribe to our AI channel!

Pretiorates' Thoughts 77 – Gold gets the glory, Silver could steal the show

Shortly before Liberation Day, markets were still concerned that US tariffs could affect Gold and Silver imports. This fear triggered a mass exodus of precious metals from London to New York, with COMEX warehouses seeing weekly increases in physical Gold inflows of up to 20%. Silver was also shipped to New York at lightning speed, but weekly stock increases never exceeded 6%.

However, since it became known that precious metals are not affected by the tariffs, the situation has calmed down. Gold stocks on COMEX actually fell by 1.7% last week...

...and Silver stocks also fell by 0.7% over the last five days. As it stands at present, the massive imports were not part of a large-scale secret agenda…

Nevertheless, Gold prices are rising due to growing global uncertainty, whether it be geopolitical tensions or a full-blown trade war with China. And as ‘Liberation Day’ reminded us, lurking in the background is the battered bond market, weighed down by unsustainable government debt. This is a story that Gold loves.

We can also see this in the Shanghai Gold Exchange's 'Smart Investors Action' indicator: Chinese investors remain in an aggressive accumulation phase – well above last year's levels…

The 'After Open Action' indicator, which tracks institutional transactions on the Shanghai Stock Exchange, shows the same trend: large buyers continue to buy…

But what about London and Chicago? The picture there is different. Western ‘smart money’ is heavely distributing. This could prove to be a brilliant move – or spectacularly backfire if the Gold price continues to rise. Many of these investors are passive asset managers who will soon have to face uncomfortable questions from their clients as to why they missed the rally…

Even in the 'after open action', there is still no sustained buying interest in western trading...

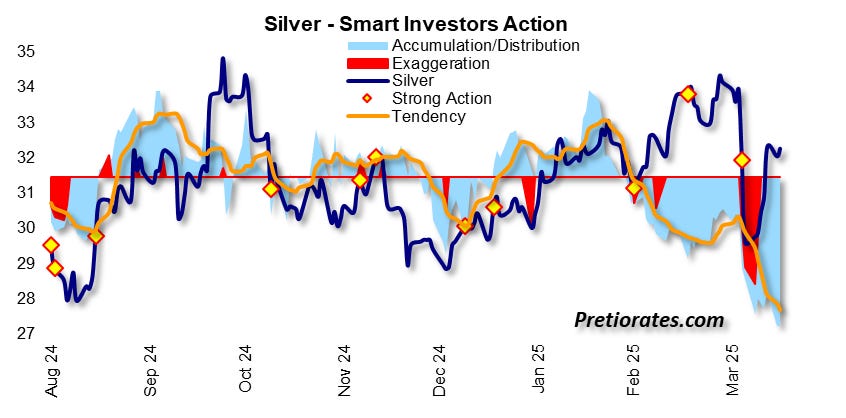

The Silver market tells a similar but slightly more pronounced story. The decline in the price of Silver since Trump's announcement of 'Liberation Day' has disappointed many. But experienced metal experts know that Silver never sprints first. It is volatile, moody, and ALWAYS arrives late to the party... but when it runs, it really runs…

And so far? We're still waiting. Market sentiment remains surprisingly pessimistic. Which is... somehow optimistic…

The short-term trend indicator 'Balance of Power' suggests that a change is imminent: it measures the strength between the bulls and the bears. The bulls seem to be regaining control. And that could be the spark that lights the fuse…

Let's not forget what the Silver Institute reminded us in its annual report published today: in 2024, industrial demand already accounted for 83% (!) of annual global Silver production – or 67% of total global supply, including recycled metal. That's enormous.

Gold, on the other hand, does not disappear. It is hoarded and recycled. That is why Gold in inflation-adjusted terms and Silver in absolute terms have always moved in parallel in the past. If this correlation continues to hold, Silver should already be well above $40/ounce…

ETFs tell a similar story, private investors are particularly active in these financial products. In China, private investors continue to invest heavily in Gold ETFs. The number of outstanding certificates is exploding…

In the West, however, interest is only just beginning. At its peak in 2020, private investors held 25% more Gold ETFs than they do today. Therefore, despite the recent rise in the price of Gold, we are still far from euphoria…

Silver? Nothing to see here. The number of outstanding Silver ETFs is still 30% below its 2021 peak. Yawn...

Meanwhile, Gold Mining ETFs are even recording strong outflows! Investors are taking profits as mining stocks finally rise – even though the sector still ranks among the cheapest valuations in the entire stock universe…

Bottom line: The big banks – Citi, Goldman, UBS – are currently outdoing each other with optimistic Gold forecasts. $3,500? $4,000? Why not? Such hype often signals that we are approaching a peak. But here's the catch: most investors are not enough invested! There are just not many investors who can realize profits!

This makes the bold price targets more of a green light than a warning signal. Investors who have not yet committed themselves, or have only done so to a limited extent, are encouraged to jump on the bandwagon. And a growing number are also looking for latecomers as a Plan B. Which brings us back to Silver...

We wish you successful investments!

Yours sincerely,

Pretiorates

These thoughts will be available as an AI video on Youtube.com within 48 hours: https://www.youtube.com/@Pretiorates

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.