Pretiorates' Thoughts 78 – The markets still have their finger on the trigger

Published on April 24th, 2025

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Dear readers,

Before we get to the new thoughts, check out the AI video from our last edition:

Gold gets the glory, Silver could steal the show!

Please watch and give it a like! Or even better: subscribe to our AI channel!

Pretiorates’ Thoughts 78 – The markets still have their finger on the trigger

At first glance, the situation appears to have calmed down. But appearances can be deceiving. The political and financial landscape has shifted noticeably in recent weeks. The US dollar is weakening significantly, which is making imported goods more expensive even without punitive tariffs. And the former rock in the storm – the US Treasury market – has been shaken considerably. The last safe haven is losing its appeal.

Fed Chairman Jerome Powell is also coming under increasing fire: if he hesitates to cut interest rates, the criticism will come thick and fast. If he lowers interest rates at the next meeting, his independence will be called into question. If the Fed loses its monetary policy autonomy, the markets could see this as the start of a new phase of government-controlled money flooding – with more debt, a weaker dollar, and thus a cocktail that investors do not like at all.

The financial markets are therefore still on high alert – and they still have their finger on the trigger.

As far as geopolitical turmoil, economic concerns, and wage negotiations are concerned, no one can predict exactly where things are headed. What we can observe, however, is the internal state of the markets. If they radiate strength again, shocks will be easier to absorb. If not – well, then we'll see.

The US bond market currently expects the Fed to cut interest rates four times in the next twelve months – a whole percentage point less... That's no small matter. And it suggests that the market is anticipating a weaker economy that can only be countered with lower interest rates…

Or is it even a recession? Or stagflation, if the tariffs remain in place and lead to higher prices? Interestingly, market sentiment has never been as bad as it is now in the last five years...

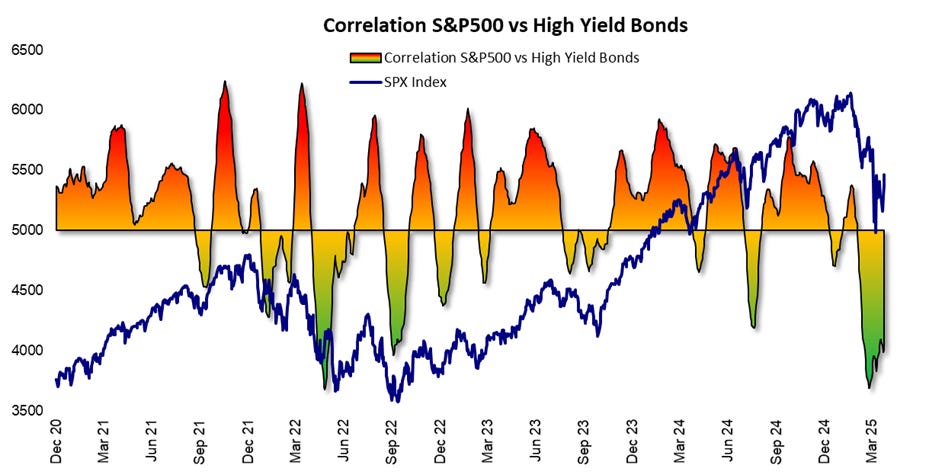

And yet, high-yield bonds, i.e., junk bonds, are not sending any obvious signals of crisis. But our correlation indicator is whispering something else in our ear: the markets are talking to each other – louder than ever. The correlation indicator between equities and high-yield bonds is at its lowest level since spring 2022. Of course, this is often a moment when opportunities arise. Often – but not always...

The spreads on the bond market speak for themselves: something has broken. And given the high correlation with the stock market, the S&P 500 is likely to have further room to fall – even if it has recovered well in the last two weeks...

What is striking is that investors continue to favor defensive stocks. Despite the recovery, there is still no sign of strength in cyclical stocks...

We are in the middle of the earnings season. And as always, there are surprises – some positive, some negative. But the key question is: What were the expectations? And our indicator for the expected P/E ratio provides a clear answer: The S&P 500 may not have bottomed out yet…

The ‘Smart Investors Action’ indicator is also indicating a warning. The latest price gains are already bordering on exaggeration. The red field in the chart and the yellow dots clearly signal this. With today's gains, this should become even clearer tomorrow, Friday...

The balance of power shows us the short-term balance between bulls and bears. A glance at this indicator reveals that the bulls are likely to run out of steam very soon, as their reserves are basically exhausted...

Bottom line: A few positive geopolitical signals could prolong the current recovery somewhat. But the air is getting thin. The markets could very soon look tired again. And when you're tired, you're more vulnerable. Potentially bad news is therefore not allowed in the coming days...

We wish you successful investments!

Yours sincerely,

Pretiorates

These thoughts will be available as an AI video on Youtube.com within 48 hours: https://www.youtube.com/@Pretiorates

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.