In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Dear readers,

Before we get to the new thoughts, check out the AI video from our last edition:

Pretiorates’ Thoughts 80 – From Fear at warp speed to Euphoria

Please watch and give it a like! Or even better: subscribe to our AI channel!

Pretiorates' Thoughts 81 – The Rise of the Alternative Metals

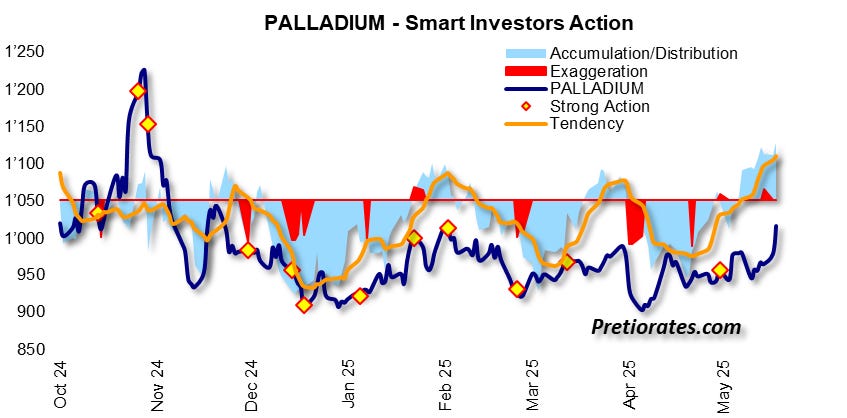

The quiet times on the Platinum market are over – with a loud bang, the price ended its months-long sideways movement on Tuesday. The trigger? According to Bloomberg, massive demand from China. Bloomberg also reported that China recently imported more Platinum than it has in over a year – and not for car catalytic converters or high-tech laboratories. No, this time the precious metal is shining in shop windows: jewelry is suddenly taking center stage.

In the heart of Shenzhen, China, at the infamous Shuibei market – where more than 10,000 jewelry dealers vie for attention – interest in Platinum has gone through the roof. The number of Platinum dealers there has tripled within a month. A clear signal: demand is real, the rush has begun.

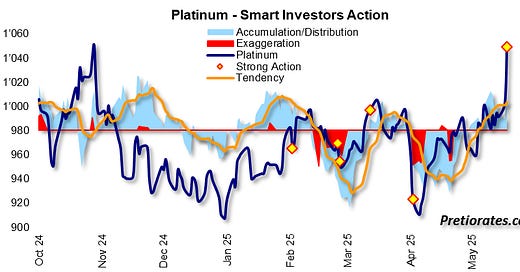

The Smart Investors Action Indicator has already shown in recent days that smart investors have been accumulating. Tuesday's price explosion triggered a “Strong Action” (yellow dot). However, despite the rapid rise, there has been no red “Exaggeration” – exaggerated hype – so far. This suggests that the trend has not yet reached its end.

Optimism has also gained the upper hand in Platinum trading over the last few days. However, the price explosion has not really reinforced this confidence...

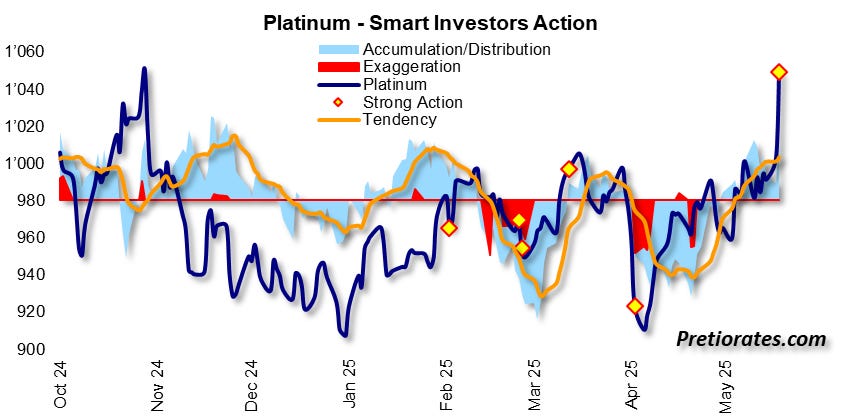

The relative strength of Platinum against Gold has already become more pronounced in recent days and weeks...

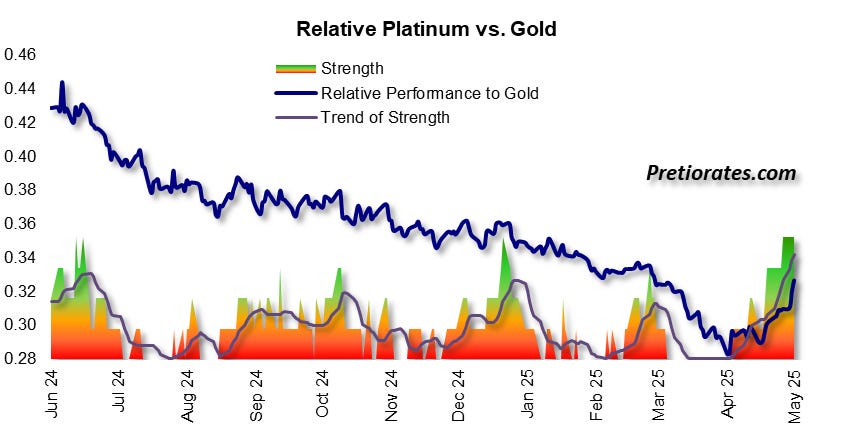

Palladium, long in the shadows, also appears to be starting to shine again – at least according to the Smart Investors Action indicator. After months of silence, there is once again increased “nibbling” here.

There is still no sign of any real outperformance compared to Platinum – but the quiet scratching at the door cannot be ignored.

Meanwhile, Gold is showing signs of... well, a slight recovery. After smart investors withdrew from the Shanghai Gold Exchange in recent weeks, new life is sprouting. The distribution seems to be over – new bullish sentiments are spreading...

Bottom line: The return of Chinese demand for Gold is noticeable – but what is happening in parallel is much more exciting: attention is increasingly turning to Platinum. The reason? The price of Gold has skyrocketed – and the call for alternatives is beginning. Platinum is obviously already in play, and Silver is likely to follow soon.

But there is another issue: the availability of physical metal. This topic, which has been discussed mainly in Gold bug circles, has now officially entered the mainstream. The European Central Bank itself warns that physical Gold shortages could soon become a reality. Margin calls, delivery problems, potentially serious losses on derivative contracts – these are no longer side notes.

When central banks are thinking aloud about the scarcity of physical Gold, one thing is clear: times are getting more exciting.

We wish you successful investments!

Yours sincerely,

Pretiorates

These thoughts will be available as an AI video on Youtube.com within 48 hours: https://www.youtube.com/@Pretiorates

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.