In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Dear readers,

Before we get to the new thoughts, check out the AI video from our last edition:

Pretiorates’ Thoughts 82 – A Big Beautiful Bill for the Bond Market

Please watch and give it a like! Or even better: subscribe to our AI channel!

Pretiorates' Thoughts 83 – Party Too Long, Face the Hangover

In Thoughts 82, we discussed the carry trade in the Japanese market. Rising interest rates in Japan are making this popular financing strategy – borrowing cheap Yen and investing in expensive US Dollars – increasingly unattractive. What was considered virtually risk-free for years is now becoming obsolete. What does this mean for the US Treasury market in the medium term? The script is currently being written… - and explained in Thoughts 82.

At the same time, the risk window is opening further – significantly so. The war in Ukraine, which has recently been more of a background noise from the perspective of the financial markets, could once again become the loud main topic. The latest drone attack on Russian military airfields on its own soil may have military symbolic significance for Ukraine, but it puts Vladimir Putin under pressure domestically. No counterstrike? Then he risks losing power. A counterstrike? Then the situation escalates. The statement by the new German Chancellor Friedrich Merz that weapons for Ukraine are no longer subject to range restrictions is also causing heated debate in Moscow.

The financial markets have so far reacted only sporadically to these developments. Gold and silver have responded to the increased geopolitical risk with sharp jumps – a classic signal. But the stock markets continue to celebrate. The big resurrection party has been going on since April – only the cautious investors have already quietly taken their leave. The rest are still dancing. But those who stay too long risk a hangover.

Why the gloomy tone?

Because the correlation between equities and high-yield bonds is at its highest level in over five years – a sign of massive risk appetite. Investors are as deeply exposed to risk as they have been since the outbreak of the pandemic.

In April, demand for hedging – for example via put options – was still high. Now? Tempi passati. The 21-day average of the put/call ratio has returned to a level that has often been observed in the past shortly before corrections.

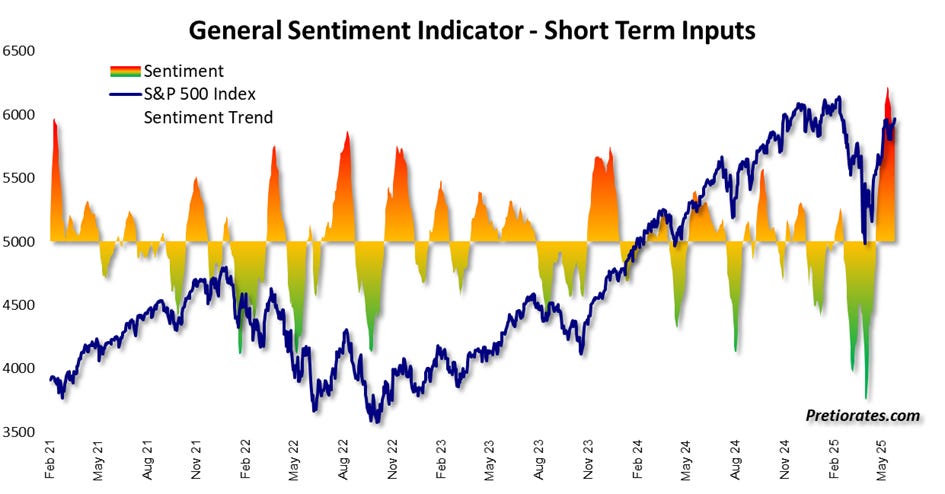

The General Sentiment Indicator – with short-term inputs – is also sounding the alarm: the markets have not been this euphoric in five years!

Smart investors are still showing accumulation behavior, but to a much lesser extent than last month. We would not be surprised if this indicator shows in the coming days that investors are beginning to distribute their holdings behind the scenes...

The next sentiment indicator also shows that optimism has declined sharply recently, but the bulls still have the upper hand...

And the consolidation of the US stock markets during the last few trading days has already caused the balance of power to shift back toward the bulls...

Bottom line: The rally since the April sell-off is lasting much longer than previously expected. And according to the indicators presented today, the party could indeed continue for a little while longer. However, the risk of a severe hangover one of these mornings is continuing to rise sharply.

We wish you successful investments!

Yours sincerely,

Pretiorates

These thoughts will be available as an AI video on Youtube.com within 48 hours: https://www.youtube.com/@Pretiorates

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.