Pretiorates' Thoughts 87 – Gold and Silver with tailwinds from another direction

Published on July 2nd, 2025

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Find out more about Pretiorates.com

Dear readers,

Before we get to the new thoughts, check out the AI video from our last edition:

Pretiorates’ Thoughts 86 – Red Metal, Red Alert

Please watch and give it a like! Or even better: subscribe to our AI channel!

Pretiorates' Thoughts 87 – Gold and Silver with tailwinds from another direction

Since April, the price of Gold has been consolidating around its current level. For some, this is a sign that the correction is still ongoing. Others, however, see this stability following the strong rally as a sign of inner strength – and they may be right.

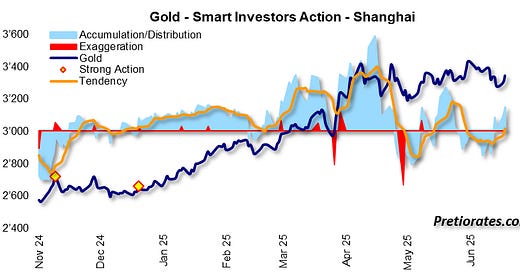

We keep hearing that the Chinese central bank in particular is supporting demand. But if you take a closer look, you will see that it is not quite that simple. The Smart Investors Action Indicator has recently signaled renewed buying in Shanghai, but in rather homeopathic doses. Will this have an impact on the price? Hardly noticeable.

Institutional investors from the Chinese region have remained rather cautious recently, and were even net sellers...

The mood on the Gold market has also deteriorated significantly since June and is now hovering in pessimistic territory. Not exactly ideal conditions for a new price rally. However, there are signs that the mood is slowly brightening again.

A particularly exciting signal comes from the Smart Investors Action Indicator for Western precious metal markets: it shows a rare combination of ‘exaggeration’ on the selling side and ‘strong action’ at the same time. Historically, this constellation has often been a harbinger of a trend reversal – in this case a bullish indication, similar to the end of March this year, when the Gold price rose significantly again...

The number of outstanding Gold ETF holdings in China also provides valuable information: in positive terms, the number of outstanding ETFs has remained stable. However, there are no signs of sustained buying interest...

In contrast, exposure in Western markets is rising again. The number of outstanding Gold ETFs in the Western hemisphere is increasing significantly. This suggests that Western investors are finally building up their exposure. However, there is still a long way to go before the 2010 high is reached...

Silver confirms this picture: The Smart Investors Action Indicator shows the significant selling pressure that has prevailed in recent weeks. Nevertheless, the price remained impressively stable. This is a clear confirmation of the market's inner strength.

Here, too, Silver ETF holdings in the Western world are rising again – another indication that Silver is returning to investors' interest. Silver seems ready for more...

And the potential remains considerable: compared to the inflation-adjusted price of Gold, the price of Silver should be significantly higher. Although this is NOT a forecast, according to this comparison, the price of Silver shcould be closer to 50 US Dolllars.

The picture for mining stocks remains mixed – but by no means negative: some established companies are buying back their own shares, reducing the number of outstanding shares on the market. However, this does not explain why the number of ETF certificates for mining stocks continues to decline so significantly... But that is a topic for contrarians...

Bottom line: The Gold and Silver markets are proving more robust than many expect. However, it is not the Chinese who are keeping the Gold price up, but increasingly Western private investors – via ETFs. The same applies to Silver, which is showing impressive stability and signs of further potential. Mining stocks, on the other hand, remain in the shadows for the time being – which is not necessarily a bad thing. Perhaps they are simply waiting for their big discovery. However, this is a topic for another edition.

We wish you successful investments!

Yours sincerely,

Pretiorates

Find out more about Pretiorates.com

These thoughts will be available as an AI video on Youtube.com within 48 hours: https://www.youtube.com/@Pretiorates

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.