In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Find out more about Pretiorates.com

Dear readers,

Before we get to the new thoughts, check out the AI video from our last edition:

Pretiorates’ Thoughts 88 – White Metals: When Pessimism gets bullish

Please watch and give it a like! Or even better: subscribe to our AI channel!

Pretiorates' Thoughts 89 – FED up? What if Jay Powell walks

On the US bond market, things appear calm on the surface – but beneath the surface, things are boiling. US consumer prices remained in line with expectations, but bond traders have long been on high alert. One of the reasons: Donald Trump. The US president would have preferred to sack the current Fed chairman Jerome Powell yesterday. His contract runs until May 2026, but the political pressure on the president of the US central bank is enormous.

Powell's premature resignation would send a signal. A Fed chair appointed by Trump is likely to pursue a softer monetary policy: lower interest rates, a weaker Dollar, and tailwinds for Wall Street.

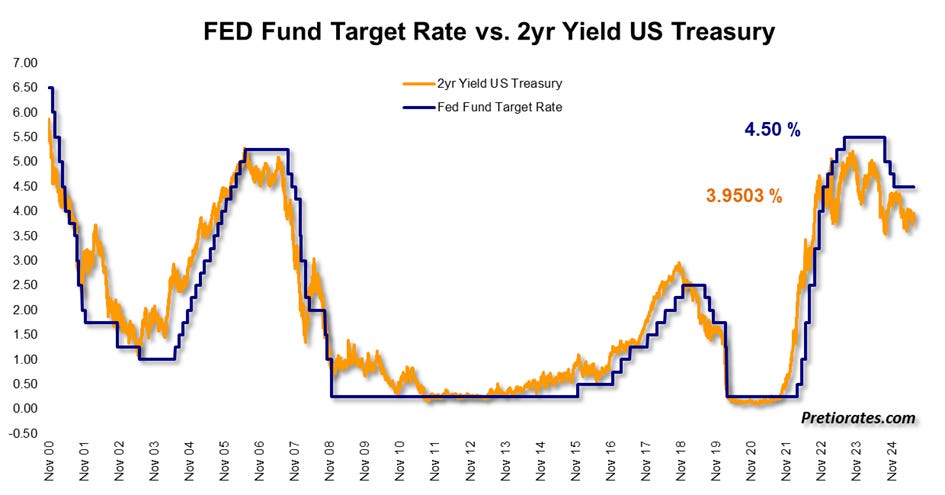

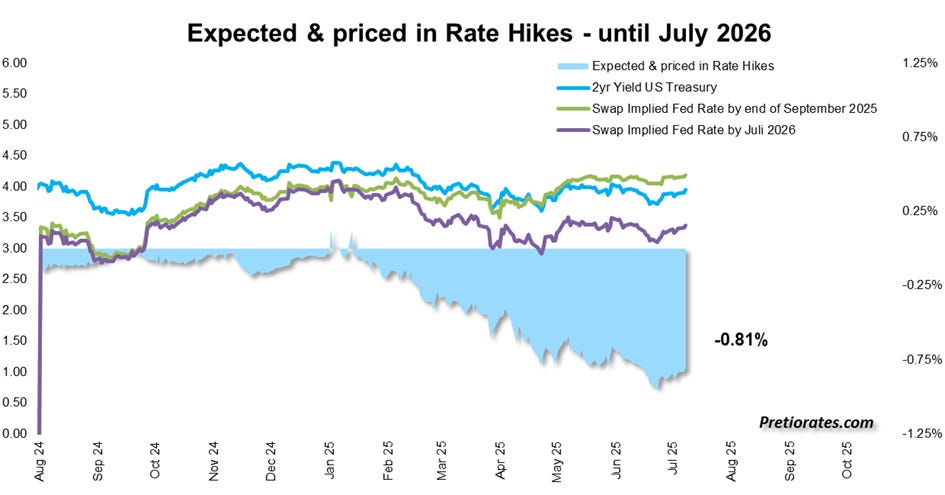

And that seems to be exactly what the market is already assuming. Lower interest rates are on the horizon: the spread between the Fed Funds Rate and the yield on two-year Treasuries is pricing in an interest rate cut of over 50 basis points.

Optimism is even greater on the swap market, with a spread of 81 basis points between September 2025 and July 2026.

But caution is advised: several factors could cause this “interest rate cut cocktail” to spill:

1. Big Beautiful Bill – The new deficit package increases US government debt and thus risk premiums.

2. Debt Ceiling 2.0 – Another debt showdown looms in August. An increase in the debt ceiling is considered certain, but it would trigger a flood of up to USD 1 trillion in new government bonds – at the expense of liquidity of the investors.

3. Inflation Reloaded – Although inflation is on track, parallels with the 1970s suggest a second wave of inflation. Trump's planned import tariffs and the weak US Dollar, which makes imports more expensive, could bring this about – provided consumer spending is not stifled beforehand.

At the moment, US consumers do not appear to be weak. The ISM Services Report is an almost perfect precursor to the consumer price index. It indicates rising inflation in the coming months...

A fourth argument would be an interest rate shock in Japan – the carry trade is faltering: Japanese bond yields are continuing to rise, making loans in Japanese Yen increasingly expensive.

A look at our “Balance of Power” trend indicator shows that interest rates are likely to rise further.

The 10-year yield is testing its annual high of 1.60% for the third time – a breakout to the upside could push it up to 1.91%.

Bottom line: The market is expecting interest rate cuts – but there are powerful counterforces. If Powell does indeed leave, which would be a surprise, that would only be part of the equation. The other part is: How long will rising market yields in Japan continue to have no impact on the US bond market? As explained in Thoughts 82, the carry trade in Japanese Yen has been used to borrow billions at low interest rates to finance equity and bond investments in US Dollars. This refinancing of US investments is at risk – with potentially massive implications for the financial markets.

We wish you successful investments!

Yours sincerely,

Pretiorates

Find out more about Pretiorates.com

These thoughts will be available as an AI video on Youtube.com within 48 hours: https://www.youtube.com/@Pretiorates

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.