In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

Not entirely serious (the chart works as long as it works): The 1929 scenario is still relevant... 90% correlation...

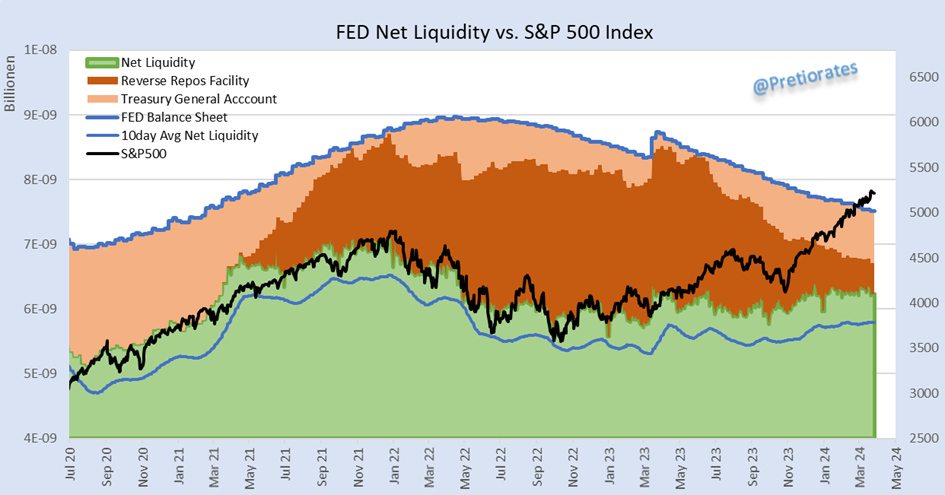

As mentioned last week: The FED is starting to talk about the end of the QT when the water trough of the reverse repos (brown area) has slowly emptied... But the important thing is: FED liquidity (green area) is still rising - and thus not (yet) bearish...

The reverse repo facility has now fallen below USD 500 bn. Not much compared to the amount of new debt that the US government wants to take on in the near future... (no wonder the FED is now talking about a coming end to QT, as expected last week...)

Is there a correlation between the money supply and the US stock market? Below is the YoY development between the S&P500 and the US M2. Exciting: According to the performance of the S&P500, the M2 should now increase massively...

Also exciting: The huge short positions in the US Treasury future over 2 years are being rapidly reduced...

And whenever the correlation between the S&P500 and high yield bonds decreases again from a high level, clouds very often appear in the US equity market...

Hedge funds, on the other hand, are massively invested on the long side...

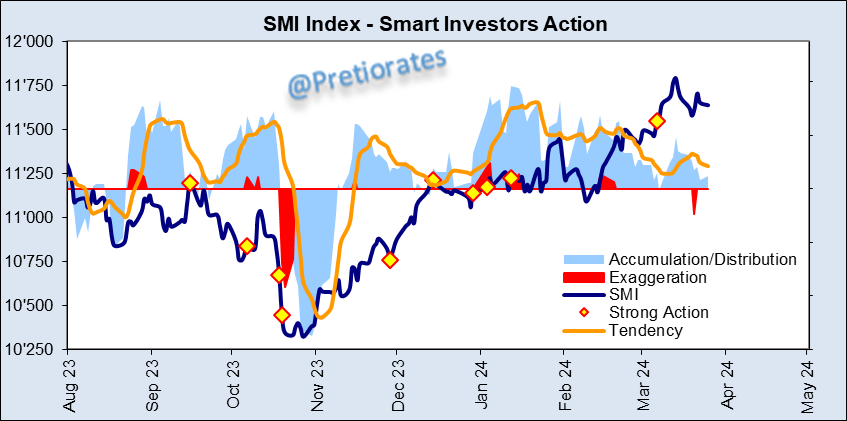

The Smart Investors Action shows that smart investors are continuing to accumulate...

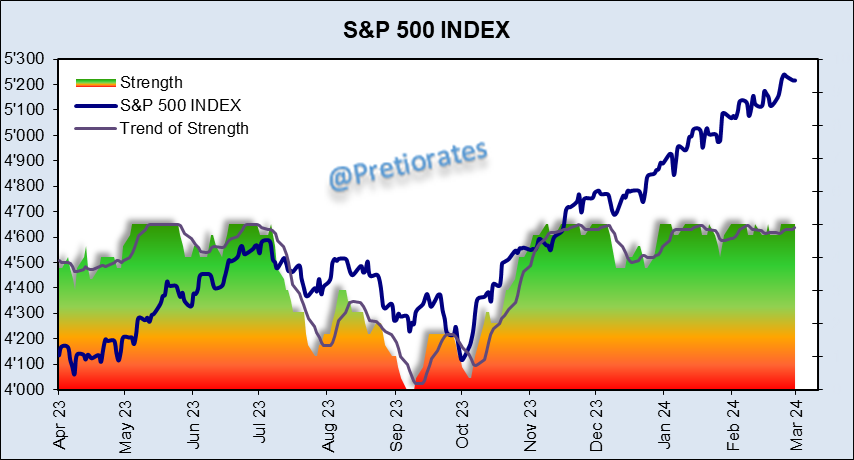

The strength of the S&P500 also continues to show a green light...

In contrast, the various and combined indicators are losing more and more momentum and will soon fall into bearish territory...

The same chart for the Nasdaq index: this has already fallen into bearish territory...

European Equity Markets:

The Smart Investor Action is also still positive for the SMI...

And according to the combined indicator, massive accumulation continues...

PS: The star among the global indices is still the German DAX...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.