In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

Anyone who believes that the correlation between the gold price and the real rate of the US bond market no longer exists is not looking closely enough... the performance over the last six months shows an almost perfect correlation...

Also important for the gold market: according to the 5.31-year cycle, the current downtrend in inflation (US CPI) should see an end by the end of the year at the latest...

The Smart Investor Action points to a phase of distribution in the short term...

This is also reflected in the smart/dumb investor indicator...

The ratio of up/down days over the last 30 days also indicates a somewhat overbought market...

A similar picture in the silver market: accumulation is no longer as strong as it was a few days ago...

The indicator of smart/dumb investors is losing some upward pressure in the short term...

And the ratio of up/down days of the last 30 days is already correcting somewhat...

Interest in US silver futures has increased massively...

Gold stocks continue to accumulate...

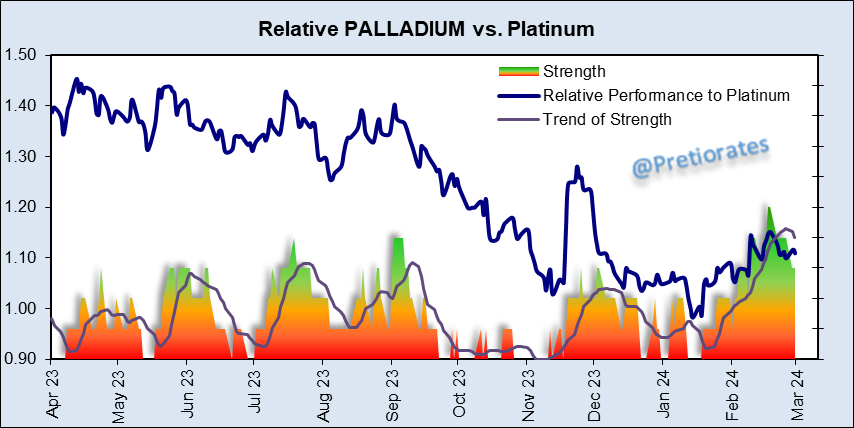

The EV market is looking more and more like a disaster, without the government support they sell much worse. Ford and Hertz have recently issued a clear decision against EVs. This brings gasoline-powered cars back into the spotlight - and with it, interest in palladium for catalytic converters should also grow... in any case, accumulation is strong again...

For a sustained uptrend, however, the outperformance vs. platinum would have to continue - which palladium has not yet managed to do...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.