In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

The combined indicators of the Dow Jones Index are still positive...

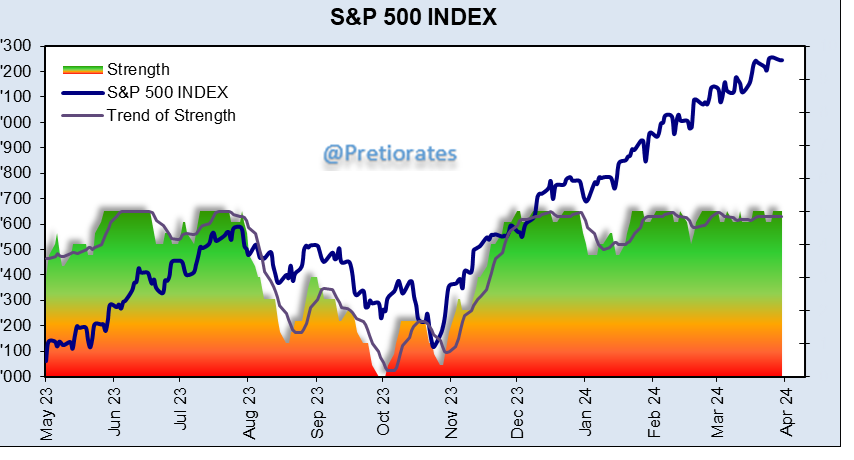

But those of the S&P500 have hardly any inner strength left. It would be very surprising if the bears did not launch an attack now...

The long-term picture continues to show strength, so for the moment it looks more like a short-term sell-off...

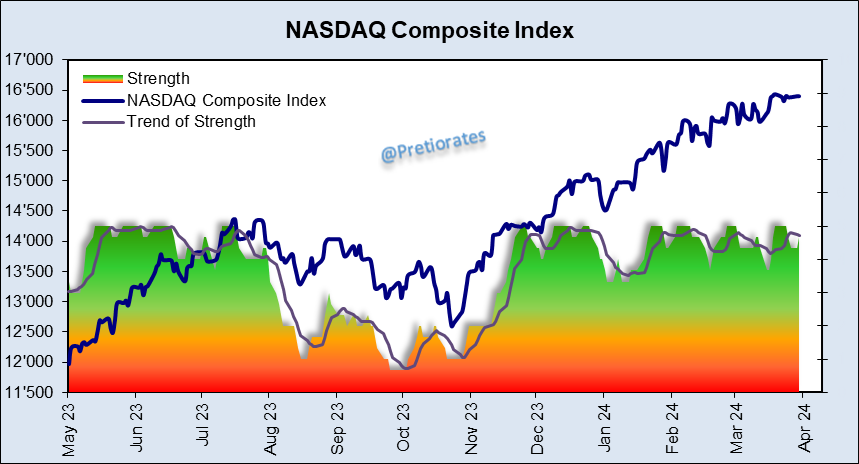

The combined indicators of the Nasdaq Composite Index are already in negative territory...

Here too, the long-term picture still shows strength, so for the moment it looks like a temporary attack by the bears...

This should give us pause for thought: The former leader Nasdaq Composite has underperformed the broad S&P500 Index since mid-February...

The European equity markets

The strength of the European Stoxx 600 Index turned south about a week ago.

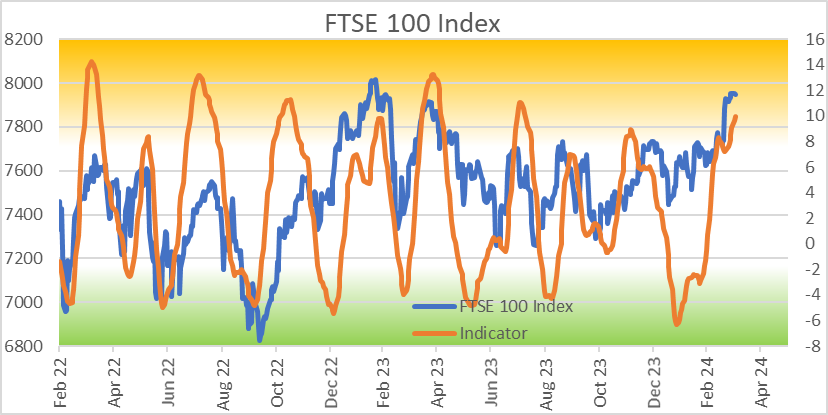

The intrinsic strength of the FTSE 100 Index has reached a level where energy is normally depleted...

The French CAC 40 Index also turned south a week ago...

The star among the European indices in recent months, the German DAX Index, also appears to be under the control of the bears...

The same picture with the Swiss SMI index... a break of the bulls seems to be in order…

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.