In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

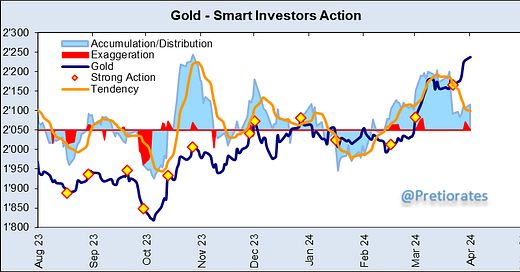

Smart investors continue to accumulate diligently in gold. Only minor exaggerations on the part of the bulls (red areas)...

The "After Open Action" also continues to show a positive picture, even if the internal strength has recently declined somewhat...

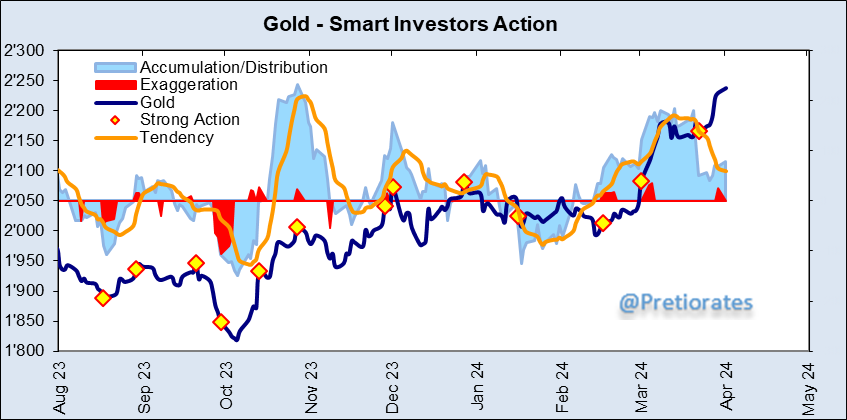

The long-term picture shows high strength since the beginning of March...

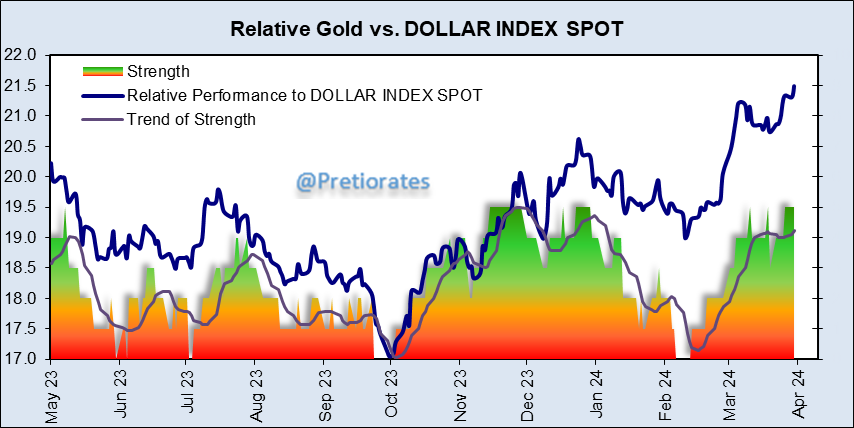

Very positive: Gold is showing great strength against the US dollar. The positive trend is thus coming from its own strength and not from dollar weakness...

The silver bugs have not really woken up yet. It is therefore currently being pulled along by gold and still lacks its own strength. This is not unusual, silver has always been a late starter...

Silver should outperform gold... On a relative basis, the first shy signs are emerging...

Platinum can't keep up with the gold bull market... The EV market is extremely weak and fossil-fueled cars could get higher demand again - and so could catalyst demand...

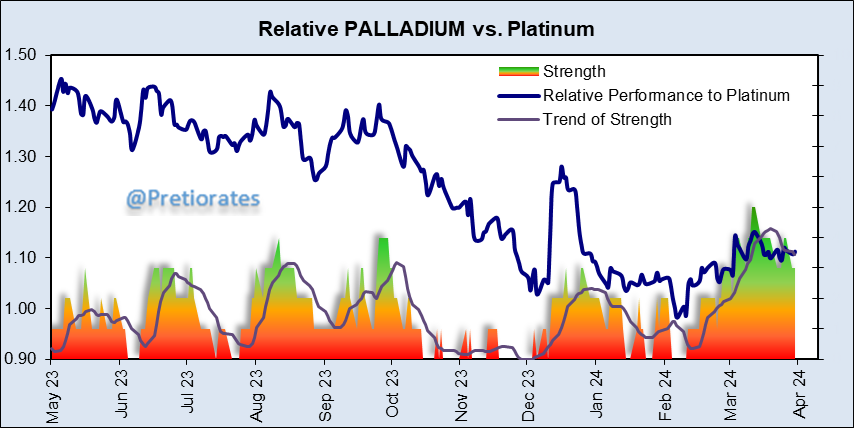

Palladium may slightly outperform platinum... is palladium also benefiting from a return to higher catalyst demand...?

The senior gold miners have finally caught up with the gold price. It looks as if the internal strength is only just building up here...

Gold miners have been accumulating since the beginning of March...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.