In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

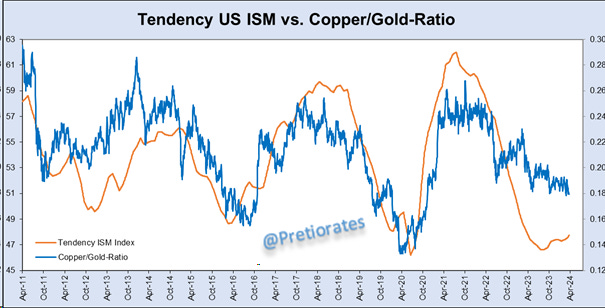

The copper/gold ratio is a very good indicator of boom times (copper) and doom times (gold). It is therefore not surprising that the ratio also has a high correlation with the US dollar - the mirror image of the US economy...

Of course, the boom/doom sentiment from the copper/gold ratio should also be reflected in the economic indicators - which is indeed the case with the US ISM...

The US ISM index should therefore also reflect whether cyclical or defensive stocks are to be preferred. This correlation also existed for years - but in the meantime cyclical stocks have moved away from it... away from reality?

The Yoy performance of the S&P500 Index also has a high correlation with the ISM Index - and has recently moved into a new reality (?)...

The stock markets are therefore very optimistic about the development of the ISM Index. A precursor of this ISM is the "Philly Fed Order Intake" indicator. The development of the Philly Fed Order Intake in recent months does indeed suggest that the ISM Index will continue to improve...

A precursor to the S&P500 Index is the "Real Wages". It suggests that the S&P500 Index is likely to consolidate over the next few months...

The extremely positive investor sentiment is also reflected in a comparison with consumer sentiment, which is not determined by the stock market but by economic developments. Investor sentiment is far more positive than consumer sentiment. Rightly so?

The oil market is back in a stronger backwardation. In other words, the oil available in the short term is not enough to meet demand... As long as backwardation increases, this is positive for the oil price...

The opposite in the LNG market: there is a surplus of natural gas on the spot market... However, this is probably already largely priced into the market price...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.