Pretiorates' Thoughts No. 15 - Cycles, USD, Bitcoin & Precious Metals

Published on April 3rd, 2024

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

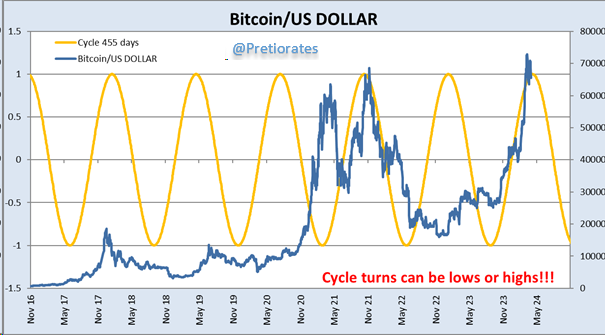

Bitcoin: The 455-day cycle suggests a trend change in a few weeks...

Gold's 405-day cycle is still positive until at least the middle of the year...

Inflation is likely to calm down further for the time being. However, the low is expected to be reached towards the end of the current year and inflation is likely to become more of an issue again in 2025...

According to the 83-month cycle, the volatile times on the bond market are behind us, likely for a few years...

Whenever the blue dots appear, we can expect a high in interest rates...

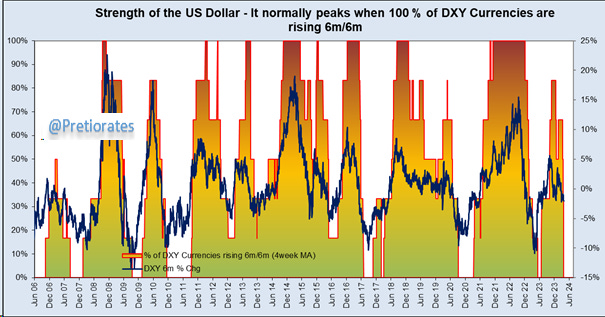

In the fall of 2023, the US dollar still showed great intrinsic strength, but this is now disappearing again...

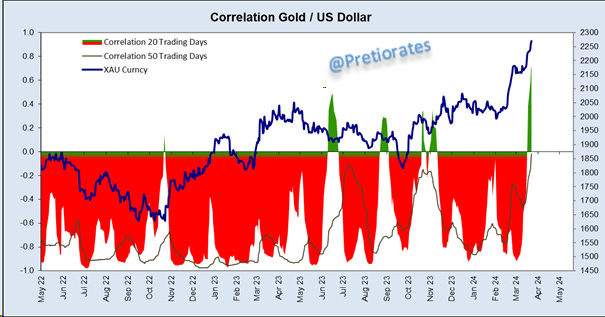

The gold price and the US dollar are currently moving in tandem... Gold can also gain ground with a rising US dollar...

Incidentally, it is still the Chinese who are buying gold. The premium in Shanghai over the markets in London and/or Chicago recently rose again to over 2%...

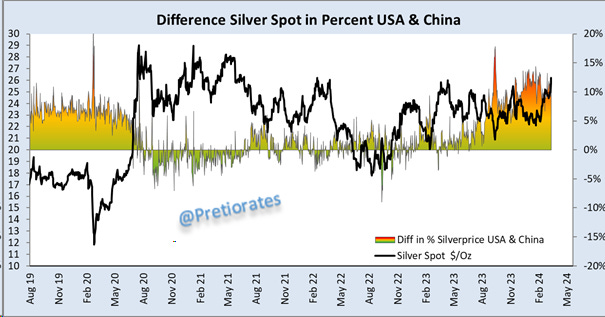

The Chinese are still paying a premium of over 10% for physical silver compared to London and/or Chicago markets...

In the short term, the market appears to be somewhat overbought... Whenever this indicator rose above 20 points, a temporary high in the gold price was evident...

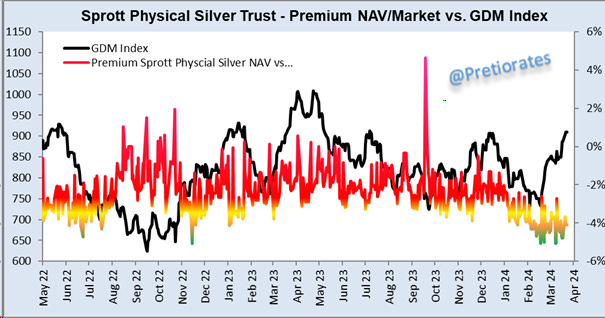

The GDM Gold Mining Index also seems to be heading for a temporary high in the short term...

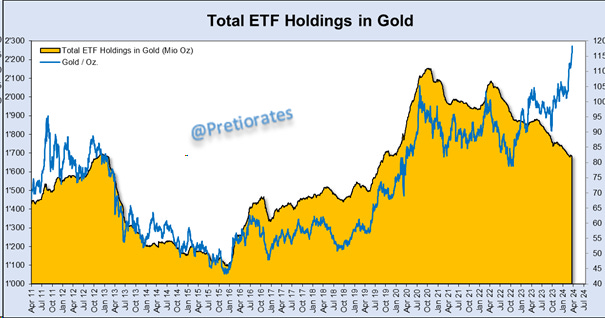

Increased interest in a rising gold price among investors in the West? Far from it... the number of outstanding gold ETFs has still not increased... There are many investors who are still massively under-invested...

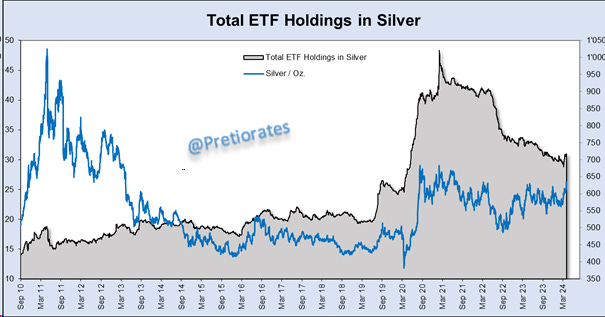

The situation is not much better for silver ETFs, although there has been a slight increase in the number of outstanding ETFs for the first time... Western investors are still not participating in the current rally...

The Canadian Sprott Physical Silver Trust continues to trade at a discount of over 4% to net asset value... A confirmation that Western investors do not believe in a sustainable rally... Bullish!

The sentiment indicator for silver is showing a positive side for the first time in more than a year... promising!

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.