In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

Precious metals appear to be overbought in the short term: Gold has risen for 23 of the last 30 trading days...

However, the gold ounce has created its own strength, as is rarely the case: Against the US dollar, there is no longer any counter-correlation. This rose from the usual -0.8 to +0.6!

Nothing new in the West: Western investors are shaking their heads and do not understand the rally in the gold price. The number of outstanding gold ETFs has not increased despite the big price rise...

The number of outstanding silver ETFs, on the other hand, has increased slightly. However, this may also have to do with the fact that fears of recession have subsided somewhat and silver is once again more in demand than gold...

The Sprott Silver Trust with physical silver continues to trade at a discount of 2% to NAV...

In the futures market, there is a slight increase in gold exposure among non-commercials, but no euphoria...

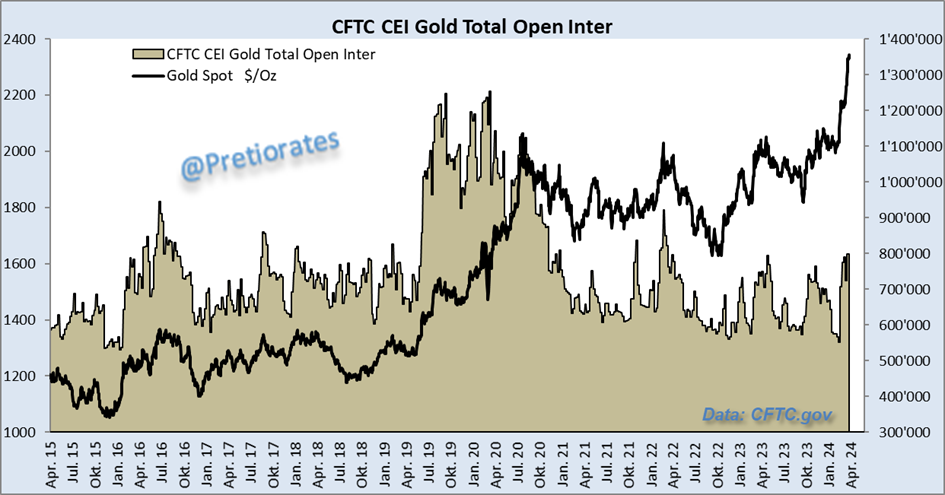

The number of open futures contracts in the gold market also shows that the rally in gold has passed almost all investors by...

The same picture in the silver futures market: only slightly increased interest in silver exposure on the part of ‘non-commercials’, i.e. the investment industry...

The number of open futures contracts in the silver market increased slightly... but again, the market is far from the euphoric phase that is usually observed during the highs of a rally...

A Bank of America chart shows that 75% of professional investors have less than 1% of their asset allocation in gold...

In Shanghai, on the other hand, the Chinese are still willing to pay a 2% premium on physical gold. Demand does not seem to be abating...

For physical silver, Chinese buyers are even still paying premiums of 10% compared to London or Chicago... The Chinese government's capital controls do not allow direct purchases in London/Chicago - and the PBoC obviously cannot import enough silver...

Now the Indians are coming too: Indian imports of silver in February amounted to around three times the usual amount...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.