In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

The strength of all other currencies determines how strong the US dollar is against them. And at the moment it looks as if some other currencies are stronger than the US dollar. This means that we should expect the US currency to weaken in the future...

The Risk Factor compares the currencies of the top countries with the currencies of the second-tier countries. The result gives us an idea of whether investors are prepared to take risks (bullish for equities) or seek safety (bearish for equities). This long-term index has fallen back into negative territory for the first time since fall 2023. In other words, investors are increasingly looking for safety...

The blue area indicates accumulation/distribution by large investors in the background, red areas are exaggerations and suggest a countermovement. If we look at the Smart Investors Action of the Dow Jones Industrial Index, we see an exaggeration on the sell side. Consequently, a (short?) recovery is possible...

And in contrast to the Industrial Index, the S&P500 still shows hardly any distribution (blue area in negative territory), but also no exaggeration that calls for a recovery...

The After Open Action of the Nasdaq Index is still in negative territory. The performance of the index is correspondingly tired. No change to be expected for the time being...

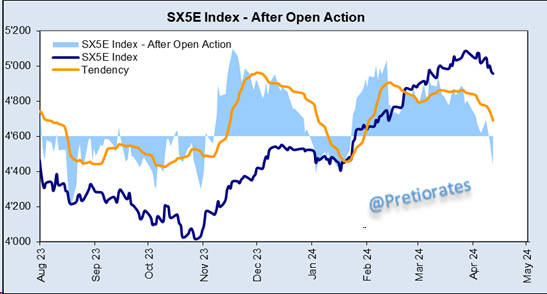

The Stoxx50 index suggests that the European markets will have a rather difficult time in the coming weeks...

The bears are also back in control of the broader European index, the Stoxx 600 Index, for the time being...

Even though today's weekly opening was very positive in the German DAX Index, this does not appear to be more than a countermovement...

A similarly bearish picture can also be seen on the French CAC40 index...

The Italian FTSEMIB index has also already corrected, investors have switched their strategy back to distribution...

Swiss investors have done exactly the same...

Even if things are not moving as fast as with other indices: Accumulation continues in the UK FTSE...

Spanish investors should be prepared for the IBEX index to fall again. Accumulation has been strong recently, but now the music seems to have stopped...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.