Pretiorates' Thoughts No. 19 - Macro, Currencies & Precious Metals

Published on April 16th, 2024

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

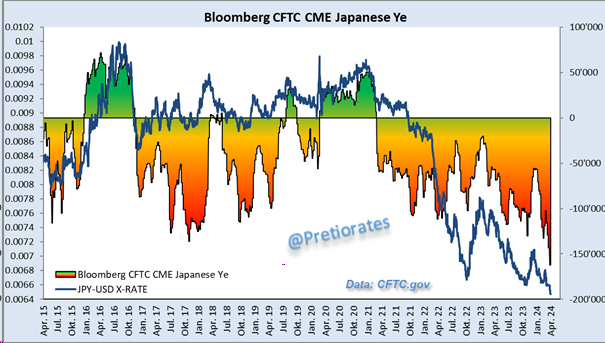

Speculation against the Japanese yen is increasing. Asset managers' short positions in futures trading have increased once again. When so many investors speculate on the same trade, this often goes wrong as contrarians could speculate against it. Nevertheless, if the Bank of Japan (BoJ) gets into trouble, the other central banks are also likely to find themselves in crisis mode very soon...

In contrast, short positions in US Treasuries over 10 years have been massively reduced... Investors in the futures market are obviously not expecting yields to rise much further...

In contrast, the intensity of sales of US Treasuries by the People's Bank of China continues to decline. No wonder: Chinese economic growth was published this morning. At 5.3 %, growth remained extremely high, even if not everything was really convincing. The Chinese can now pay for imports, especially raw materials and energy, with their own currency and no longer necessarily need the many US dollars from exports to pay these bills...

Is this an explanation for the fact that the anti-correlation between the US dollar and the gold price has recently disappeared?

By contrast, the fantasies of interest rate cuts in the US bond market are disappearing more and more. In the meantime, people are still dreaming of just over a quarter of a percent. Interest rate cut fantasies have been on the wane since February 2024 - and yet the price of gold has risen. This proves that the gold market has never paid attention to the hopes of the bond market. The rise therefore has other reasons...

Gold continues to trade higher in Shanghai than in London/Chicago, currently by 1.9 %. As long as a premium is paid, the Chinese are buyers in the global market and the uptrend is likely to continue.

Even after last Friday's significant interim high, physical silver in Shanghai is still trading 12.1 % higher than in London/Chicago. When a buyer as large as the People’s Bank of China, Chinese Industry or the Chinese Consumer pays a double-digit premium, the buying will not stop today...

For many, this is rather surprising: there is a feeling in the market that fears of recession have eased recently. The Macro Fever Curve, on the other hand, has risen to 100% recession risk again... With this outlook, market yields would not rise much further and it would make sense why the short positions in the US Treasury are being massively reduced - as explained at the beginning…

The Heart Beat is also rapidly approaching the expectation of a recession. It recently rose from 81 % to 86 % again…

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.