In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

Gold has entered a new era

This tweet from @SilverWolfAG impressed us. The price of gold no longer seems to be determined in London and Chicago, but in China - at least physical gold. At the moment, however, it is still possible to influence prices using paper gold.

When determining the price of gold, geopolitical developments are important, US government debt is important, confidence in governments is very important. The interest rate cut fantasies were not.

The biggest change from yesterday, however, is simply how much and for how long China will continue to pay a premium on prices in London and Chicago on the Shanghai exchange. A premium only arises if supply cannot satisfy demand. Given the (economic) size of China, this is likely to be the case for some time to come.

The PBoC does not provide reliable data on gold imports. We therefore try to confirm that they are nevertheless responsible for the upswing in the gold price:

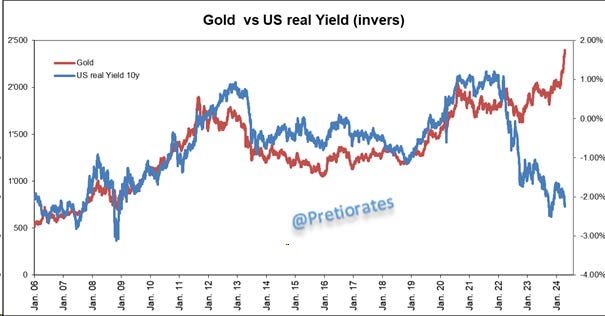

The old world: six-month US real market yield performance continues to correlate with the gold price...

However, a direct comparison shows that a new era has begun since spring 2022...

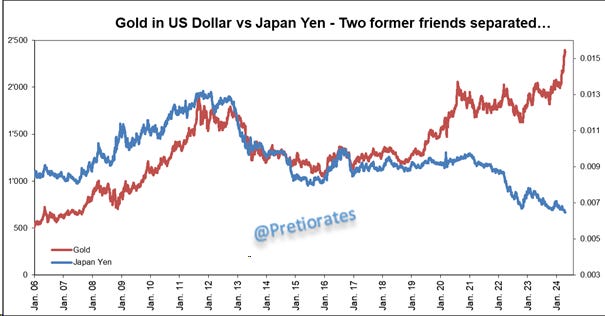

The previous correlation with the Japanese Yen is also a thing of the past. The yen was the 'gold of academic investors' (who could see no sense in gold)...

The traditional counter-correlation to the US dollar no longer seems to pay attention to gold either. This can be explained by the tradition that commodities and precious metals were mainly bought when the US dollar tended to weaken. A change can only be explained by the fact that the performance of the US dollar is less relevant...

The intrinsic strength of gold against the US dollar has also reached peak levels...

In reference to the tweet by @SilverWolfAG and the geopolitical development (BRICS)

China is increasingly importing commodities with its own currency, the yuan

Exchanges currency reserves (US dollars) for gold

Imports using the yuan lead to a weakening of the yuan (exporters sell the yuan they receive)

The weaker yuan increases the price of gold in yuan

The PBoC cannot import enough physical gold and silver, resulting in a premium on the Shanghai stock exchange

The Chinese solar industry is flooding the world market with its products and needs a lot of physical silver - resulting in a higher premium on the Shanghai stock exchange

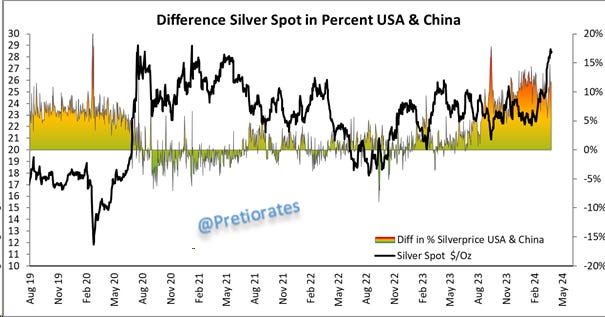

The Chinese gold market continues to pay a premium of 2% to London/Chicago...

As well as a premium of over 10% for silver...

Western investors are using the higher prices to take profits. This can be seen in the number of outstanding ETFs for gold and silver...

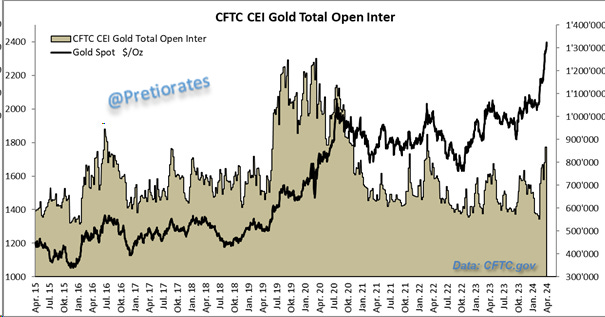

There is no additional interest in the Chicago futures market: the number of open futures contracts has increased only slightly...

We have adjusted the Smart Investors Action (SIA) indicators to the trading hours of the Shanghai and Chicago exchanges. The SIA for the Shanghai Stock Exchange shows a clear accumulation of 'smart' investors since mid-February...

The SIA for the London/Chicago exchanges, on the other hand, shows a clear distribution since the end of 2023...

In our opinion, this clearly shows that buying interest is coming almost exclusively from China...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.