In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

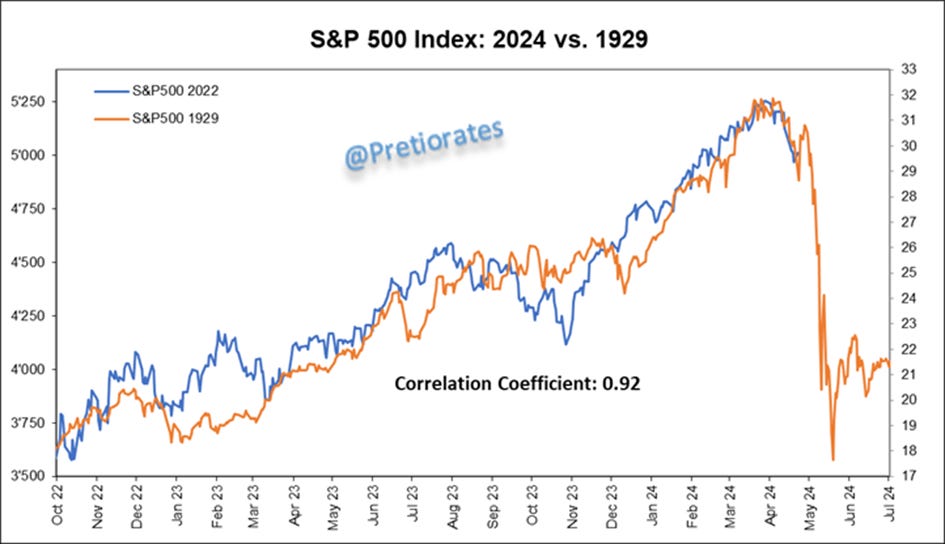

History never repeats itself, but it often rhymes... This Fractial-Chart is not really meant seriously, but the extremely high correlation of +0.92 between the movements of 1929 and the current one is quite overwhelming...

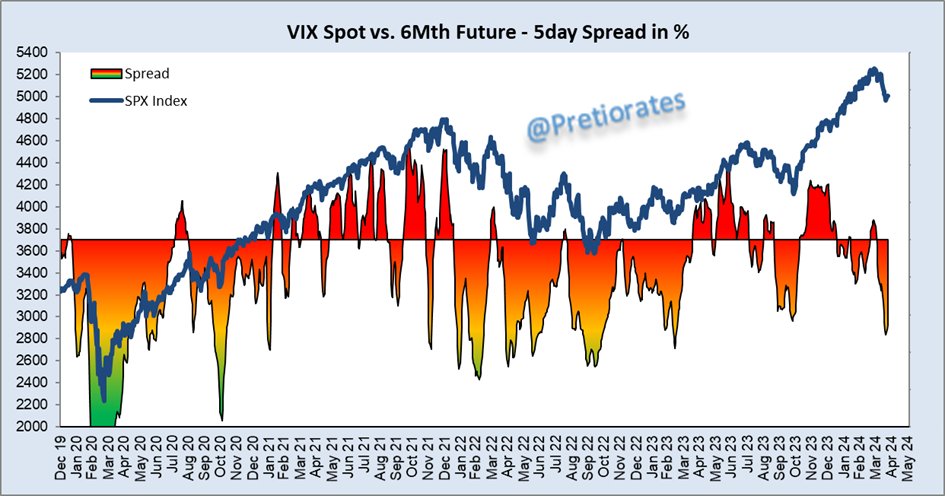

The spread between the Volatility Index Spot and the 6 month future of the VIX Future suggests a technical recovery of the US equity markets...

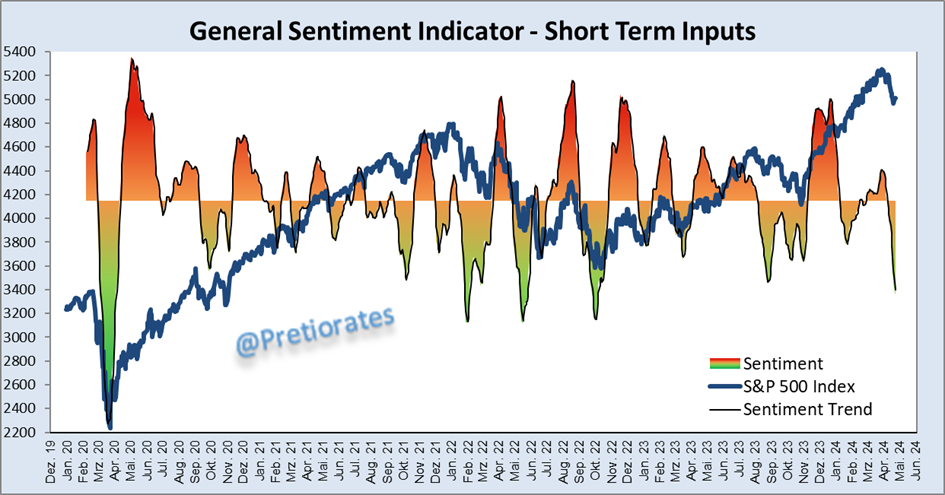

The short term inputs of the 'General Sentiment Indicator' also show the current oversold situation. This explains the massive recovery on Wall Street...

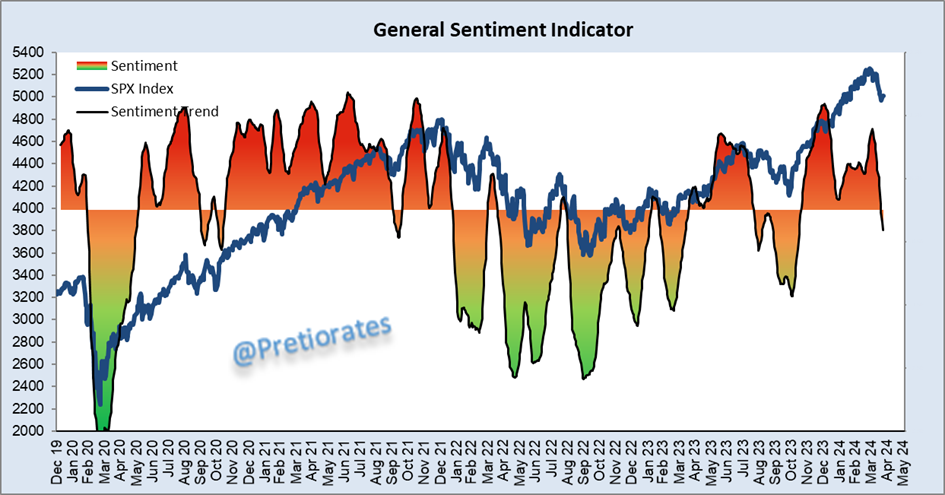

However, the 'Long Term Inputs' suggest that this is only a recovery...

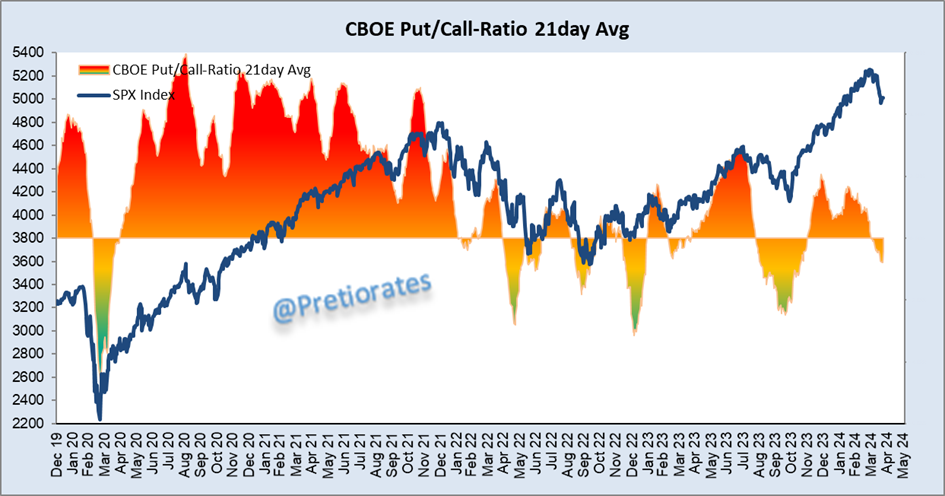

The put/call ratio was also not yet really so pessimistic that the contrarians would start with new investments...

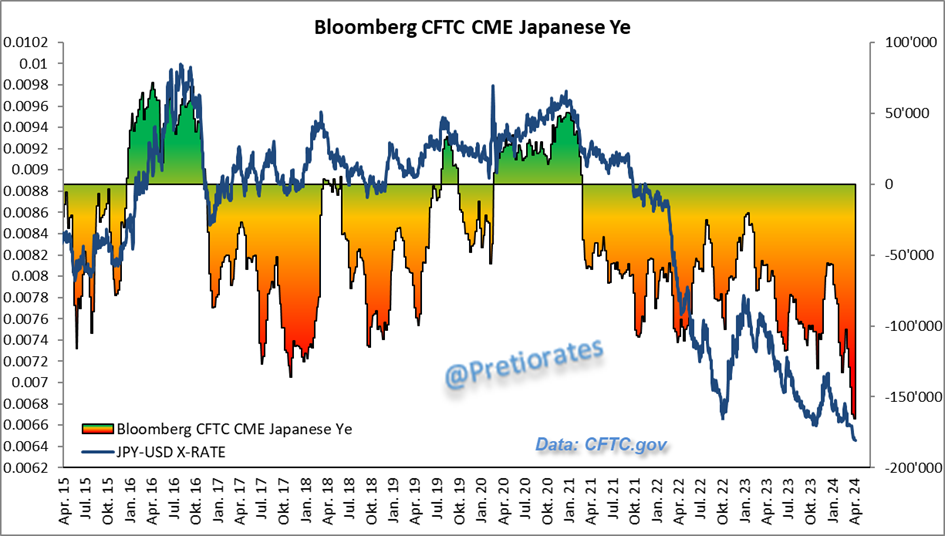

This raises concerns: Short positions in the Japanese Yen continue to grow and grow. If the Bank of Japan (BoJ) has a problem, all central banks will have a problem too...

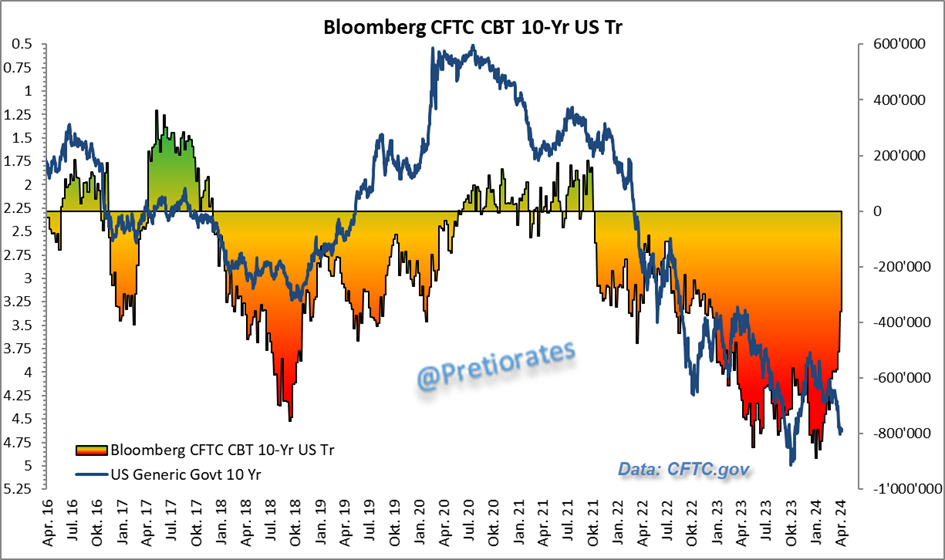

Also very interesting: The short positions in the US Treasury over 10 years are being covered at a rapid pace. Why the rush?

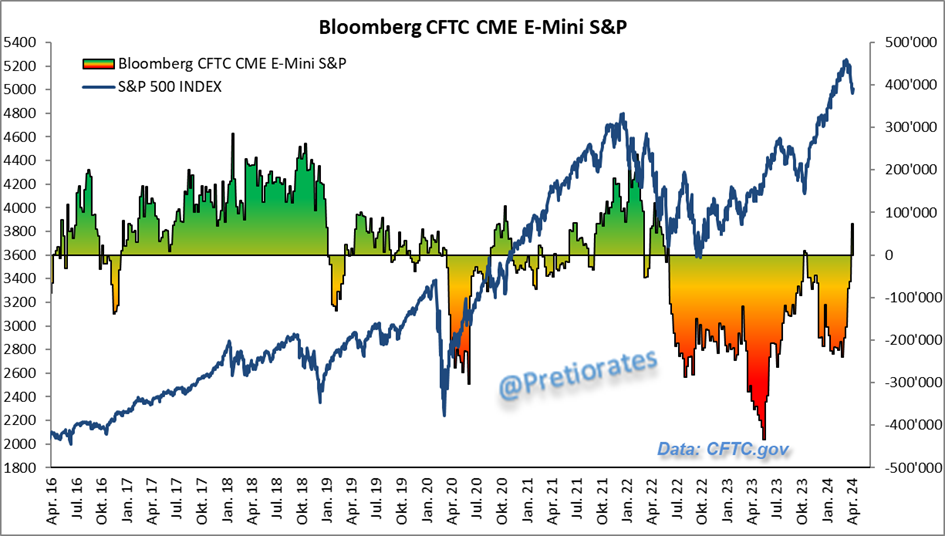

The short positions in the S&P500 were also fully covered and for the first time since July 2022 (!) the 'non-commercials' (institutional financial investors such as funds) are net long in the S&P500 again... (BTW: The short positions could also have been hedges to hedge portfolios. Would mean that investors have become very (or too) bullish again...

Let's assume that we will find out more shortly...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.