In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

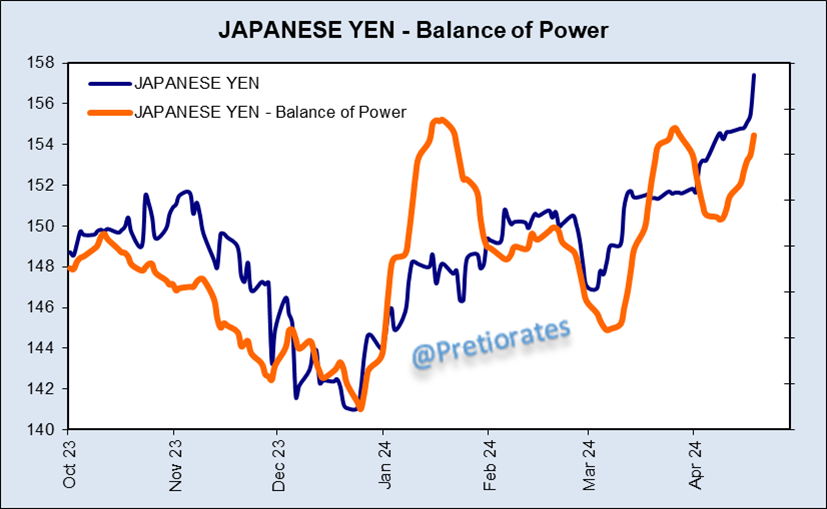

The story of the week is likely to be the weakness of the Japanese yen (shown inverse in the chart) and the unwillingness of the Bank of Japan (BoJ) to do anything about it. At the moment, the strength of the trend does not suggest that the weakness of the Japanese currency could diminish soon...

The short-term balance of power also suggests that the yen bears are still in control...

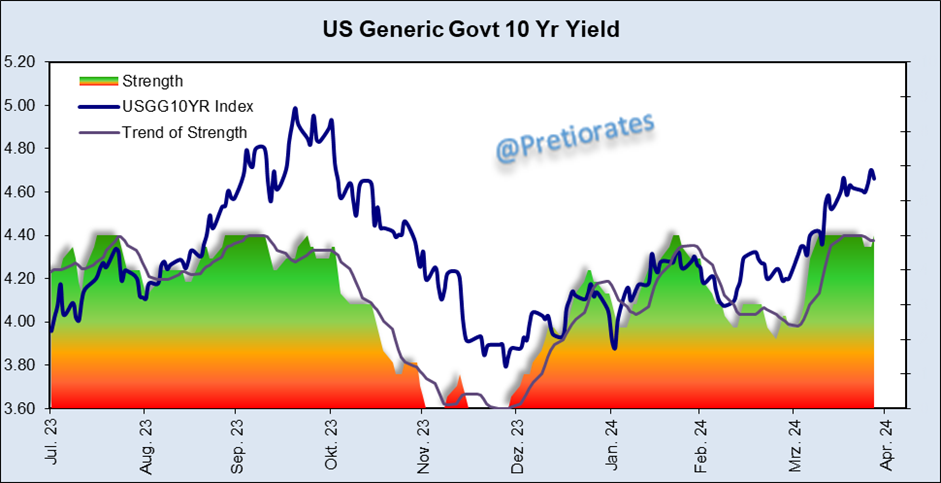

The movement of the Japanese currency has an impact on the market yield of US Treasuries. The current correlation suggests that US Treasuries should fall further or yields should rise... Not really what the financial markets are expecting at the moment...

This is also confirmed by the intrinsic strength of US market yields: According to this indicator, they are continuing to rise...

Higher US market yields would lead one to expect strength in the US dollar. But far from it, the strength indicator of the US currency assumes a weaker US dollar...

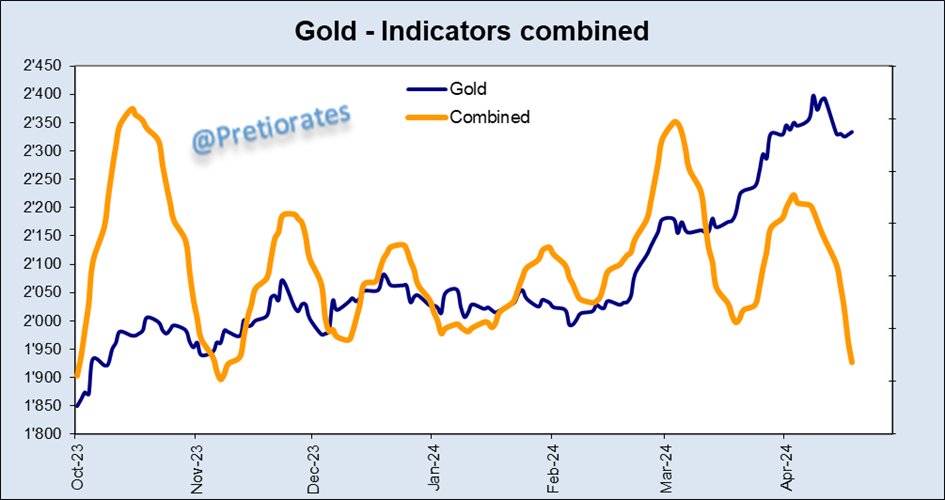

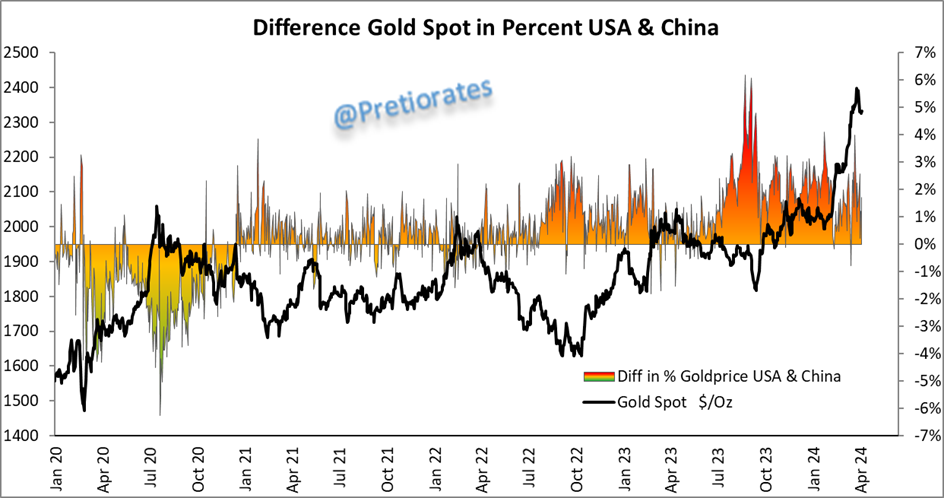

A look at the world of precious metals: Gold continues to be unperturbed by the US dollar. The correlation is at an unusual +0.65...

The consolidation of Gold is already well advanced and could soon initiate a new upswing.

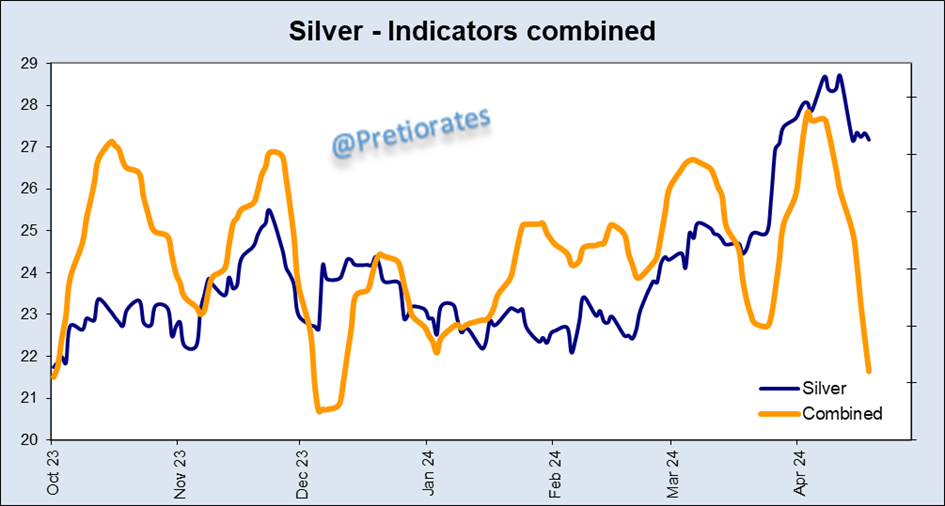

The same bullish picture can be seen in Silver

Chinese investors (or rather the People's Bank of China) are still prepared to pay a premium of currently 1.7 % on physical gold... bullish...

Chinese investors even paid a premium of 12.9 % for physical Silver today...

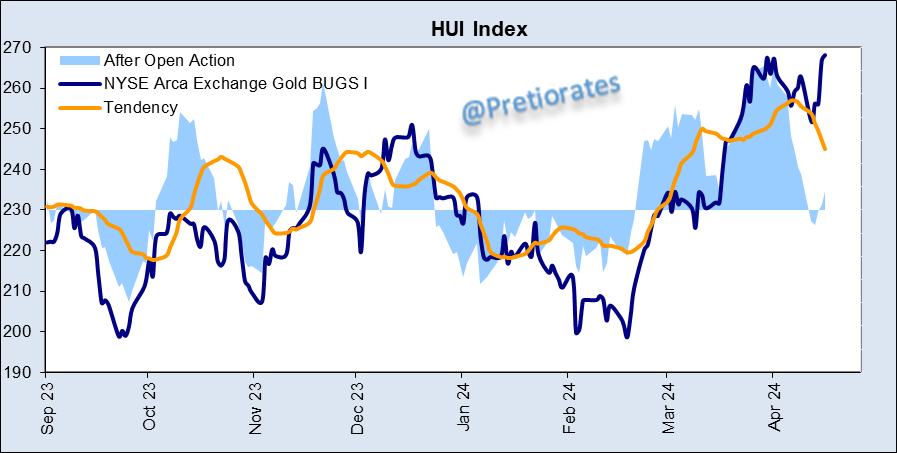

The consolidation among Gold miners is progressing. However, distribution does not appear to be very strong...

One more look at the stock markets: The S&P500 Index is currently seeing a recovery, which is likely to continue for a few more days...

The less ‘smart’ investors have recently sold off massively. This supports the hope that the US stock market will improve again – short term...

But 'smart investors' are using the recovery for distribution. It is therefore likely to remain a technical recovery...

Even if the quarterly figures in the Nasdaq stocks help to bring about larger movements, the Nasdaq continues to underperform the S&P500 index. No change is to be expected over the next few days...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.