Pretiorates' Thoughts No. 25 - Do the stock markets only see a short-term recovery?

Published on May 6th, 2024

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

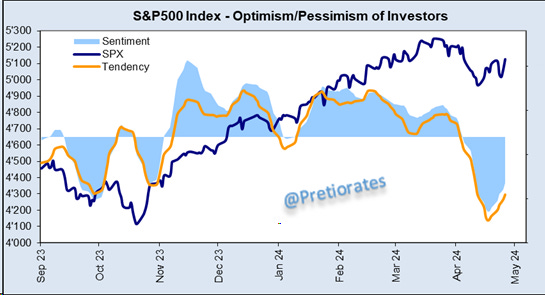

After the brief correction in the S&P500 index, optimism is strengthening again. This is positive in the short term...

However, a slightly longer-term perspective also shows that smart investors are continuing to distribute. It follows that the current movement in the US market is probably just a technical recovery...

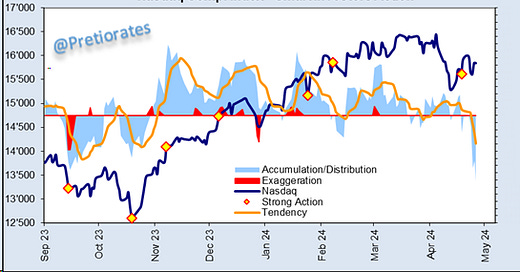

We have the same picture with the Nasdaq index. Optimism is returning...

But the smart investors are still distributing...

In Europe (Stoxx 600), too, optimism seems to be returning...

Meanwhile, in the background, the action has been greatly reduced since the beginning of March... not bullish...

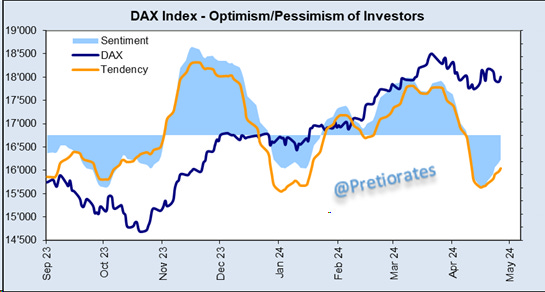

The individual countries look quite different: In the German market (DAX index) optimism is also returning...

...but accumulation is now only cautious...

The British FTSE index has never really had any negative sentiment recently...

And there is slight accumulation, but always with the maximum necessary (red areas)...

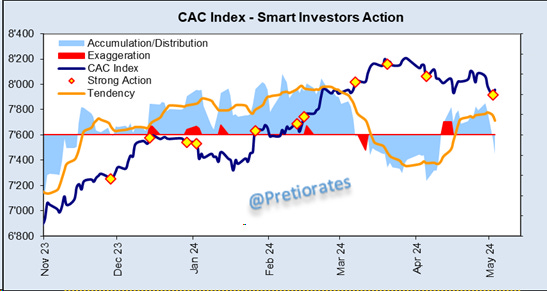

The French (CAC 40) is also taking a more positive view of the world again...

But distribution in the background is so strong that it even triggered a ‘strong action’, which usually brings a countermovement...

In Switzerland, the market does not really seem to be moving away from pessimism...

In the defensive-rich market, however, accumulation tends to take place in the background (!). Do investors want more defensive stocks?

The Hang Seng Index was the star of last week and is enjoying optimism...

A 'strong action' or slight signs of 'exaggeration' indicate that the party needs a break soon...

One sector of the US market looks promising again: The gold miner index GDM Index also went through a correction recently, but sentiment never fell into negative territory...

...on the contrary: the selling pressure has already been recognized by our indicator as an very strong ‘exaggeration’ (red area). This usually results in clear counter-movements...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.