In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

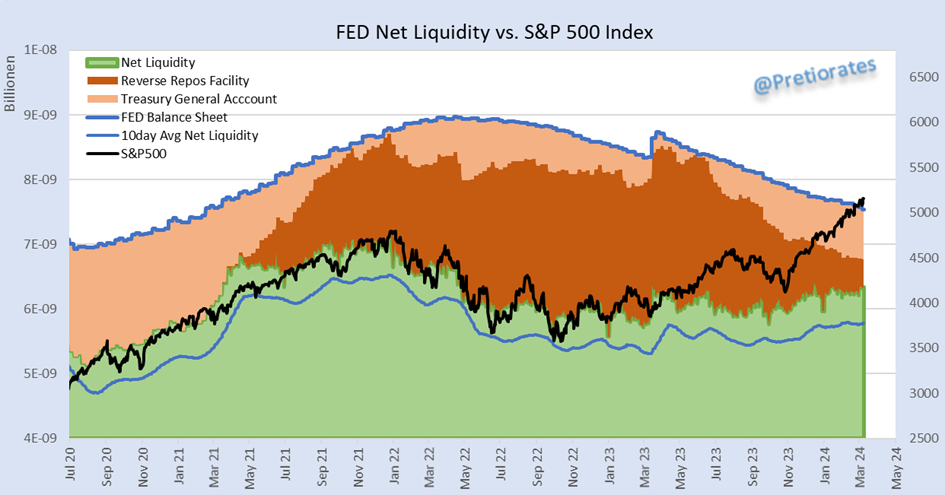

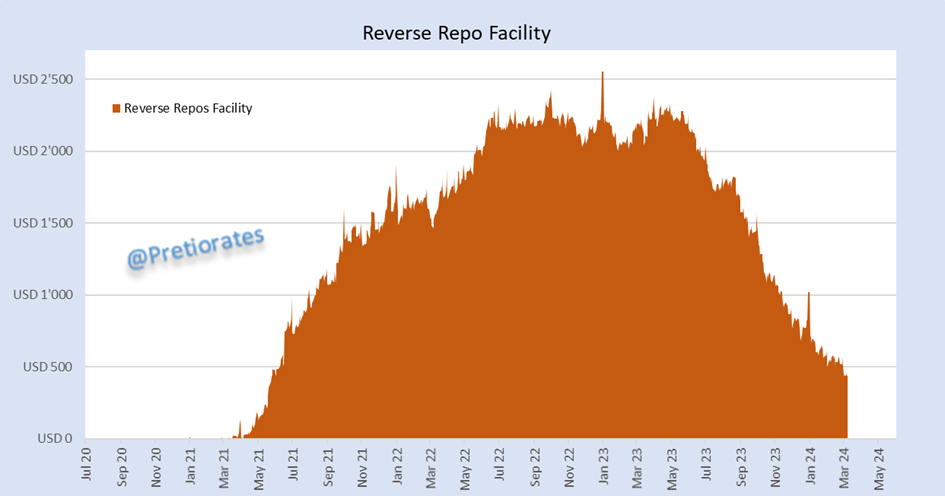

The Fed's balance sheet continues to fall by around UDS 95 billion per month. Despite the massive new borrowing, the stock markets were able to reach new highs. This was thanks to the Reverse Repo Facility (RRP), from which the required liquidity could be withdrawn. Thanks to the RRP, the Fed's net liquidity (green) increased despite QT...

As already mentioned several times, the QT should come to an end when the RRP liquidity has dried up. Just in time with the fall below USD 500 bn in the RRP, Dallas FED chief Lorie Logan lets it be known that it is probably appropriate to slow down the pace of balance sheet contractions.

If the liquidity from the reverse repo facility is missing from the market, Biden's new debt will have to be financed differently... Possibly with money that was last in the stock market?

US debt is rising faster and faster. For a trillion US dollars in new debt, the US President only needs 100 days...

The lower the confidence of the citizens of a country, the higher the price of gold in the currency of the same country...

Take a look at this table...

https://www.visualcapitalist.com/confidence-in-the-global-economy-by-country/

Anyone who claims that the gold price no longer pays attention to the real market yield of the US Treasury is wrong: Performance of gold vs. the US Treasury real rate over the last six months

Bullish: The gold price is regaining strength against the US currency...

Demand from China fell in line with the explosion in gold prices: the premiums paid in Shanghai compared to London/Chicago fell to around 1%...

While the gold price has exploded and the Chinese have stocked up heavily on gold over the last two years, interest among Western investors continues to fall. Outstanding ETFs with physical gold continue to decline worldwide...

The same picture applies to ETFs with physically backed silver: the decline in interest is striking. Best fodder for contrarians...

Extremely negative sentiment in the silver market: When the Sprott Physical Silver Trust trades below its own NAV, these have always been good entry points...

The stock of gold and especially silver on the London Metals Exchange continues to fall...

Investors are underinvested in gold and silver, which suggests that the rally will continue. We are getting the same indications from the cycles...

With the falling US dollar, the extremely high gold/silver ratio should also fall...

The combined indicators for the gold price are back in positive territory: bullish...

The same picture for silver...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.

Great article, thanks 😊 for sharing.