In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

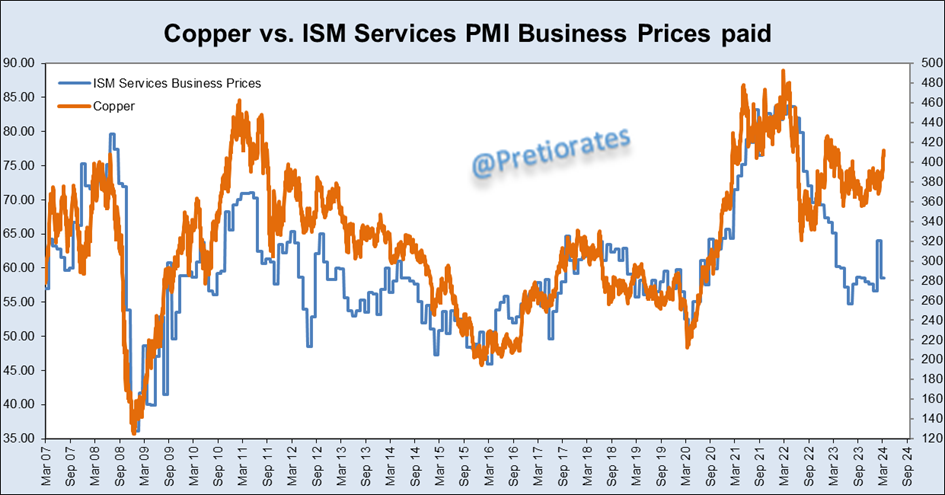

While iron ore and coal are correcting massively, the price of copper is rising. If there were hopes for a stronger Chinese economy, all three commodities would have to rise. As only copper is rising, it is unlikely to be related to the Chinese economy. The copper price is also too high in relation to the development of the US economy. Are we seeing the first signs of a shortage in the copper market?

Compared to the S&P500 index, the copper price seems to have further catch-up potential...

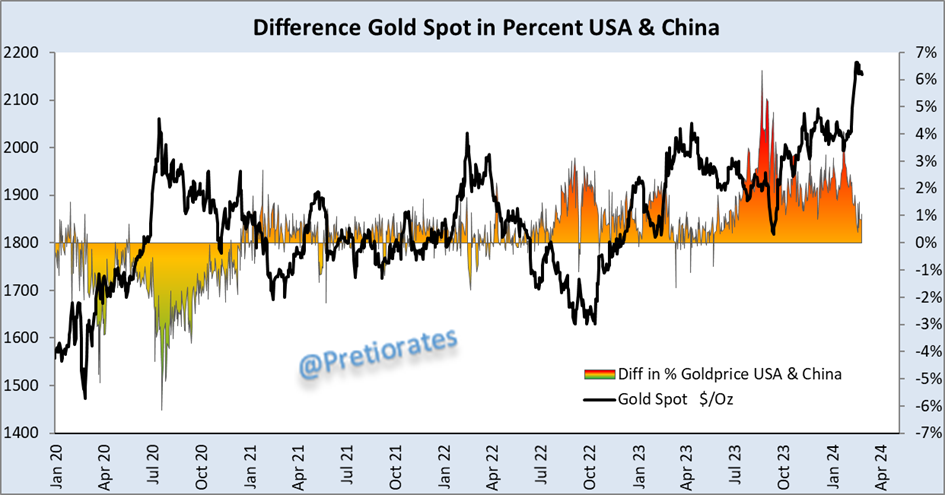

The Chinese are still interested in gold - but when comparing the Shanghai and UK/US gold exchanges, premiums of more than 2% are no longer being paid...

In contrast, around 10% more is still being paid for physical silver in China!

In Canada, on the other hand, there is no interest in physical silver at all: the Sprott Physical Silver Trust is currently trading at a discount of almost 6%...

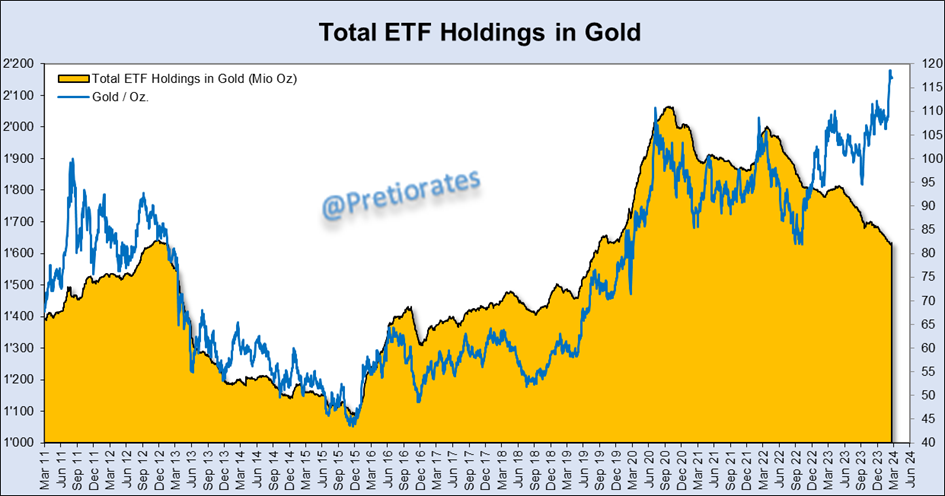

In general, the number of outstanding ETFs with physical gold continues to fall in the western hemisphere...

There is no new interest in silver ETFs either...

Gold is likely to consolidate in the short term...

Likewise silver...

Silver, on the other hand, seems to be gaining strength relative to gold...

That’s it for today!

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.