Silver Delta Hedge

Published on December 29th, 2025

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Find out more about Pretiorates.com

Dear readers,

Before we get to the new thoughts, check out the AI video from our last edition:

Pretiorates’ Thoughts - Noise, Myths and Mechanics in the Silver Market

Please watch and give it a like! Or even better: subscribe to our AI channel!

Pretiorates’ Thoughts – Silver Delta Hedge

We actually wanted to spend the holiday season without any updates. But recent developments in the silver market were simply too exciting to ignore.

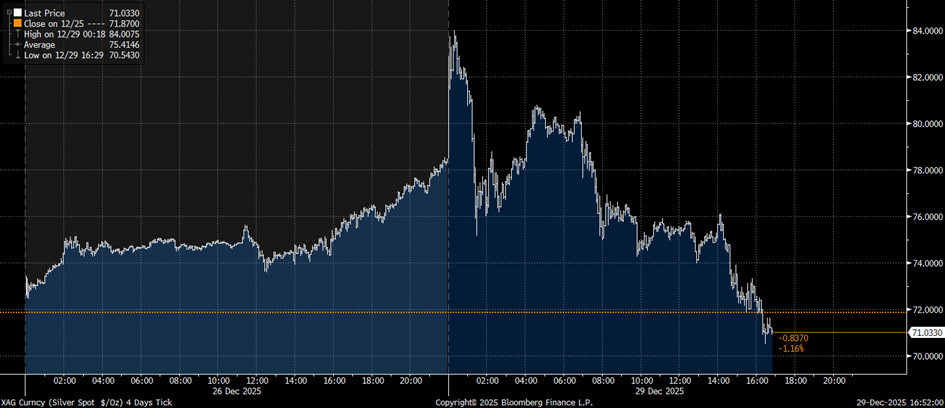

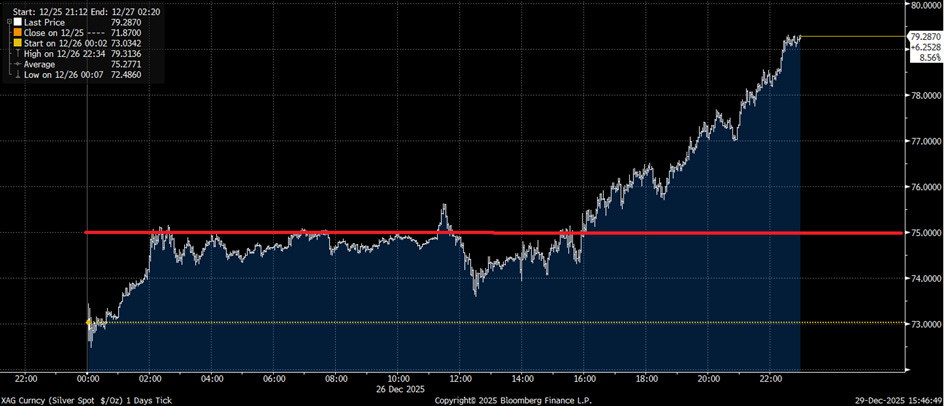

Last Friday, the price of silver exploded by more than 10%. As is so often the case, it didn’t take long for speculation to spread across the web that certain banks had been forced to cover their short positions at a massive loss. In the last few hours, there have even been rumors that a bank has gone under. This has not yet been confirmed – and based on our current knowledge, we consider this scenario to be very unlikely.

In the last edition of our Thoughts, we explained how the COMEX futures exchange and its parent company CME work – and the central role that margin plays when purchasing a futures contract. The increase in margin from USD 20,000 to USD 22,000 at that time was the main trigger for the silver sell-off of over 6% on December 12, 2025.

As a reminder, a futures contract covers 5,000 ounces of silver. At a silver price of USD 70 per ounce, this corresponds to a value of USD 350,000. However, only USD 22,000 needs to be deposited for this – just 6.3%. Given daily price movements of several percentage points, this is, viewed objectively, a very thin safety margin.

Against this backdrop, the next reaction came as little surprise: After the price jump of over 10% on Friday, the CME raised the margin again after the close of trading – from USD 22,000 to USD 25,000.

But even with this increase, the ratio remains unchanged: with a silver price of USD 80, the contract value is now USD 400,000, while only 6.3% still needs to be deposited as collateral.

Per contract, futures investors must now add USD 3,000 in cash within a few hours – otherwise the position will be liquidated immediately. The situation becomes even more critical if the silver price falls by more than this 6.3%. It is precisely this scenario that is likely to cause considerable stress in US silver trading today, Monday. Margin calls force market participants to sell, which inevitably leads to massive selling pressure. However, this only happens in the paper market. Few investors are likely to sell their physical silver.

Even though Friday’s price explosion is already history and much of the movement has since been corrected, it is worth understanding this process in detail. Such mechanisms will continue to occupy us in the near future – with increasing significance.

It was reported on the web that a very large call position of around 41,000 contracts with a strike price of USD 75 and expiry on January 16, 2026 was open. We tried to verify this information, but were unable to obtain confirmation from any exchange. However, it is possible that this position was established over-the-counter (OTC). Given the price movements observed, we consider this scenario to be plausible. There are many indications that a classic “delta hedge” triggered the price jump on Friday – and is now generating additional selling pressure in return.

For a better understanding: As we already explained in the last Thoughts, we do not believe that a bank would take the immense risk of speculating with large amounts of money on one side or the other in the silver market. What they do do, however, is act as market makers, taking the opposite position in the derivatives market. If the rumor is true that one or more clients have entered into the huge call position mentioned, the market maker had to hedge accordingly. Here are a few important points:

· The call option mentioned above gives the right to buy silver at USD 75 until January 16, 2026.

· An option contract refers to 5,000 ounces of silver. With 41,000 contracts, we are therefore talking about 205 million ounces – around a quarter of annual global production.

However, the market maker does not hedge with the entire nominal value. Instead, he/she uses the so-called delta ratio, which indicates how much the option price changes in percentage terms when the silver price moves by one dollar. The hedge is also carried out to exactly this extent. If the delta changes with the silver price, an algorithm adjusts the hedge continuously and automatically – by buying or selling silver on the market.

If the silver price is USD 70, the delta of a 75 call option is only around 27%. Accordingly, the market maker hedges with around 55.35 million ounces. If the silver price rises to USD 75, the delta increases to around 62% – and the hedge grows to 127.1 million ounces. The more the price rises, the more aggressively additional purchases must be made. This delta hedge is absolutely necessary to avoid incalculable risks.

It goes without saying that with Friday’s steep price rise, market makers were increasingly forced to buy additional silver. The USD 75 mark played a key role in this and was stubbornly defended for a long time. This is because only above this level does the probability increase that option buyers will actually demand physical delivery. When the price nevertheless exceeded this level in late trading, the option trader(s) had to significantly increase his/their purchases of additional silver due to the rising delta.

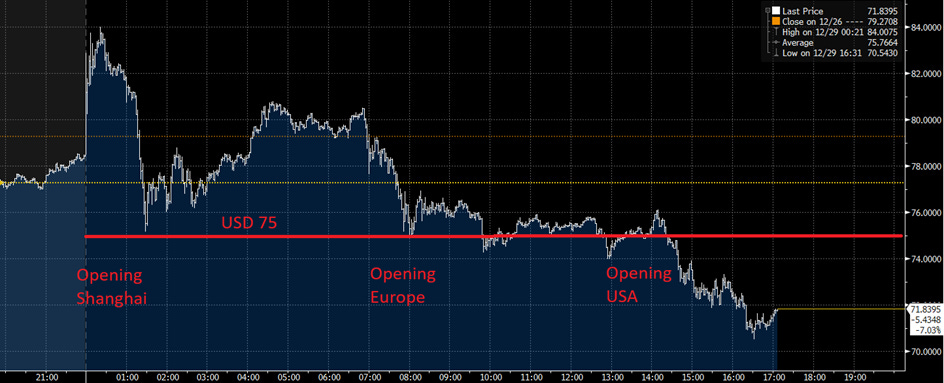

Today’s trading shows the flip side of the same coin: the more the silver price falls, the more silver market makers have to sell again – which further accelerates the price decline. This effect is reinforced by futures investors, who on the one hand have to deposit higher margins and on the other hand, with a daily loss of around 9%, have effectively already lost their previous security deposit – the margin.

At the opening of Chinese trading, attempts were already being made to quickly push the silver price back towards USD 75. During the European session, the market remained under control. With the start of US trading, the expected selling pressure then set in – triggered by margin calls that forced futures investors to sell.

This explains the violent movements of the last two days from a technical perspective. The crucial question now is: What happens next?

One thing is certain: the recent swings are primarily a product of paper trading – futures and options. Unlike previous silver rallies, such as in 1980 or 2011, however, there is now an acute shortage of physical silver.

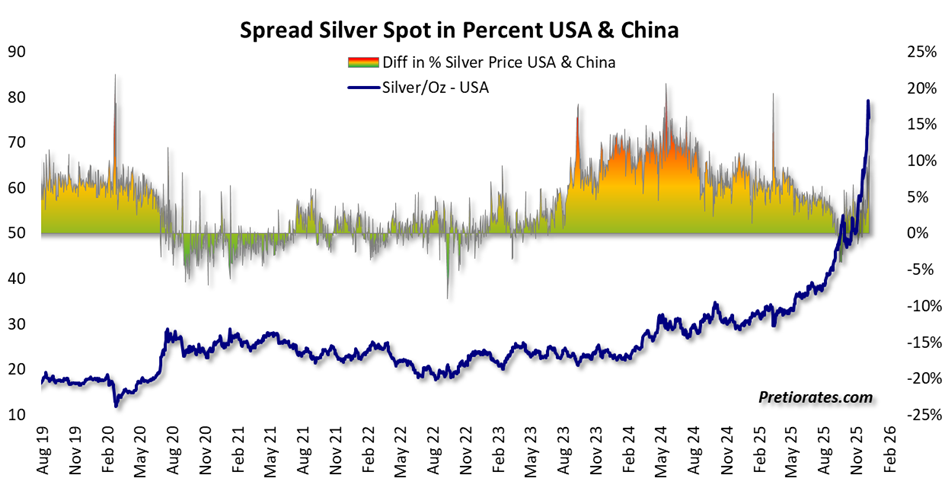

In India, pension funds are now also allowed to invest in silver – interest is likely to be correspondingly high. Even more significant, however, is that China will only be allowed to export silver on a limited basis from January 1, 2026. If high demand continues, China will be forced to increase its purchases of physical silver in the West. The spread between Shanghai and New York has risen back above 10% in recent days – a clear signal that physical silver is valued significantly higher in China.

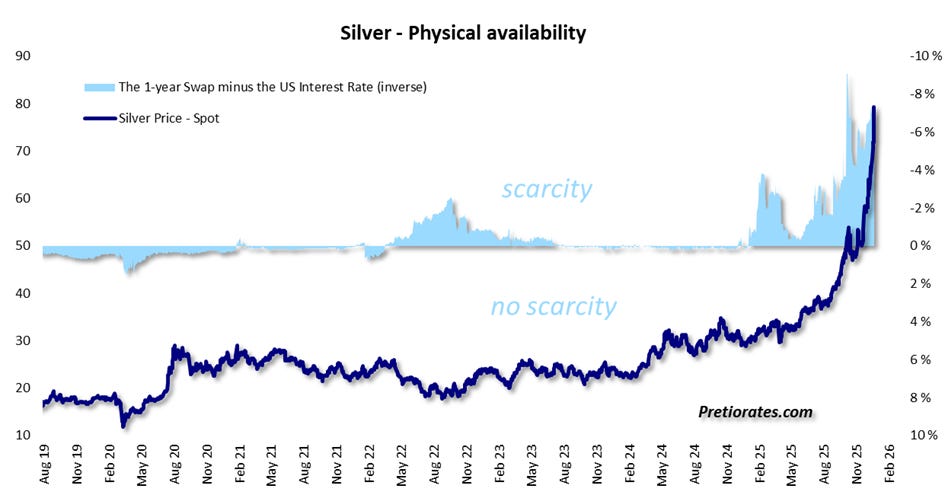

The fundamental shortage of physical silver remains unchanged. On the contrary, it will further increase pressure on Western paper markets. This is particularly evident in the continuing negative swap rates, which are of central importance for delivery availability and market tension.

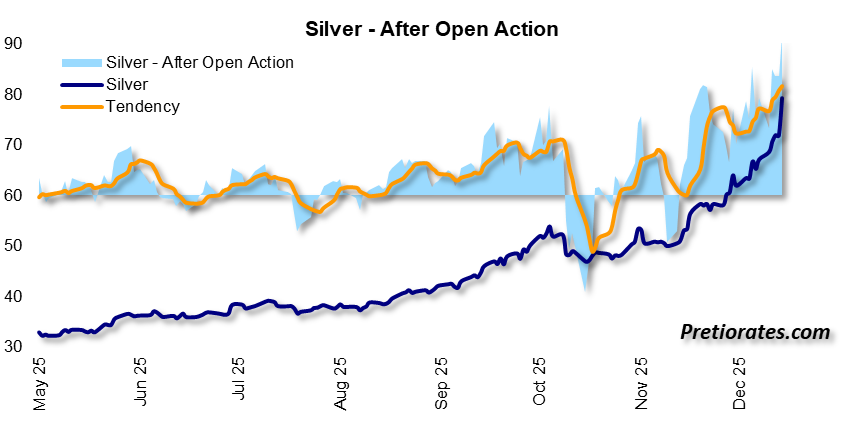

Additional confirmation is provided by the so-called after-open action, which shows that professional market participants continue to accumulate silver on a large scale behind the scenes.

Bottom line: Many silver bugs are likely to be unsettled by today’s correction – and yes, it hurts when Friday’s gains have been almost completely wiped out. But this movement is almost exclusively technical in nature. The peace talks surrounding Ukraine are likely to have taken additional geopolitical pressure off the market. However, the decisive factor remains whether China continues to be on the buying side. Given that Chinese buyers were willing to pay the equivalent of over USD 80 per ounce this morning and that the demand is not a one-day fluke, this question should be relatively easy to answer at a price of around USD 71.

We wish you a Happy New Year! We look forward to sharing more interesting thoughts with you in 2026.

We wish you successful investments!

If you enjoyed this issue, please click on the Like icon at the top or at the bottom of this email. This is very important in helping our Thoughts gain more followers. Thank you!

Yours sincerely,

Pretiorates

Find out more about Pretiorates.com

These thoughts will be available as an AI video on Youtube.com within 48 hours: https://www.youtube.com/@Pretiorates

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.