In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

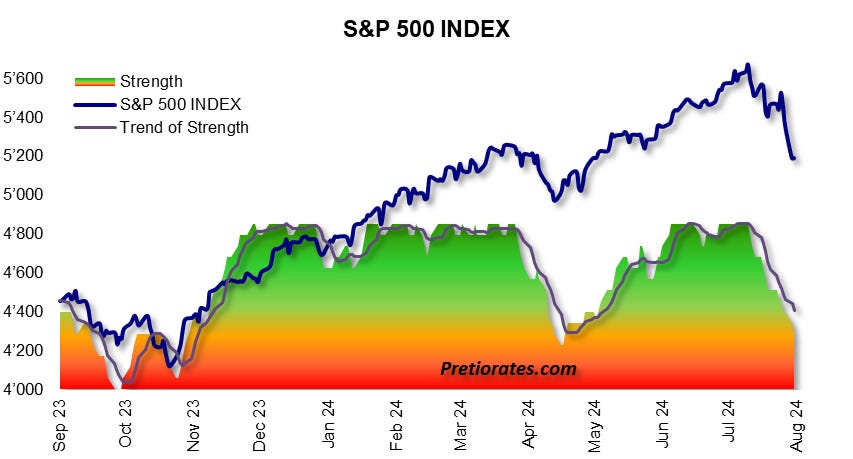

It often only takes one trigger for the financial markets to wake up from their dream world. Our indicators have been showing for some time that they are dancing on an ever thinner rope. See 'Pretiorates' Thoughts 37 - The US Equity Market, the last man standing?' from July 4, 2024.

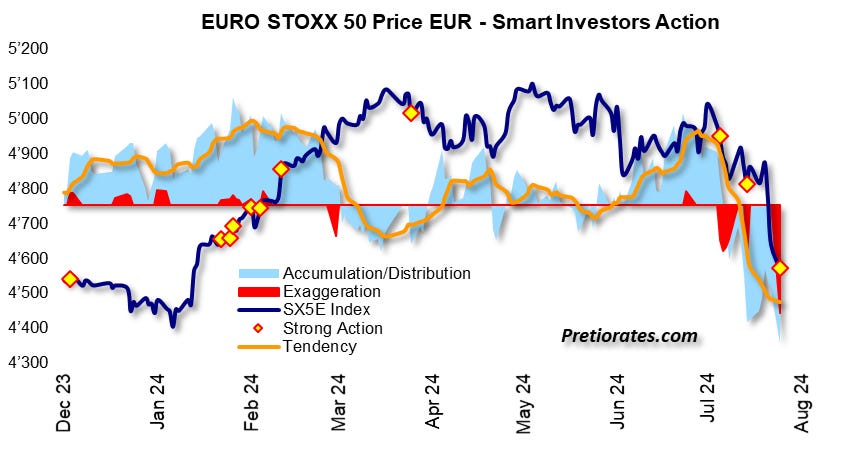

The smart investors have been distributing for some time. In the first wave of selling at the beginning of July, there was still an 'exaggeration' that suggested that a recovery was once again possible. This is no longer the case during the selling wave of the last few days. An indication that the selling pressure is not yet over, even if there will always be recoveries...

The scenario became really bearish in mid-July...

However, pessimism is now very high, which suggests a recovery of a few days...

The strength indicator of a longer-term nature has already declined sharply...

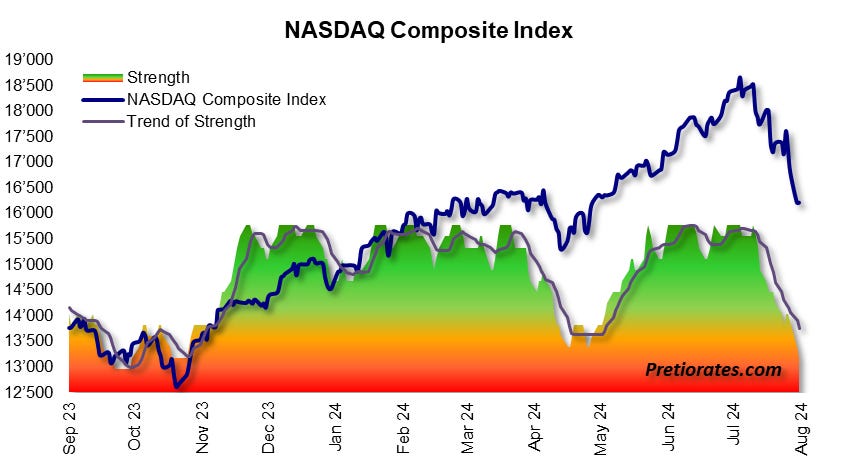

With the absolute high, the Nasdaq Index has also already shown a divergence - the accumulation of smart investors has already declined since mid-June (blue area)...

Here, too, massive pessimism is now evident, which suggests a countermovement...

In absolute terms, there has also been a clear decline in the strength of Nasdaq stocks since the beginning of July...

A lot of money was borrowed in yen by means of carry trades in order to obtain liquidity for other investments. The unwinding of these loans caused the Nikkei to take the biggest hit - and now has the highest recovery potential this morning...

When pessimism is at its strongest, shaky investors have already sold their positions. A good prerequisite for there to be more buyers than sellers again - and thus rising market prices...

Of course, the European stock markets also suffered badly. However, the distribution was rather panicky in nature (exaggeration), which means that they also have the potential to start a stronger recovery...

However, the pessimism in the European markets has been prevalent since May (blue area in negative territory) - and is not particularly pronounced. Apparently, the weakness has clearly taken people by surprise...

In order to find out whether only a brief recovery and renewed waves of selling are to be expected - or whether the correction phase is already over - we analyze the relevant indicators:

Compared to the 50-day moving average, volatility has turned massively negative - common in typical panic markets indicating a short-term low...

The spread (difference) between the spot and six-month volatility index is extremely high. This is the market's way of telling us that it expects a calmer phase in six months' time...

The skew index shows how expensive put options are, the volatility index how high the actual concern is. A high ratio indicates that people are hedging but are not really worried about a correction. This is no longer the case...

The fear in the stock market has spread massively...

The summary of several short term indicators as mentioned above suggests that the market should see at least an interim low these days...

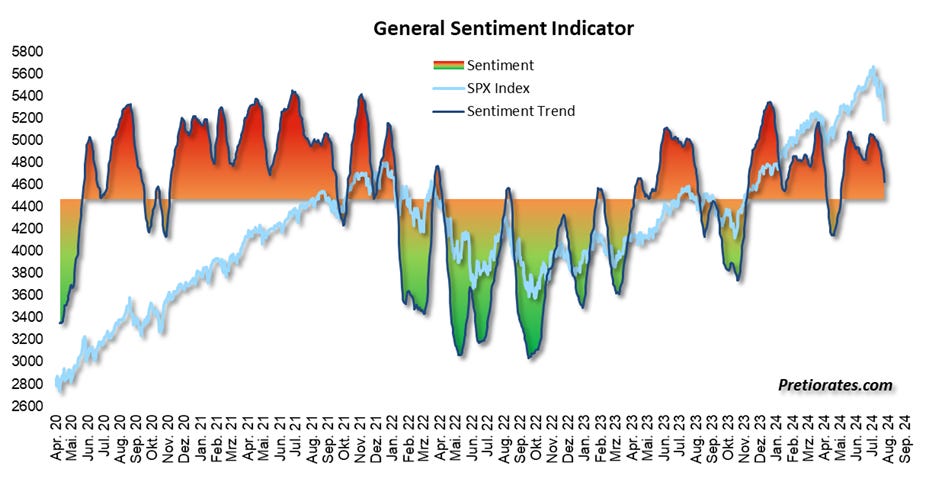

The long-term 'General Sentiment Indicator' is falling, but has not yet (?) reached negative territory. It therefore still seems too early for long-term buying...

One might expect that the strong fear would lead to large put purchases. However, this is not the case: the put/call ratio has not even reached negative territory yet. This suggests that the bears' attack is likely to last even longer...

That’s it for today! And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

We wish you successful investments!

Pretiorates

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.