In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Dear readers,

Before we get to the new thoughts, check out the AI video from our last edition:

Pretiorates’ Thoughts 79 – When correlations crackle

Please watch and give it a like! Or even better: subscribe to our AI channel!

Pretiorates' Thoughts 80 – From Fear at warp speed to Euphoria

The stock market loves extremes – and it lives them to the fullest. We have seen several times in recent years that markets rebound to their previous highs after corrections. But what we are currently observing is remarkable: the shift from fear to euphoria is happening at lightning speed. A warp-speed change in sentiment, without even a pause for breath.

One possible driver? The policies of US President Donald Trump. Initially, his unconventional course caused uncertainty. But initial successes seem to confirm his tactics – at least that is how the markets see it. Some accuse him of caving in, others praise his tough negotiating stance. We are not interested in either side of the argument. Because there is only one stock market – and it is sending a clear message: pure confidence.

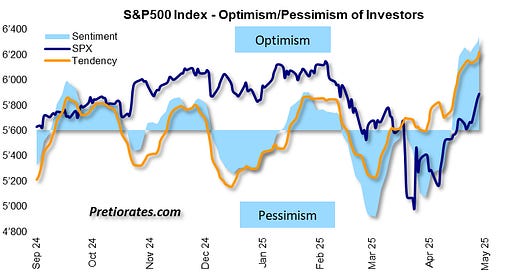

In March and April, the mood was still gloomy – now Wall Street seems to have switched to rose-colored glasses. Optimism is reaching a two-year high.

And we are seeing a similar picture in Europe. Despite political infighting – or perhaps precisely because of it – stock market optimism has been unstoppable recently. Indices are rising and concerns are being pushed aside.

However, the Euro Stoxx 50 is showing the first signs of a hangover after the party. “Exaggeration” (red area) and “Strong Action” (yellow dot) signal a possible end to the trend. This is a familiar pattern – when both occur simultaneously, a trend reversal often follows.

The same is true in the UK, where optimism is in the fast lane.

The picture is the same in France.

And Germany? It takes the cake. Despite geopolitical uncertainties, economic concerns, and political cacophony, the DAX is climbing to new heights – accompanied by an unprecedented high in sentiment.

And Switzerland? Yes, it is also playing along – but with the handbrake on. The market is dominated by defensive heavyweights such as Nestlé, Novartis, and Roche. Defensive stocks are currently in low demand, and the pharmaceutical sector is facing additional headwinds from Washington: Trump wants to lower drug prices. The result: accumulation here too – but much more subdued than in other regions of the world.

Asia is dancing along, led by Japan. The Nikkei has been heavily accumulated. But here, too, we are now seeing warning signs: exaggeration meets strong action – déjà vu?

The sentiment switch in the General Sentiment Indicator is hard to miss: from a gravedigger's mood to champagne fever – in record time.

Even the VIX volatility index is jumping on the bandwagon and sending more sell signals. These are rare – the last one was in March 2022 – but they are convincing....

Bottom line: Good sentiment is the fertilizer for rising prices. But euphoria is treacherous – it comes charmingly, but often with a rude awakening. Because those who are euphoric have usually already invested. And that is usually followed by more sellers because there are fewer buyers. But when more people sell than buy, prices fall. It's that simple, and yet so dangerous.

The party is in full swing – but those who leave too late could quickly find themselves out in the rain. We already hinted at this in Thoughts 79: The euphoria could soon take its toll. So let's remain vigilant…

We wish you successful investments!

Yours sincerely,

Pretiorates

These thoughts will be available as an AI video on Youtube.com within 48 hours: https://www.youtube.com/@Pretiorates

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.