Pretiorates' Thoughts 84 – The little brother finally becomes the big winner

Published on June 10, 2025

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Find out more about Pretiorates.com

Dear readers,

Before we get to the new thoughts, check out the AI video from our last edition:

Pretiorates’ Thoughts 83 – Party Too Long, Face the Hangover

Please watch and give it a like! Or even better: subscribe to our AI channel!

Pretiorates' Thoughts 84 – The little brother finally becomes the big winner

On May 21, 2025, in Thoughts 81, we discussed the growing appetite for alternative metals such as Silver – but especially China's increased demand for Platinum. And lo and behold: both metals have risen sharply since then, easily outpacing Gold. So it's high time to sharpen our focus once again.

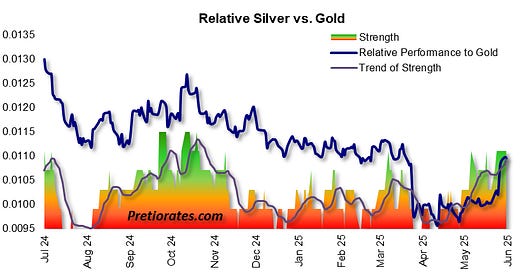

Silver's impressive outperformance relative to Gold is clearly evident in the Gold/Silver ratio, which is currently tilting significantly in favor of Silver. The inner strength of this ratio is still reminiscent of a lukewarm spring breeze, but that bodes well: there's more to come!

An interesting correlation: the Gold/Silver ratio correlates strongly with the US dollar. Why? Because Gold shines especially in times of crisis, while Silver, as an industrial metal, is in demand during economic booms – precisely when the dollar also tends to rise. The recent announcement of massive import tariffs (“Liberation Day”) has disrupted this correlation in the short term, but the old order is currently returning: the ratio has fallen from over 100 to around 90 – and is thus still above the ideal value of 77 indicated by the strength of the dollar. Translated: Silver still has room to rise compared to the price of Gold…

And although Silver has risen significantly in recent weeks, sentiment remains surprisingly sober. No euphoric exuberance, no herd instinct – a good sign of sustained strength…

A glance at the various stock exchanges also reveals that the Shanghai premium over London and New York remains unchanged – so China's hand was not at play this time. Demand has therefore also risen more strongly in the West...

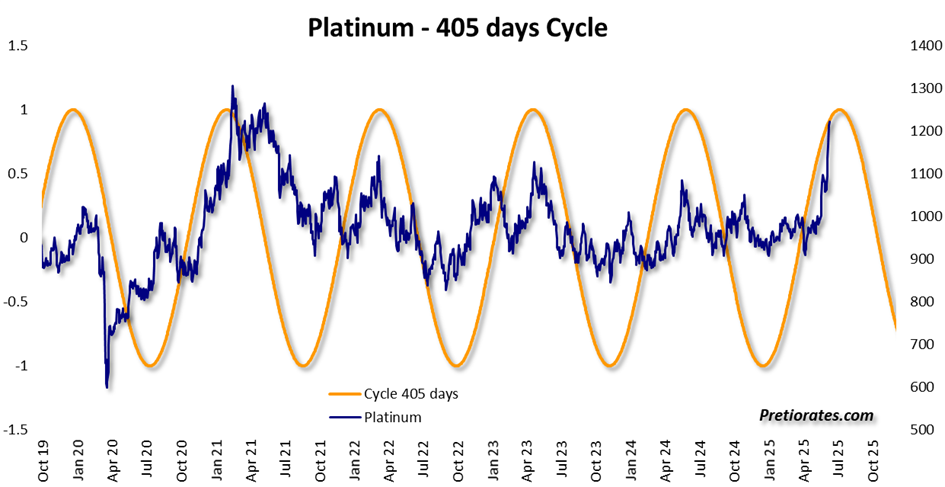

Platinum is also attracting attention – and with good reason. We already discussed the surge in demand from Chinese precious metal dealers in Thoughts 81. However, the proven 405-day cycle signaled an early comeback for Platinum bulls at the beginning of 2025. And indeed, the market is showing strength. But – caution – this cycle also heralds an imminent high…

It gets even more exciting when you combine several cycles: 78, 93 and 134 days (not the same start day). These harmonize surprisingly well and together point to an approaching trend reversal. Important to note: the cycles do not indicate the strength of the upward and downward trends, only possible changes in direction. And as with all cycles, they work – as long as they work…

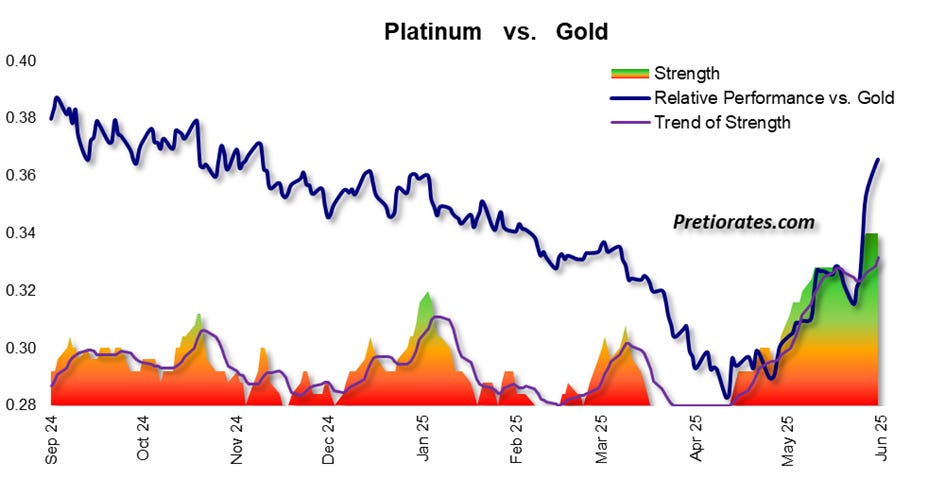

On the other hand, Smart Investors Action tells us that despite the already remarkable price rally, smart investors are continuing to buy boldly. Accumulation is continuing at the elevated level...

The optimism? Clear, but not overheated – similar to previous upward waves.

And suddenly also Platinum steals the show from Gold. What remains is a strong inner strength that has been virtually unseen in Platinum in recent years. In terms of relative performance, the white metal has clearly outperformed Gold. That is impressive.

Bottom line: From a cyclical perspective, Platinum could soon start to falter. And it is not unusual for the biggest gains to be realized in the final phase of a cycle. However, given its continued strength, we would give more weight to the bullish story than to cycle theory this time around. The trend is robust, investors are disciplined, and the momentum is clear. That's why we would work with stop losses. As long as the trend isn't broken, it's still your friend.

And Silver appears to have finally started its catch-up rally. As things stand today, its remaining potential relative to Gold is even greater than that of Platinum. Those who continue to bet on the little brother could soon find themselves the big winners in their portfolios.

We wish you successful investments!

Yours sincerely,

Pretiorates

Find out more about Pretiorates.com

These thoughts will be available as an AI video on Youtube.com within 48 hours: https://www.youtube.com/@Pretiorates

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.