Pretiorates' Thoughts 88 – White Metals: When Pessimism gets bullish

Published on July 10th, 2025

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Find out more about Pretiorates.com

Dear readers,

Before we get to the new thoughts, check out the AI video from our last edition:

Pretiorates’ Thoughts 87 – Gold and Silver with tailwinds from another direction

Please watch and give it a like! Or even better: subscribe to our AI channel!

Pretiorates' Thoughts 88 – White Metals: When Pessimism gets bullish

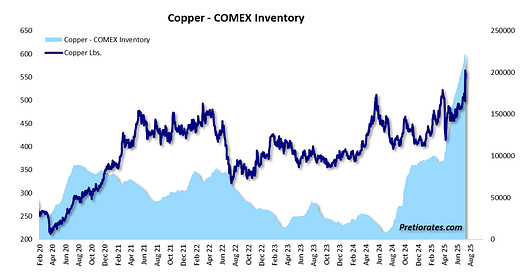

Hugh, Trump has struck again! 50% import duties on Copper – just as predicted in Thoughts 86 (“Red metal, red alert!”). The US Copper price shot up again, and traders are rushing to get their material across the Atlantic before the tariff hammer officially falls.

But what exactly will be subject to customs duties? Pure Copper? Refined goods? Concentrate? Much remains unclear – and so the potential for surprises remains high.

The direction is clear for Gold and Silver: no tariffs. COMEX Gold inventories also rose sharply before the decision, but a respectable portion of Gold has since been withdrawn...

The situation is quite different for Silver: inventories remain well filled. There are a few plausible reasons, all of which paint a rather bearish picture: Silver is bulkier and less mobile than Gold, there is less demand for physical delivery of COMEX futures contracts, industrial demand remains subdued, or quite simply, too much was delivered into storage.

The warehouses are full and the mood is very gloomy, as already described in Thoughts 87...

The ‘smart’ investors are apparently continuing to distribute, even if the intensity has decreased compared to the previous week...

However, Silver has been outperforming Gold again since April. The Gold/Silver ratio has fallen from over 100 to around 90. In fact, this is also confirmed by our indicator for the relative strength of Silver against Gold...

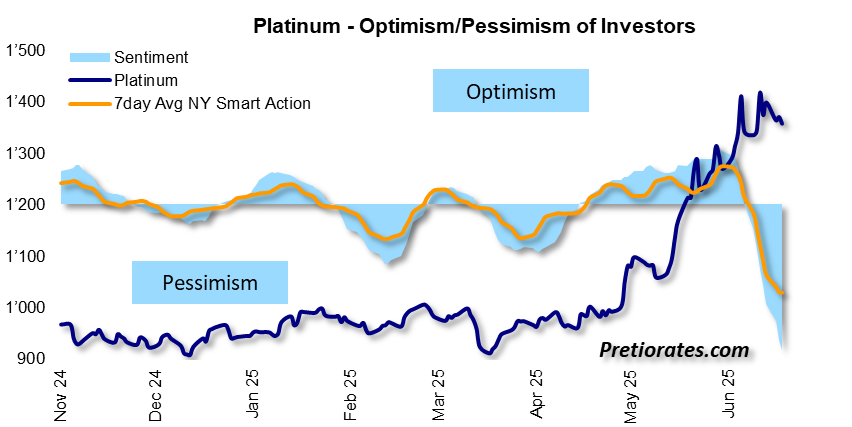

In Thoughts 81 (May 2025), we also discussed the bullish potential of Platinum, which has since gained another 30%. However, the market does not believe in the rise. Sentiment has become very pessimistic at the significantly higher level. Apparently, people do not trust the price increase – and yet the metal is managing to maintain its price level...

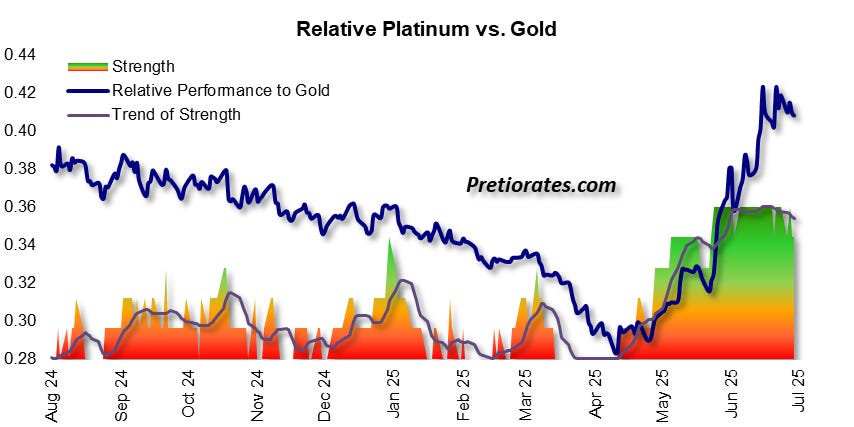

At the same time, Platinum is significantly cheaper than Gold. This was not the case just a few years ago. The relative strength of Platinum compared to Gold is also impressive...

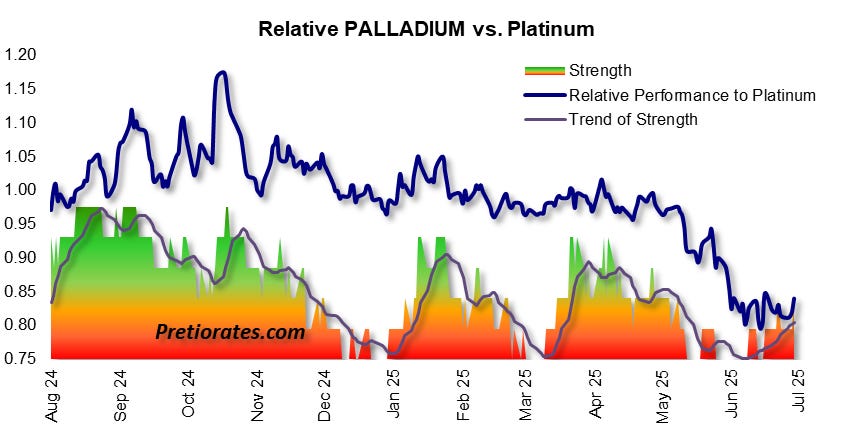

In contrast, Palladium remains surprisingly calm. The price is lagging behind Platinum and the relative weakness is obvious.

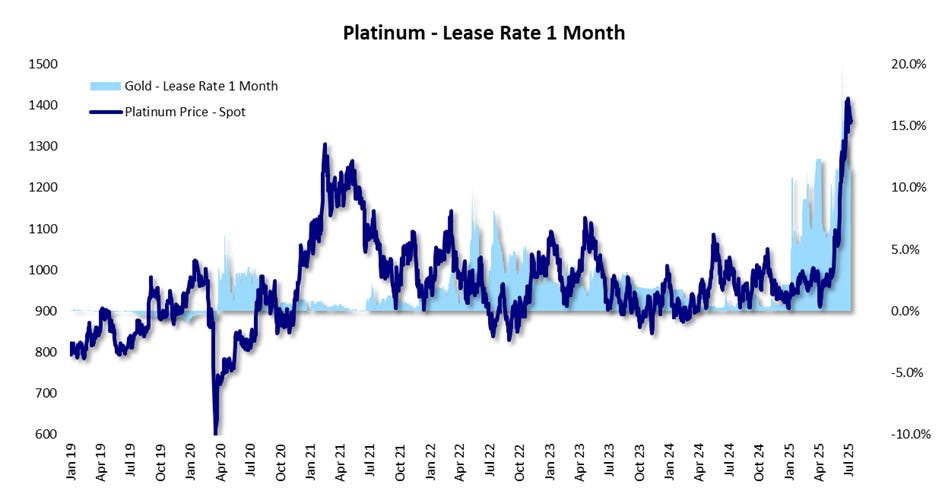

The discrepancy can be explained very well by the lending rates for physical loans. Those for Platinum are still close to a very high 15%...

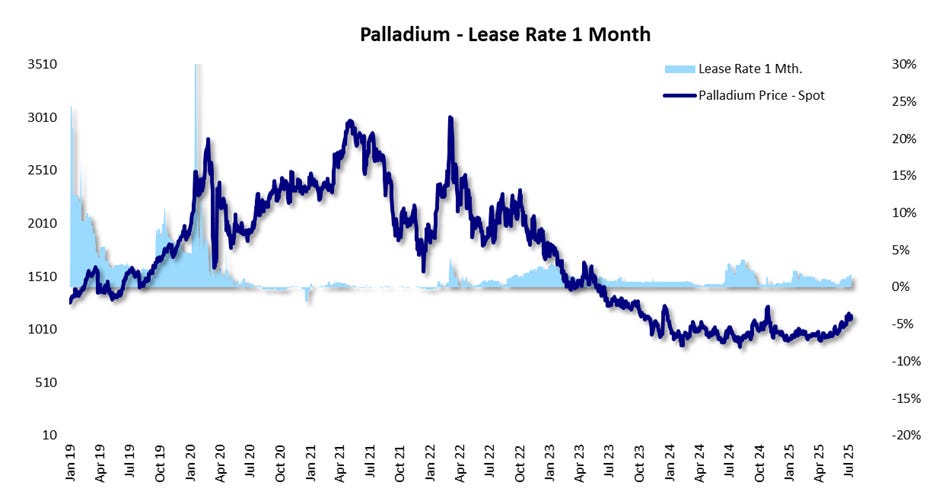

Palladium lending rates, on the other hand, remain below 1%, indicating current low demand...

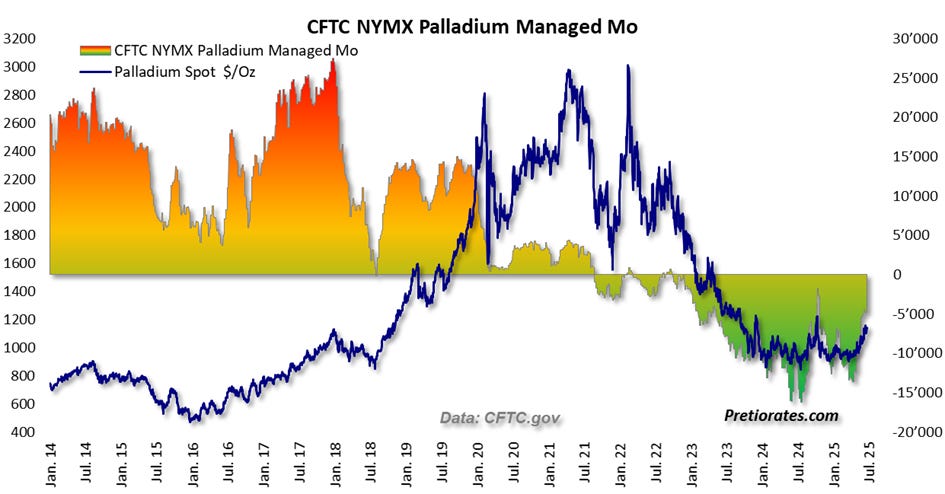

But beware: the formerly huge short positions in the futures market (non-commercials such as investment funds) have recently been reduced significantly. If there is a trend reversal, it will start right here – quietly.

🔎Bottom line: Pessimism can reach a peak, even if not everyone feels it. Usually, it is only the sellers of an asset who feel pessimistic. And this does not always require falling prices. When pessimism is at its peak, most of the selling has already taken place. If the price does not fall despite the gloomy mood, the bears no longer have the upper hand. Soon there could be more buyers than sellers again, which would mean rising prices. Therefore, such signals are considered early indicators of new or upcoming upward movements. This is precisely the pattern we are currently seeing with Silver and Platinum. This is not yet really the case with Palladium, but it is likely that it will follow as an alternative after a certain delay...

We wish you successful investments!

Yours sincerely,

Pretiorates

Find out more about Pretiorates.com

These thoughts will be available as an AI video on Youtube.com within 48 hours: https://www.youtube.com/@Pretiorates

And don’t forget to recommend us - with the button below.

Remember, we are not making any recommendations for investments, we are just giving you ideas for your own analysis and decisions! Do your own due dilligence!

If you like our short analysis, please recommend us to your friends!

Thank you for being a part of the Pretiorates community. Stay tuned for more updates, analyses, and deep dives into the realms of finance and economics.

What is the silver lending rate..??